Chapter 5

Partnerships

224

AP-4A (

4

)

Mallory Longshore, Lakisha Laffey and Avis Hemsley set up a partnership at the beginning

of 2016. Mallory contributed $10,000 in cash. Lakisha contributed a van worth $20,000. Avis

contributed equipment worth $15,000. The partnership made $9,000 net income for the

year. According to the partnership agreement, profits are divided in the ratio of their initial

contributions.

Required

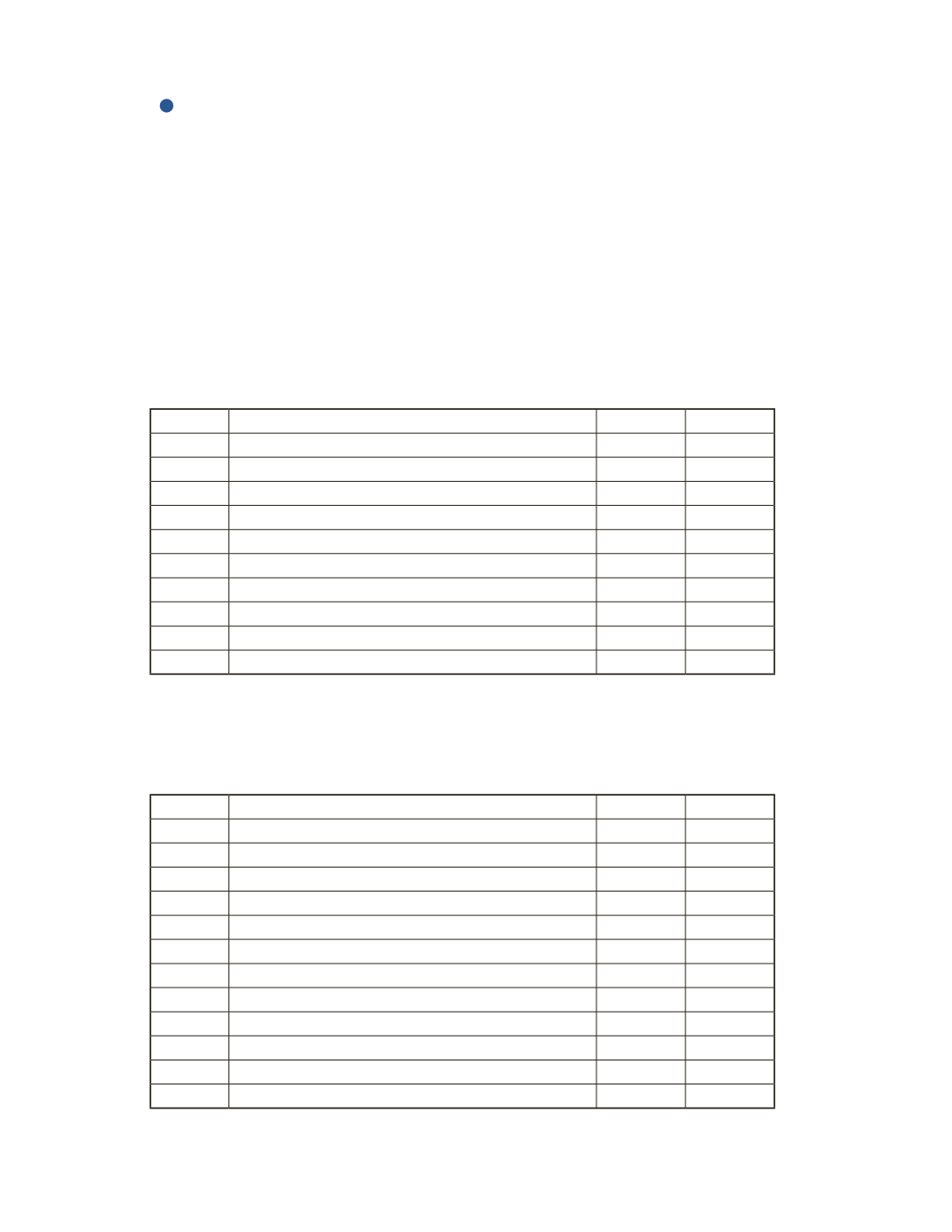

a) Record the entry for the division of the profit on December 31, 2016. Assume that

revenues and expenses have already been closed to the income summary account.

