Chapter 5

Partnerships

222

Required

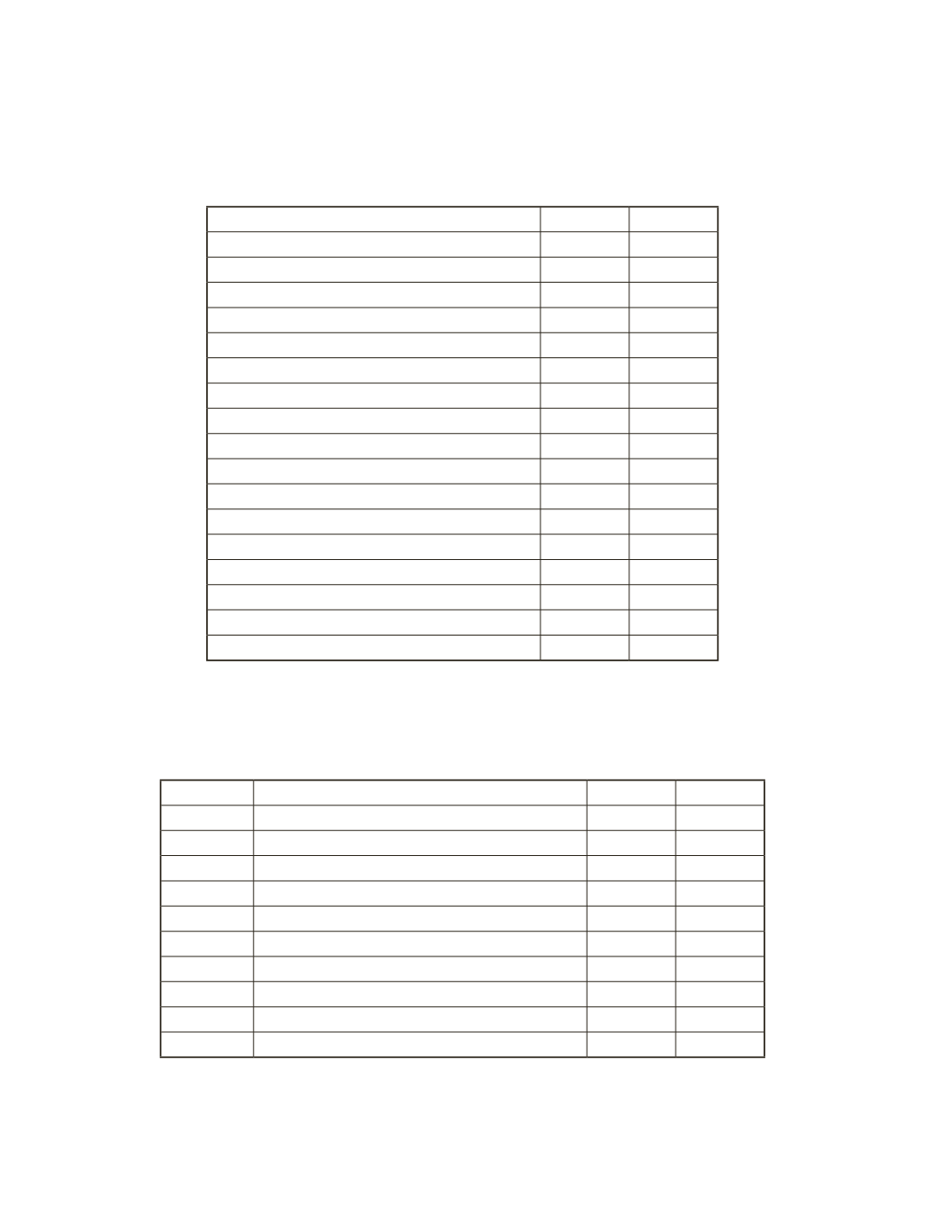

a) When the partnership is formed, show the account balances that will be listed in the

company’s books.

