Chapter 5

Partnerships

235

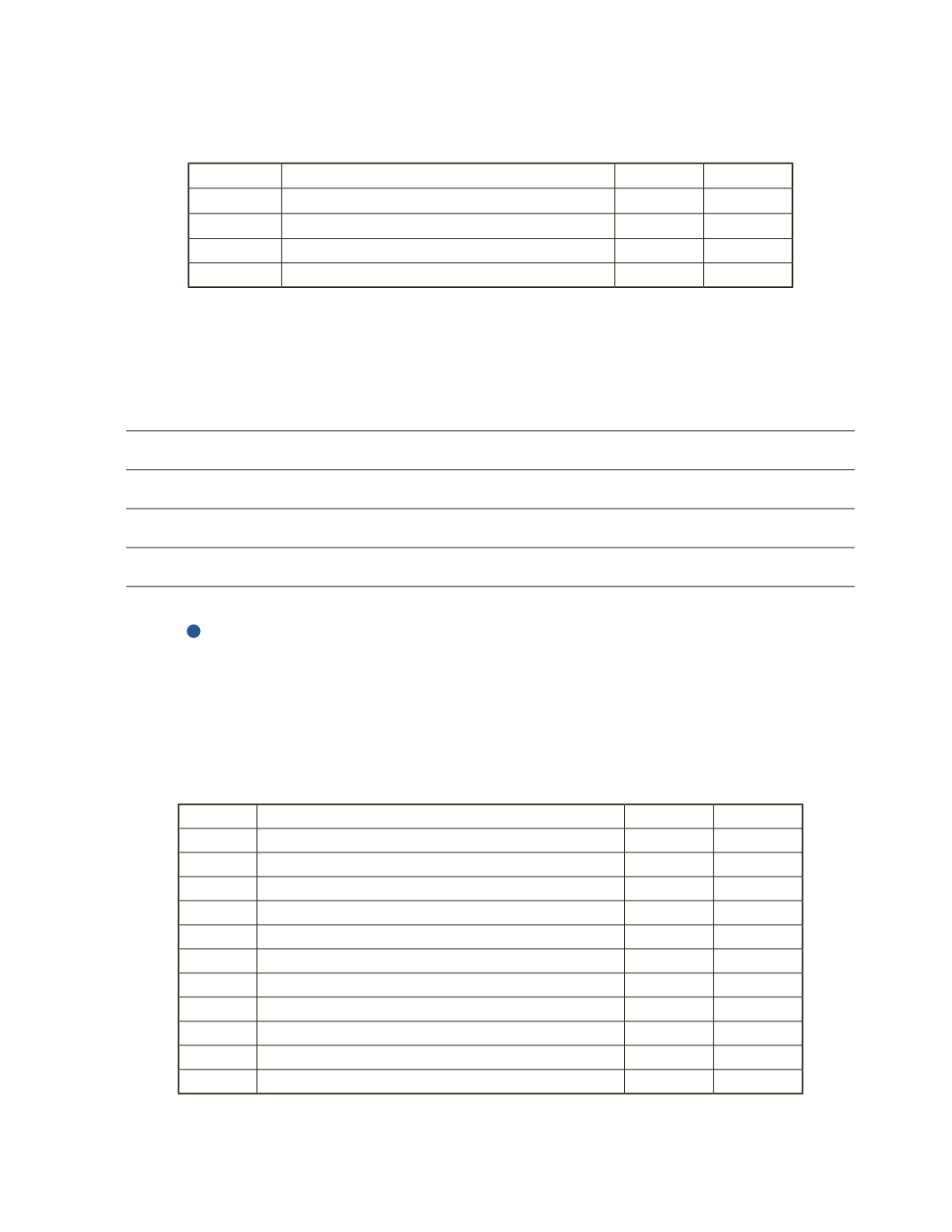

b) On May 1, 2016, Baker invested an additional $4,000 in cash into the business. Record the

journal entry.

Date

Account Title and Explanation

Debit

Credit

Analysis

What are some of the advantages of Andrew and Baker forming a partnership?

