Chapter 5

Partnerships

223

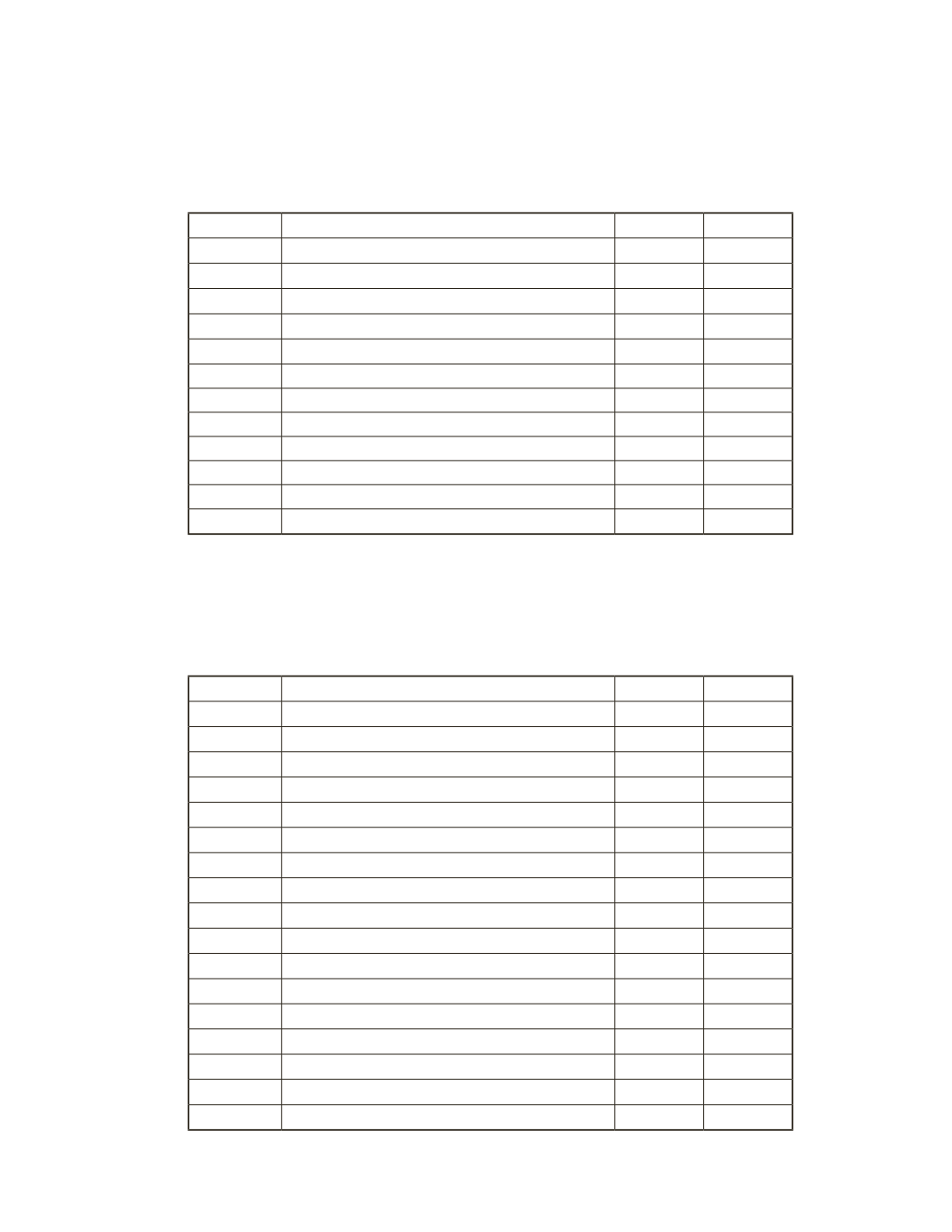

c) Independent of part b), suppose it was decided that Biyanka Lee will receive 10%, Bob

Fire will receive 25%, Larry Ding will receive 40%, and Freeda Red will receive 25% of the

profits. During 2016, the company had a net loss of $15,000. Prepare the journal entry on

December 31, 2016 to close the income summary account at year-end.

