Chapter 5

Partnerships

226

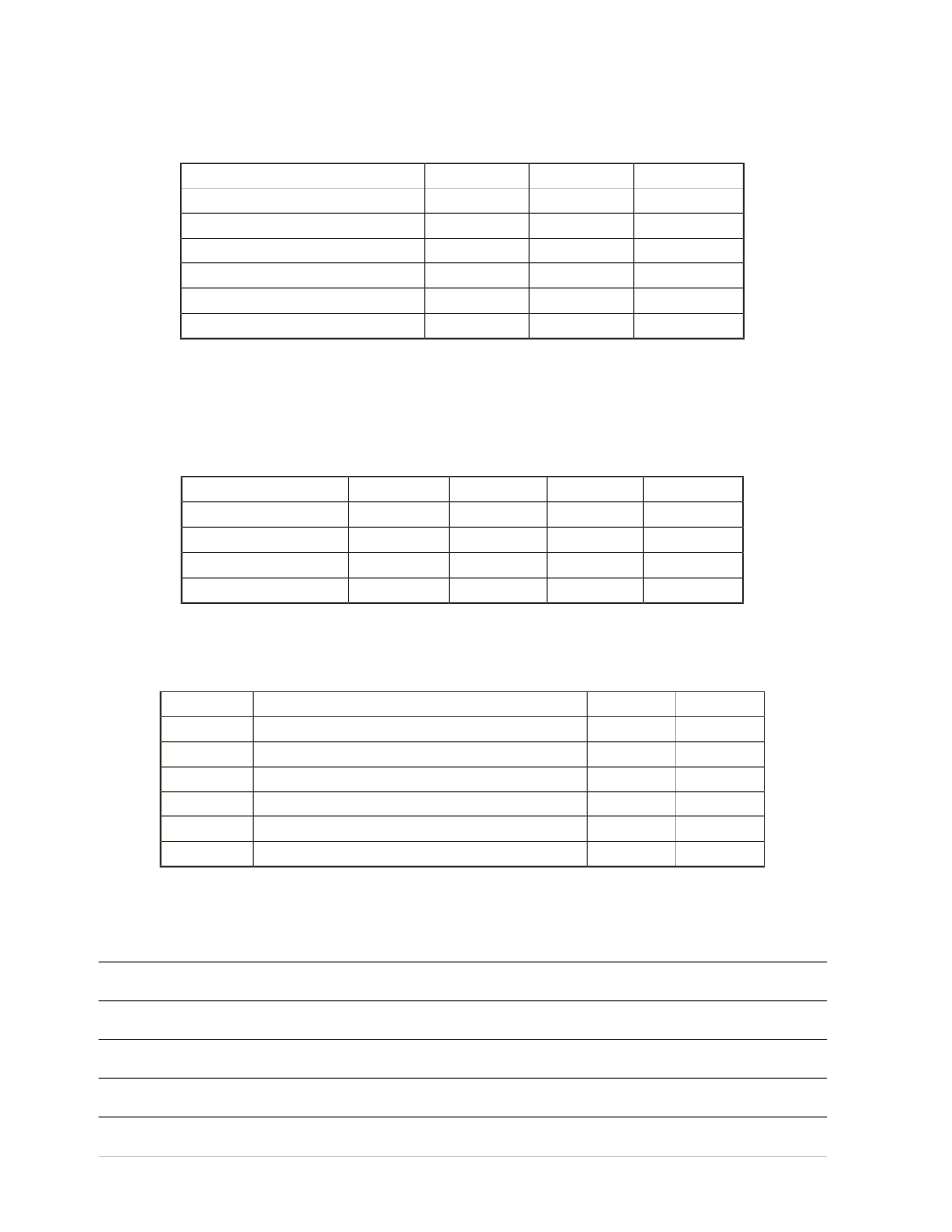

b) Calculate the ending capital balance of each partner, assuming that method (ii) is used to

divide earnings.