AP-3B (

4

)

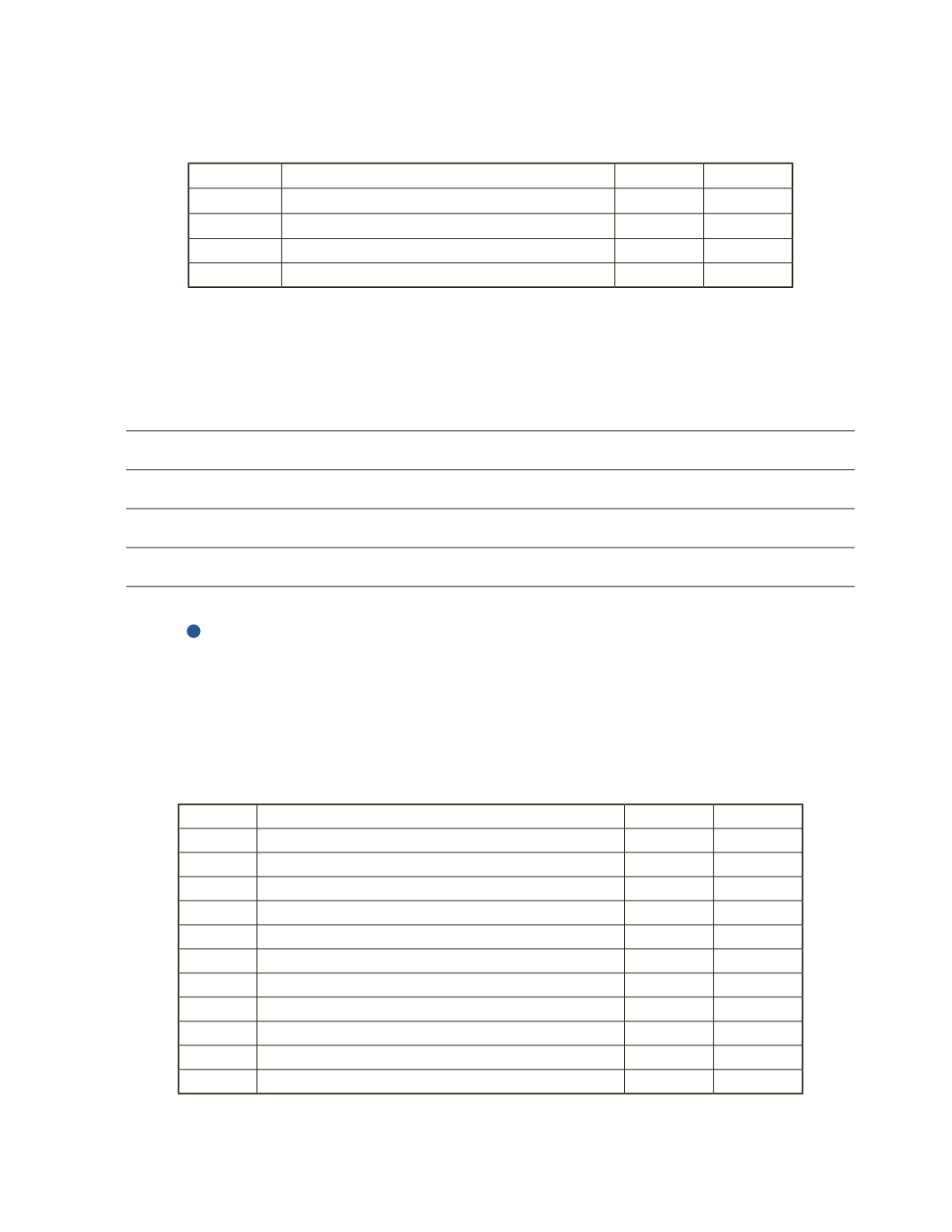

Selena Hegarty, Cody Debruyn and Lenore Raap operate their business as a partnership.

According to their partnership agreement, Selena and Lenore split 51% of the profits equally.

The remainder of the profits goes to Cody. Record the entry for the division of profits of

$100,000 on December 31, 2016. Assume that revenues and expenses have already been

closed to the income summary account.

Date

Account Title and Explanation

Debit

Credit