Date

Account Title and Explanation

Debit

Credit

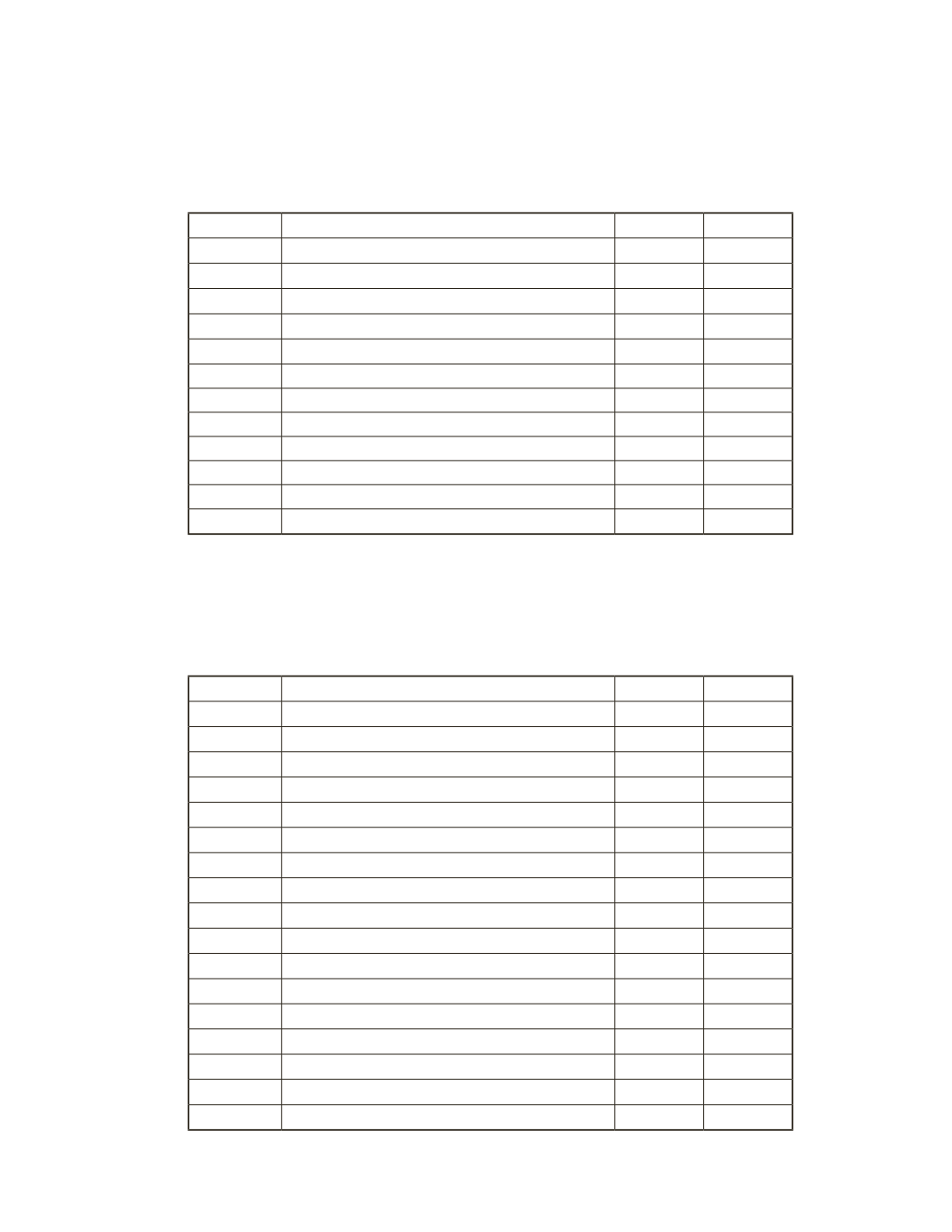

d) Independent of parts b) and c), suppose it was decided that the earnings will be divided

based on each partner’s capital contribution. During 2016, the company earned a net

income of $86,000. Prepare the journal entry on December 31, 2016 to close the income

summary account at year-end.

Date

Account Title and Explanation

Debit

Credit