Chapter 5

Partnerships

239

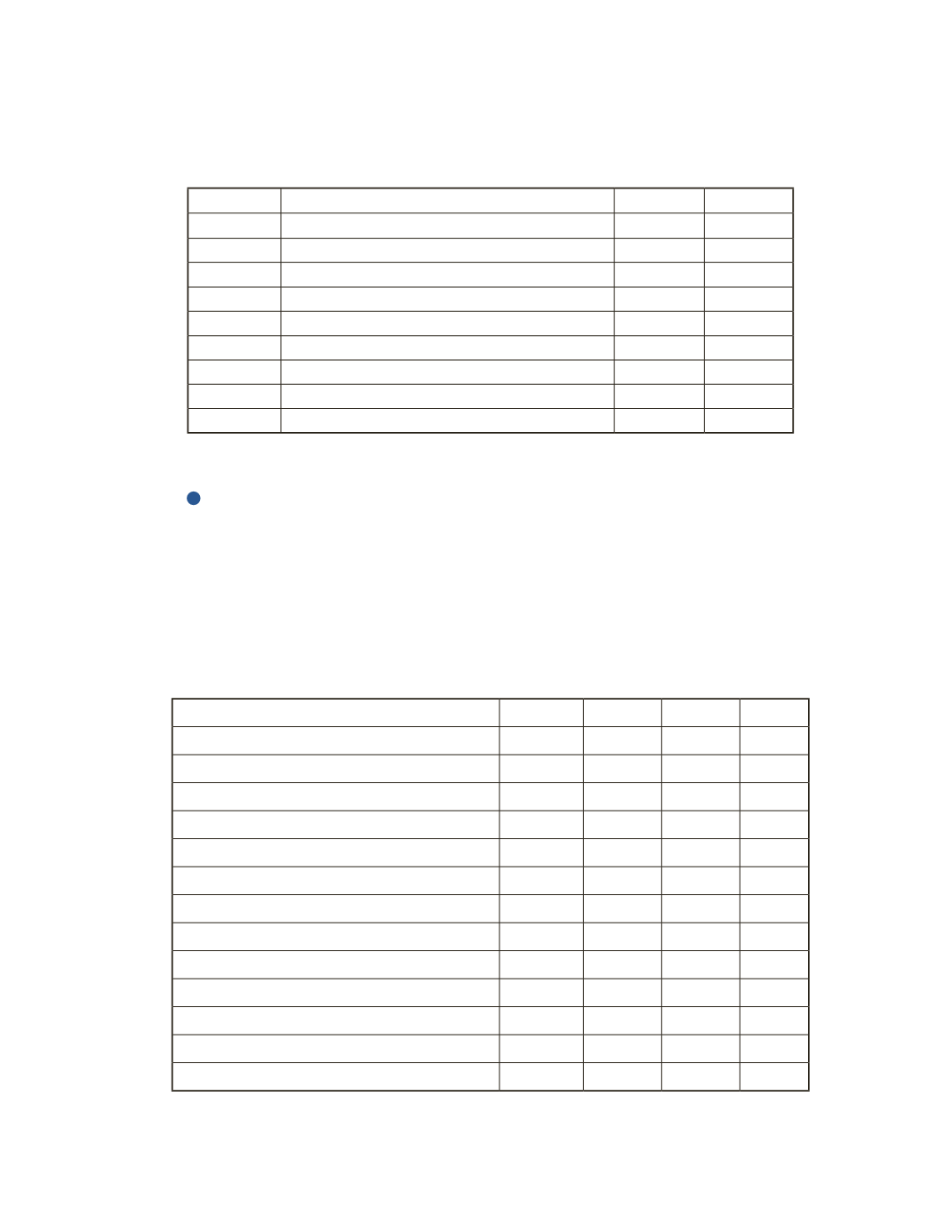

c) Assume instead that profits will be divided based on each partner’s capital contribution.

During the year, the business made a net income of $60,000. Prepare a journal entry to

close the income summary account at year-end.