A. Anna

P. Peter

J. Jackson

Beginning Capital Balance

Add:

Additional Contribution

Share of Net Income

Subtotal

Less:

Drawings

Ending Capital Balance

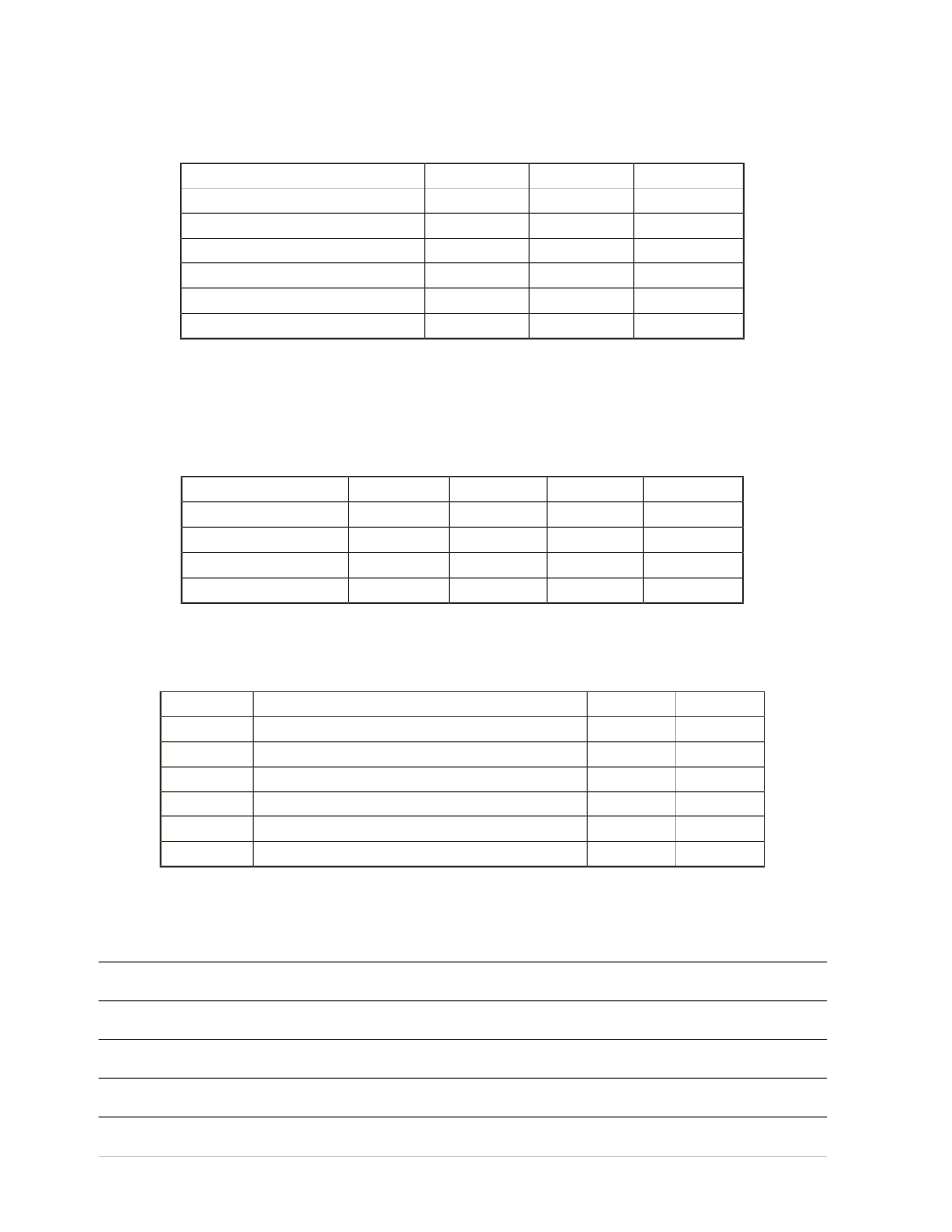

c) A. Anna, P. Peter and J. Jackson decide to receive a salary of $40,000, $55,000 and $45,000

respectively. The remaining earnings will be divided among each partner equally. During

2018, the company earned a net income of $149,000. Calculate the amount of net income

that each partner will receive.

Total

A. Anna

P. Peter

J. Jackson

Net Income

Salary

Remainder

Total Share

d) During 2018, A. Anna, P. Peter and J. Jackson withdrew $10,000, $15,000 and $12,000

respectively. Prepare the journal entries to record the drawings.

Date

Account Title and Explanation

Debit

Credit

e) Calculate the ending capital balance of each partner. The beginning balance for 2018 is

the ending value calculated in part b).