Chapter 5

Partnerships

238

AP-5B (

4

)

Mathew, Henry and Tom formed a partnership to open a grocery store in 2016. Each partner

contributed $30,000 cash. In addition, Henry brought some furniture worth $3,000 and Tom

brought a vehicle worth $8,000. An independent appraiser determined the vehicle should be

valued at $7,000.

Required

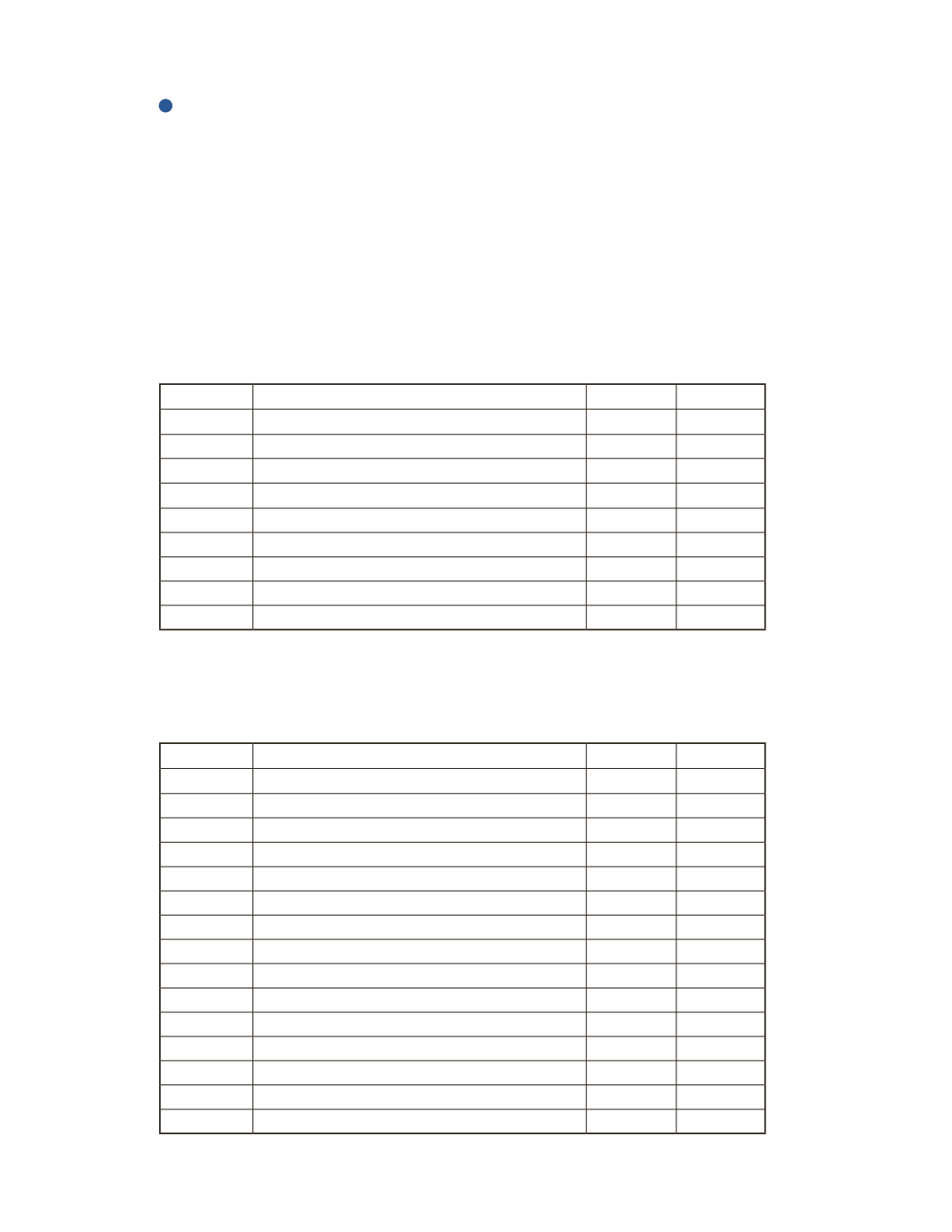

a) During 2016, the business earned a net income of $90,000. The partners decided to divide

profit equally. Prepare a journal entry to close the income summary account at year-end.

