Chapter 5

Partnerships

245

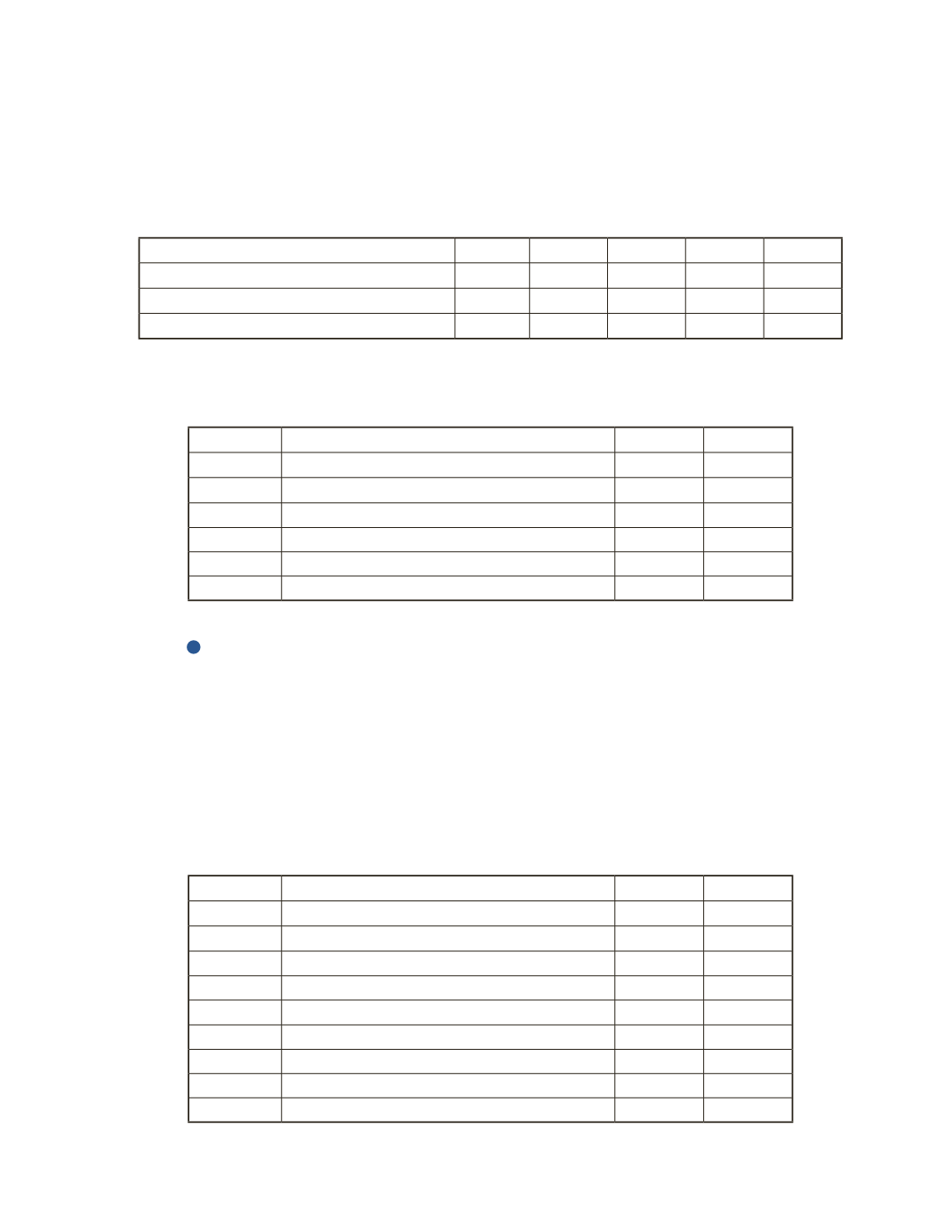

g) Independent of part a), assume that when Joe leaves, Joe is going to sell his portion of the

partnership to Jim. Jim is also going to purchase 20% of Jack’s share in the partnership.

