Chapter 5

Partnerships

232

AP-11A (

8

)

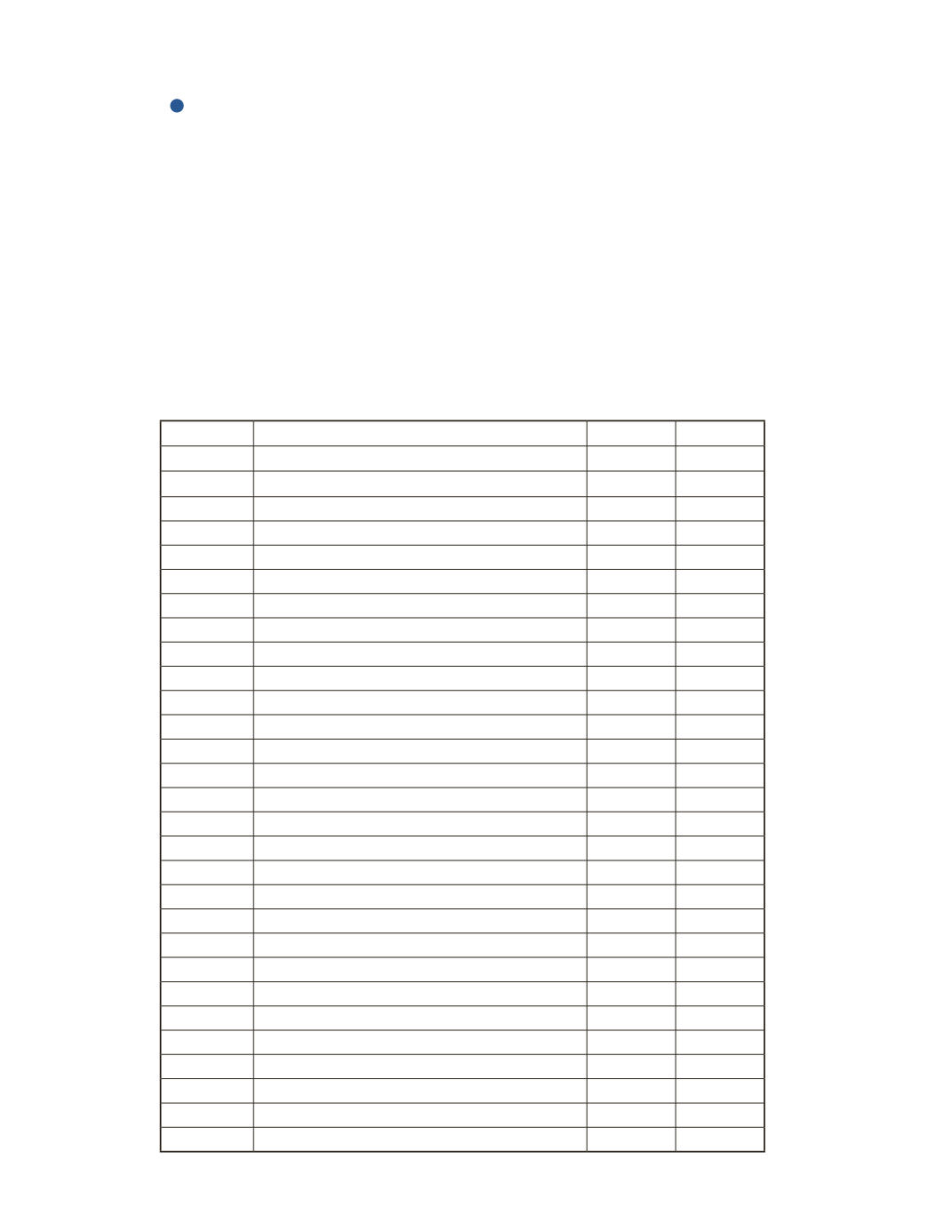

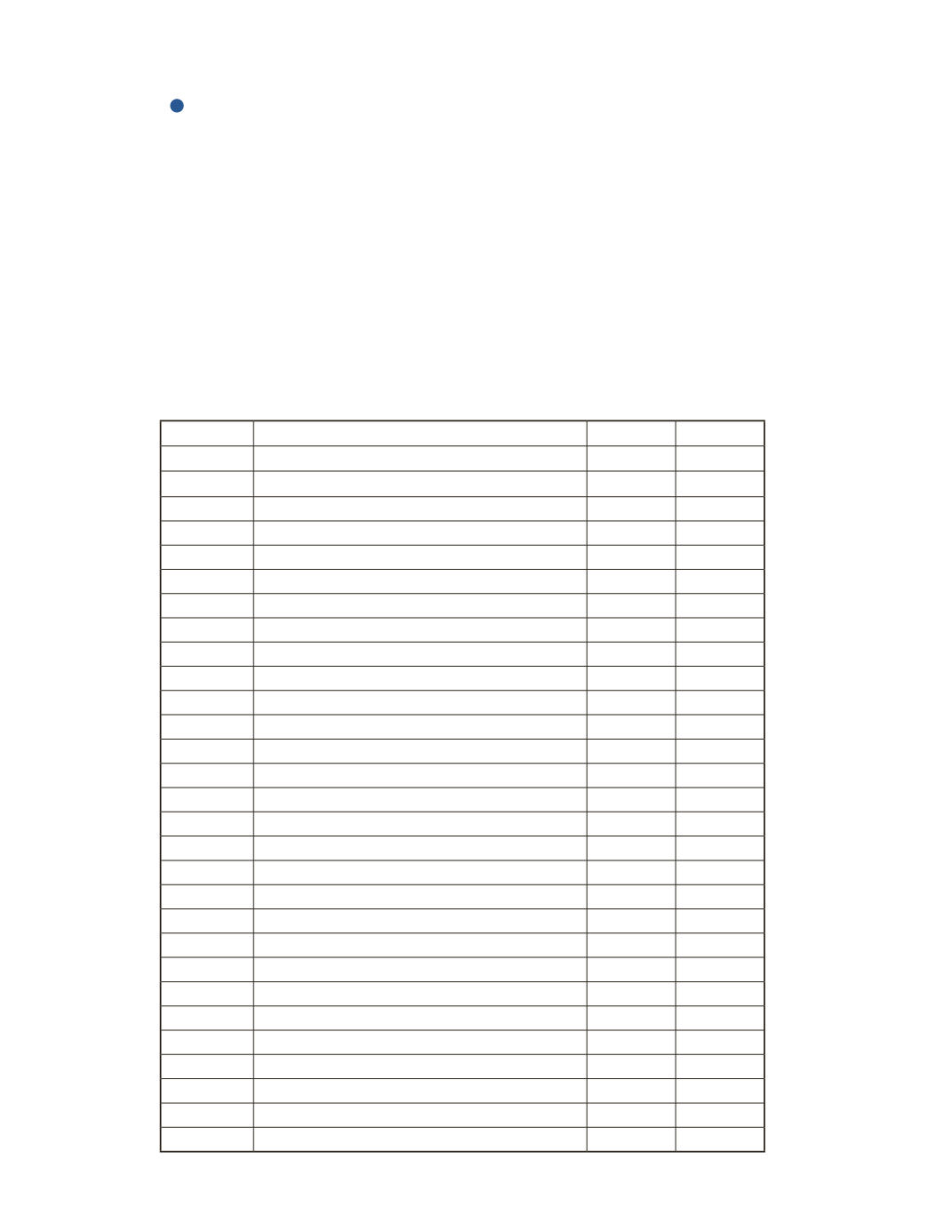

Twenty years ago, three brothers formed a partnership, which now has to end due to their

increasing conflicts. Before the liquidation, the partnership had assets valued at $500,000

and liabilities valued at $300,000. The partners’ equity balances were $50,000 for Brother A,

$70,000 for Brother B and $80,000 for Brother C. The brothers sold the net assets for $230,000.

Note that any profit or loss is distributed equally among the partners according to the

terms of their partnership agreement. Prepare journal entries on December 31, 2016 for the

following items.

• The sale of net assets.

• The allocation of the gain or loss on the sale of net assets.

• The cash distribution to the three brothers.

Date

Account Title and Explanation

Debit

Credit