Chapter 5

Partnerships

243

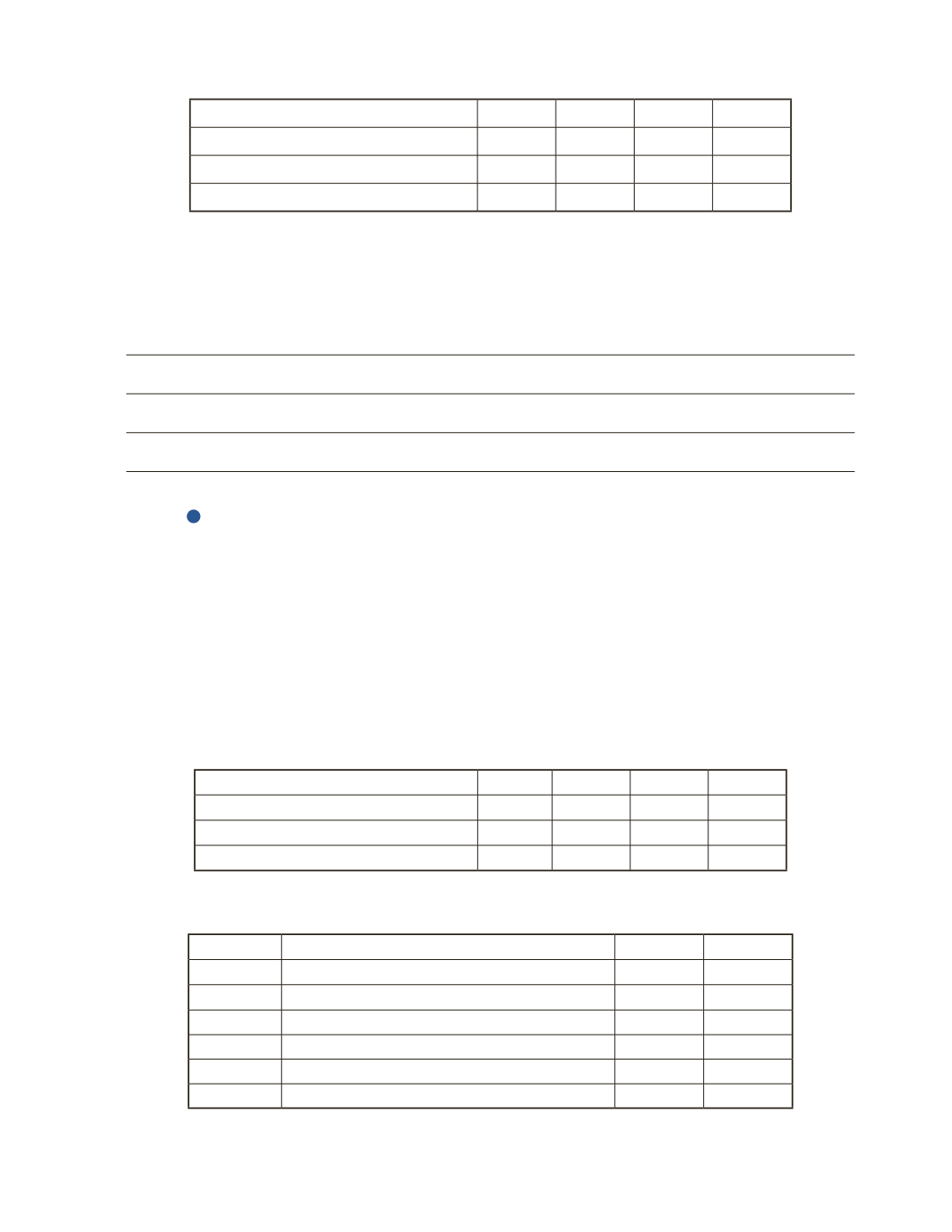

John Karthik Harish Total

Capital balance before withdrawal

Withdrawal of Karthik

Capital balance after withdrawal

Analysis

Compare the impact on the assets of the partnership in parts d) and e).

AP-8B (

7

)

Jack, John, and Joe have been operating a business as a partnership for several years. On

January 1, 2016, Jack, John and Joe had a capital balance of $255,000, $180,000 and $132,000

respectively. However, due to a business conflict, Joe decided to withdraw from the partnership.