The cash transaction will be a private matter between Jim and the two partners; however,

the capital amounts must be transferred to Jim in the partnership records. Calculate the

new capital balances for each partner

Jack

John

Joe

Jim Total

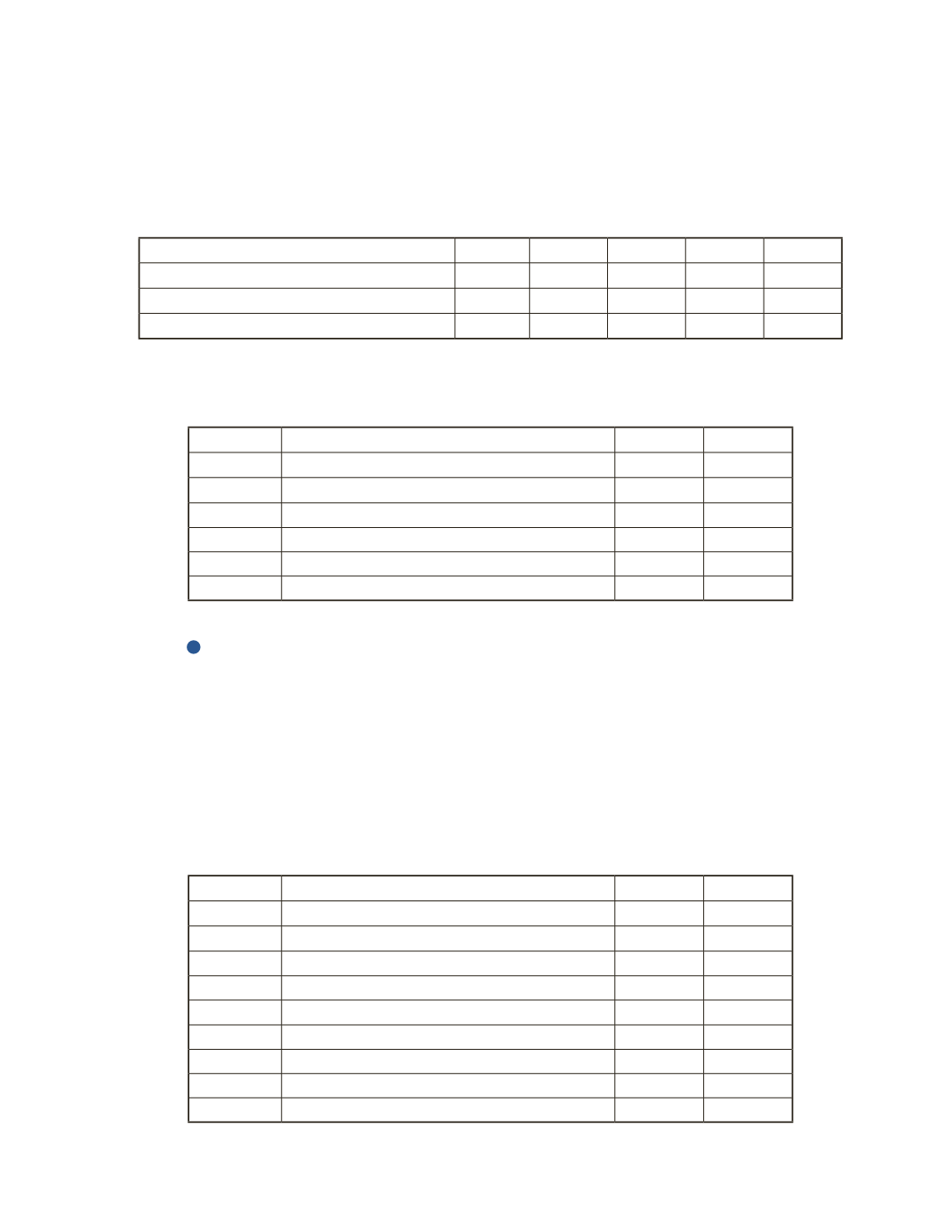

h) Prepare the journal entry to record the admission of Jim and the withdrawal of Joe from

part g).

Date

Account Title and Explanation

Debit

Credit

AP-9B (

5

)

Bryan Butryn and Jason Barfoot are in a partnership selling mobile phones. On May 1, 2016,

Jason took a mobile phone worth $800 from the business for his personal use. On December

31, 2016, Bryan withdrew $5,000 cash and Jason withdrew $3,000 cash for personal use.

Required

a) Write the journal entries to record the withdrawal transactions.

Date

Account Title and Explanation

Debit

Credit