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Doubtful Accounts

Equipment

Accumulated Depreciation

Building

Bank Loan

Note Payable

Biyanka Lee, Capital

Bob Fire, Capital

Larry Ding, Capital

Freeda Red, Capital

Total

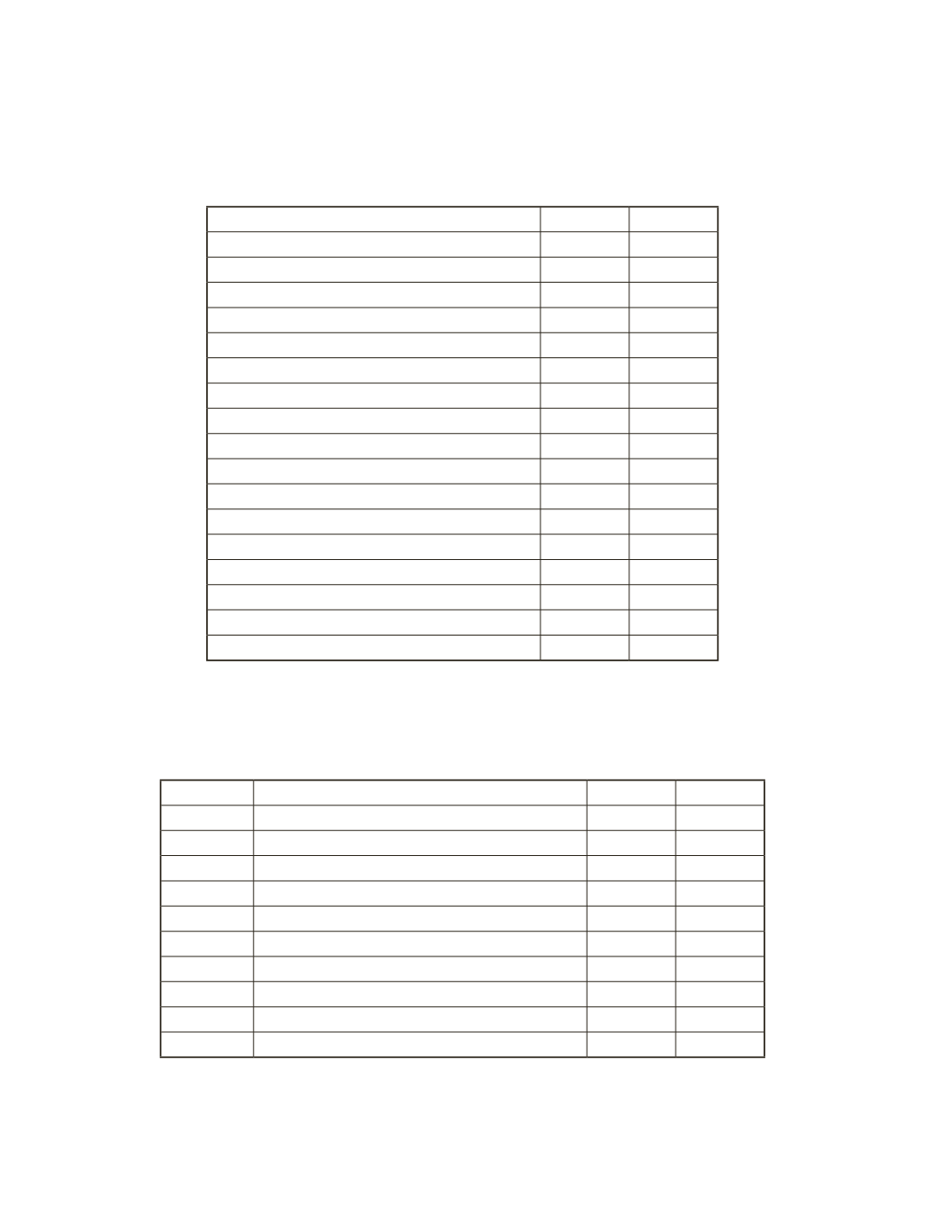

b) Earnings are equally divided among the partners. During 2016, the company earned a net

income of $360,000. Prepare a journal entry on December 31, 2016 to close the income

summary account at year-end.

Date

Account Title and Explanation

Debit

Credit