Date

Account Title and Explanation

Debit

Credit

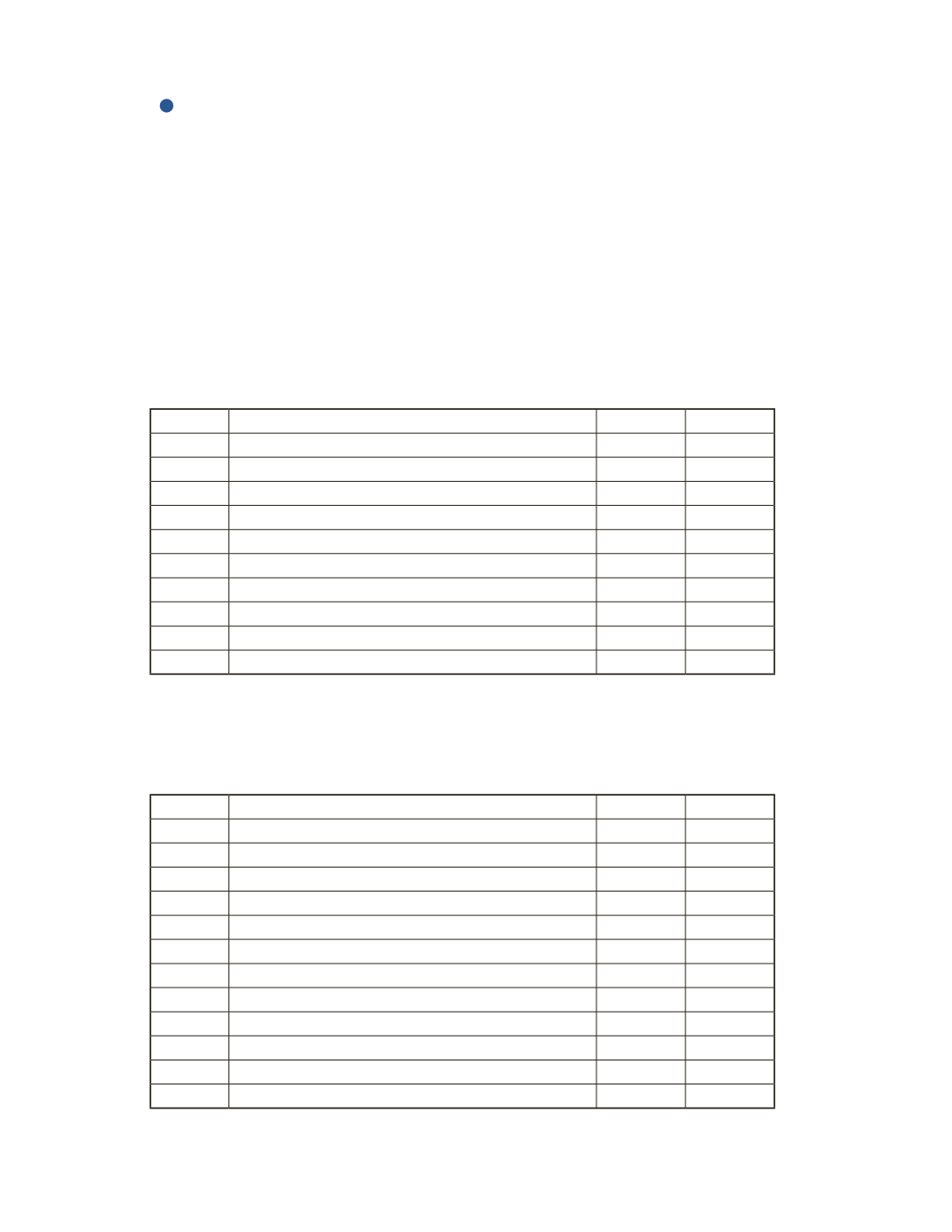

b) Assume that the partnership recorded a loss of $4,500. Record the entry for the division

of the loss. Assume that revenues and expenses have already been closed to the income

summary account.

Date

Account Title and Explanation

Debit

Credit