Jack and John decided to pay off Joe using the partnership’s cash.

Required

a) Calculate the new capital balance for each partner after the withdrawal of Joe.

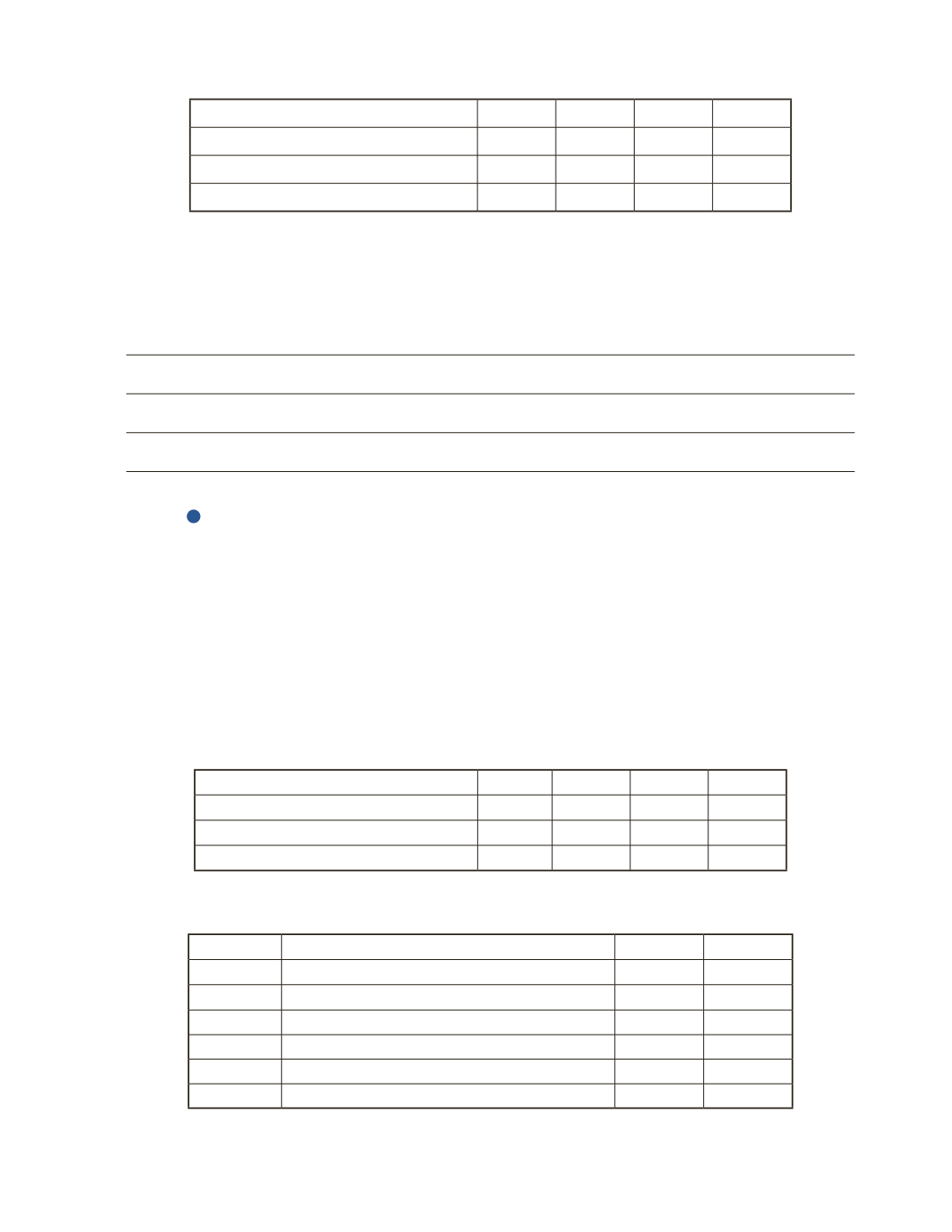

Jack

John

Joe

Total

b) Prepare the journal entry to record the withdrawal of Joe.

Date

Account Title and Explanation

Debit

Credit