Chapter 5

Partnerships

244

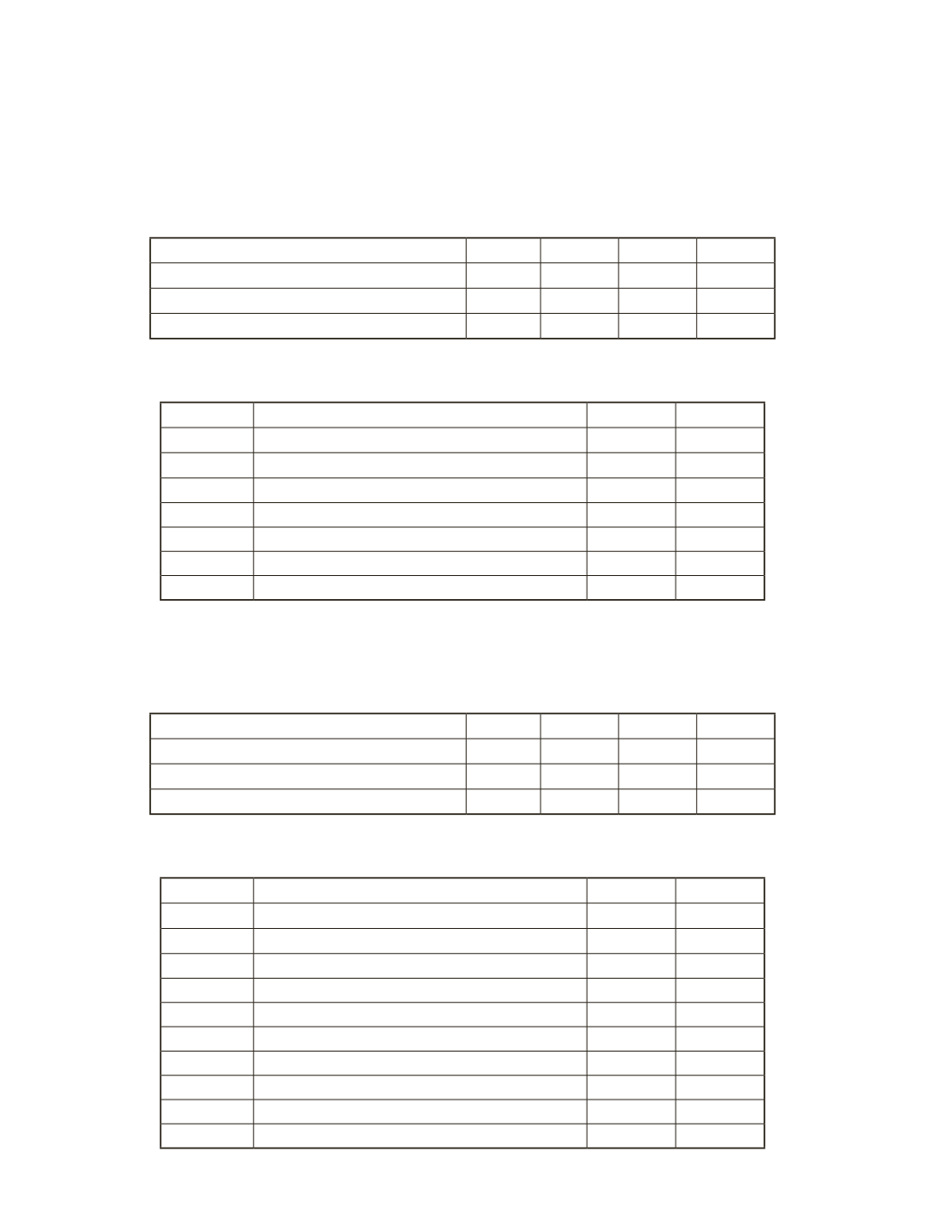

c) After Joe has left, Jack and John added Jim to the partnership on January 1, 2016. A

partnership with Jim will considerably increase the value of the business. Therefore, Jim

receives a $100,000 share of the business’ book value for an $80,000 investment. Calculate

the new capital balance for each partner after Joe has been withdrawn and Jim has been

added to the partnership.

Jack

John

Jim Total

d) Prepare the journal entry to record the admission of Jim from part c).