Date

Account Title and Explanation

Debit

Credit

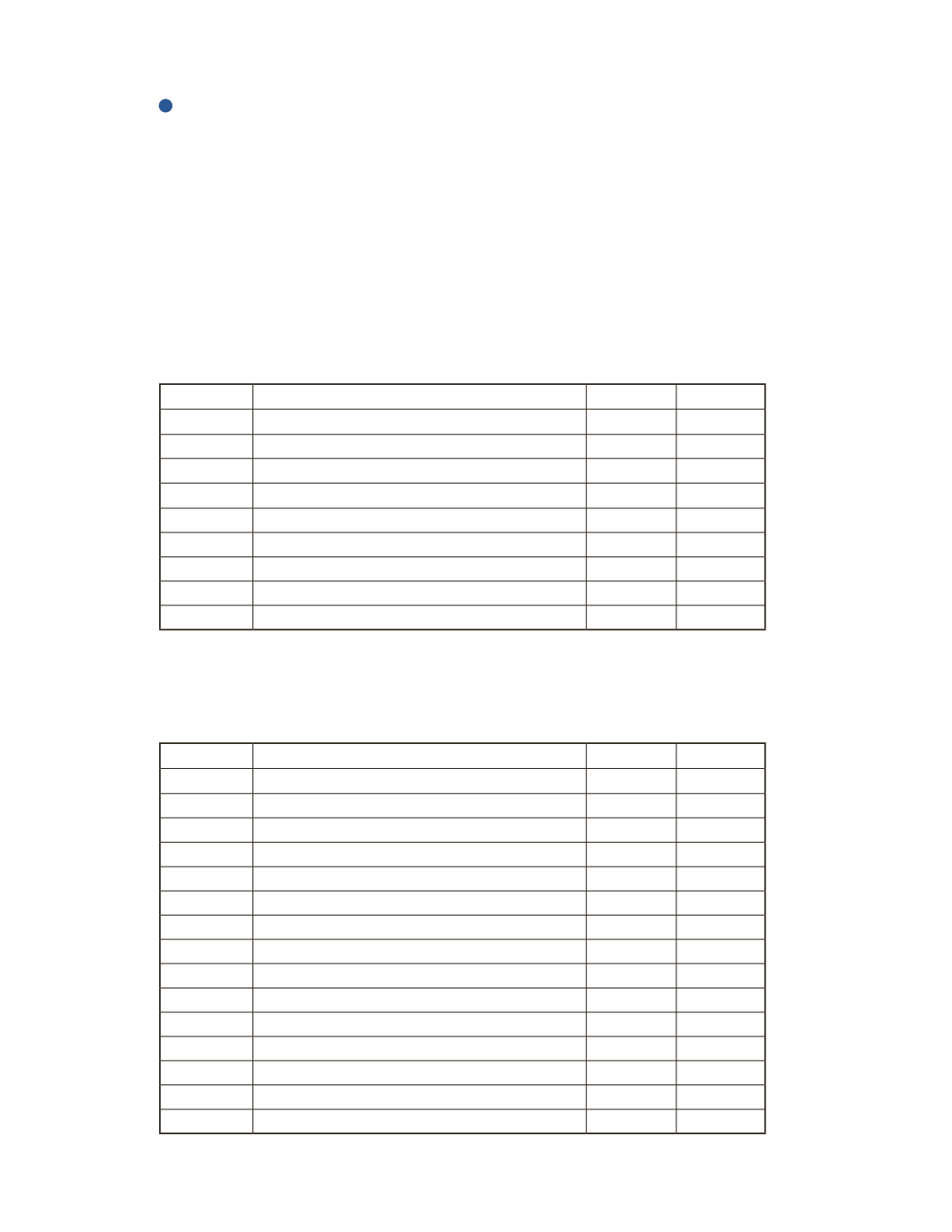

b) Assume instead that Mathew will receive 25% of the profit, Henry will receive 30% of the

profit and Tom will receive 45% of the profit. During the year the business made a loss of

$30,000. Prepare a journal entry to close the income summary account at year-end.

Date

Account Title and Explanation

Debit

Credit