Chapter 5

Partnerships

233

AP-12A (

7

)

Thomas, Helen, and Ahmed formed a partnership in 2016 to make furniture for commercial

projects. On January 1, 2017, the partners had the following capital account balances:

Thomas—$25,000, Helen—$35,000 and Ahmed—$50,000. On January 1, 2017 Helen decided

to withdraw from the partnership. Helen sold 40% of her portion of capital to Thomas and the

remaining 60% to Ahmed. Prepare a journal entry to record the transaction and calculate the

balance of the partners’ capital accounts after the withdrawal of Helen.

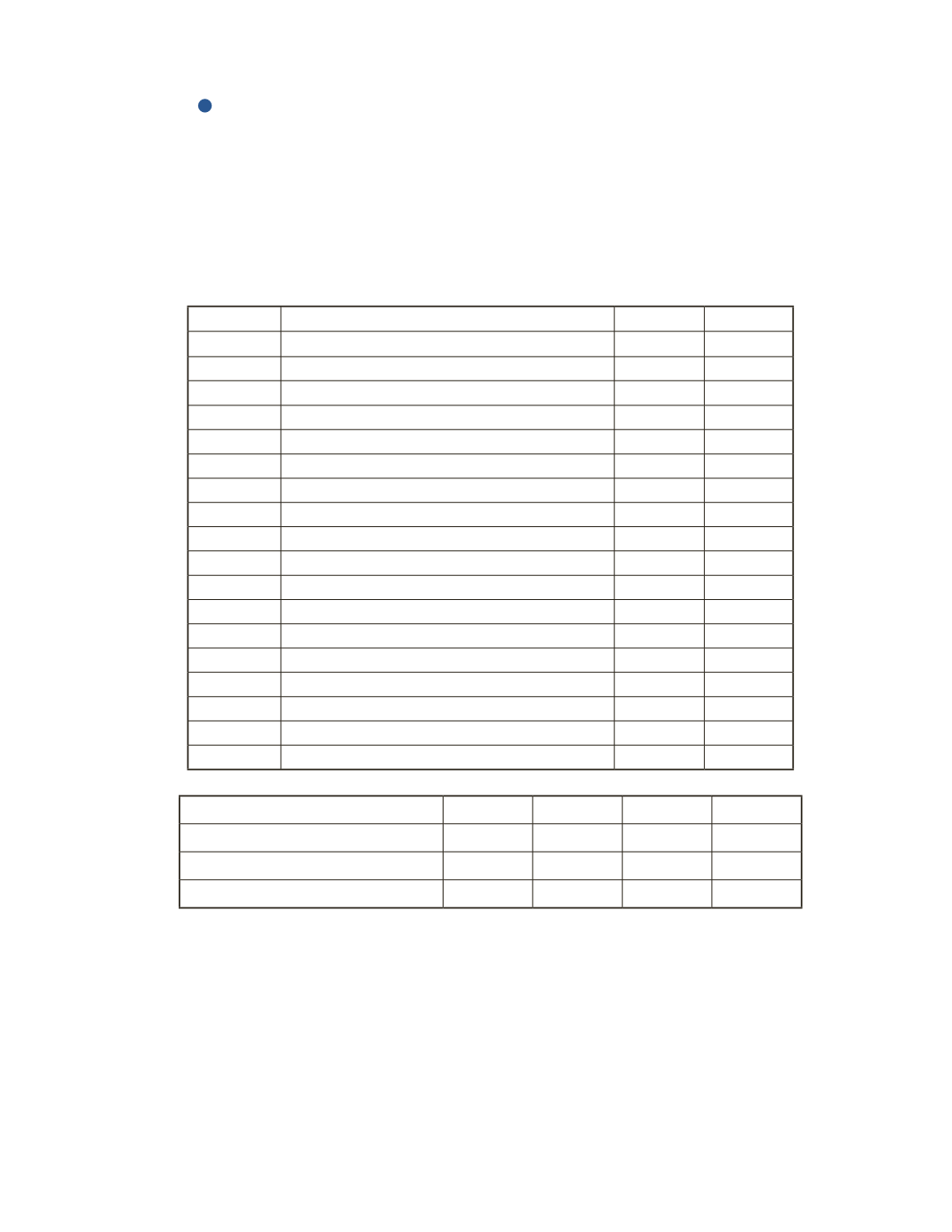

Date

Account Title and Explanation

Debit

Credit

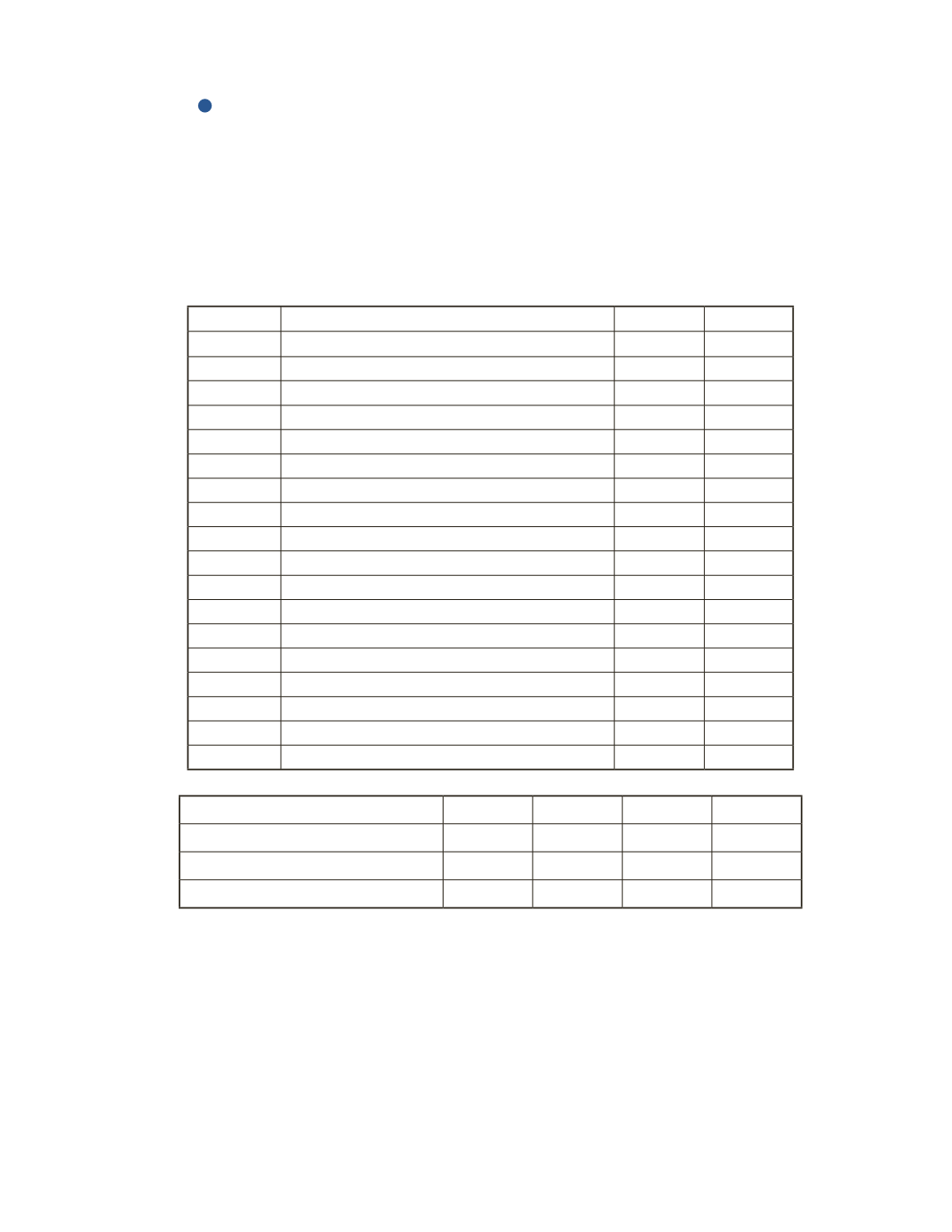

Thomas

Helen Ahmed

Total

Capital balance before withdrawal

Withdrawal of Helen

Capital balance after withdrawal