Date

Account Title and Explanation

Debit

Credit

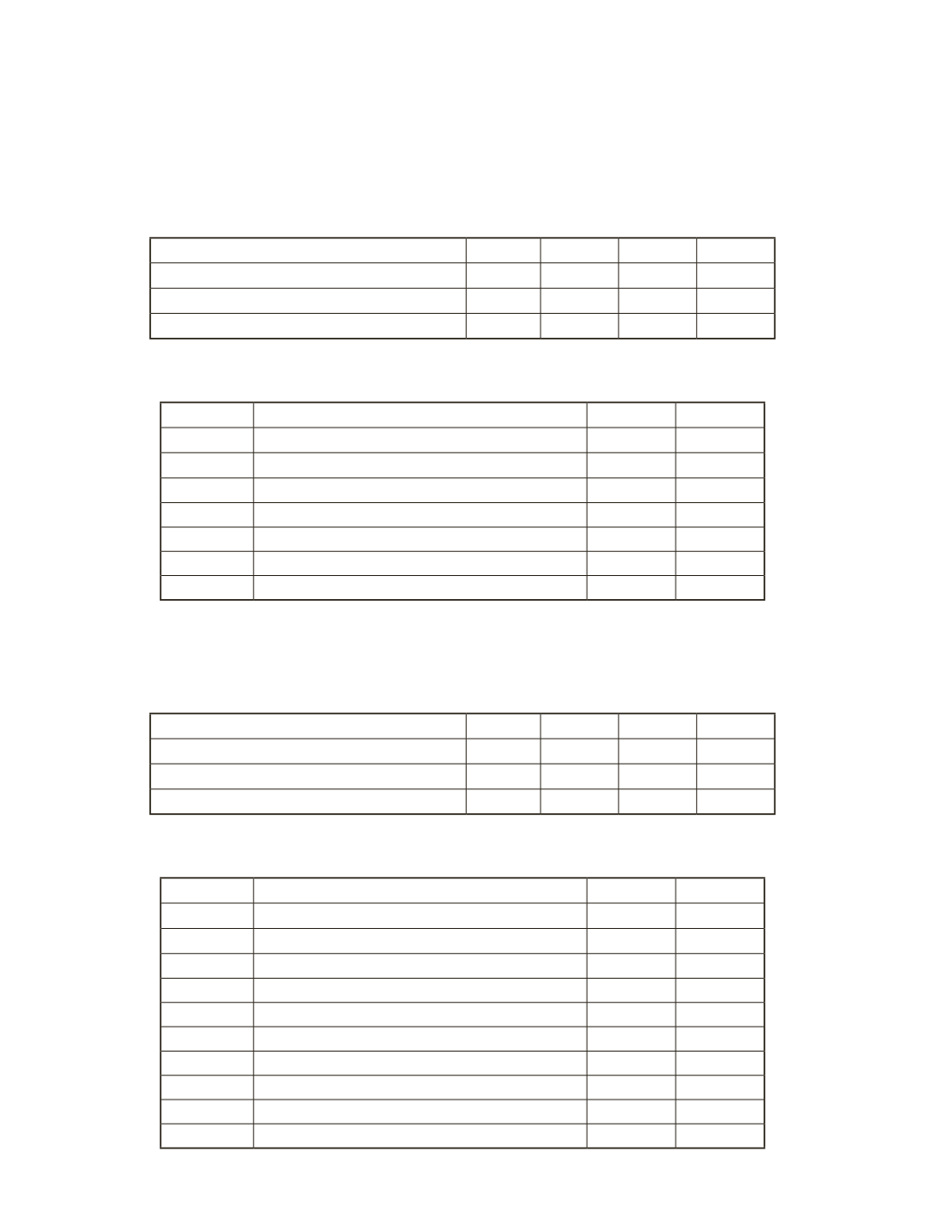

e) Independent of part c), assume that Jim will receive a $100,000 share of the business’ book

value for a $130,000 investment. Calculate the new capital balance for each partner after

Joe has been withdrawn and Jim has been added to the partnership.

Jack

John

Jim Total

f ) Prepare the journal entry to record the admission of Jim from part e).

Date

Account Title and Explanation

Debit

Credit