Date

Account Title and Explanation

Debit

Credit

AP-6B (

4

)

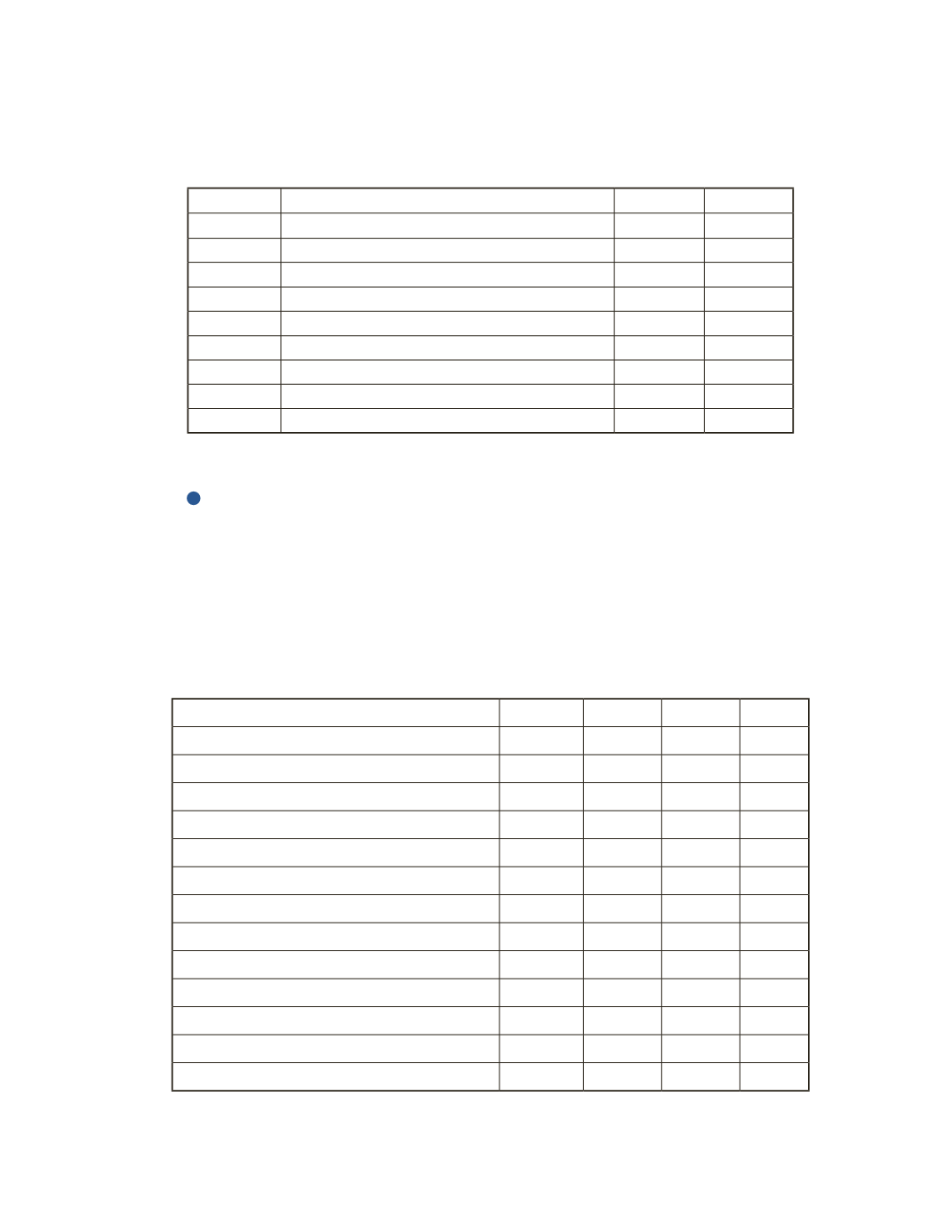

Chloe, Chen and Yang are in partnership. According to the partnership agreement, Chloe

and Chen will receive a salary of $5,000 each. Each partner will also be entitled to receive 3%

interest on their capital account balance at the beginning of the year. Any profit and losses are

to be shared in the ratio 3:2:1 to Chloe, Chen and Yang, respectively. Capital account balances

are Chloe—$25,000, Chen—$20,000 and Yang—$10,000. During 2016, the business earned a

net income of $65,000. Calculate the amount of net income each partner will receive.

Total

Chloe Chen Yang