Chapter 5

Partnerships

225

AP-5A (

4

)

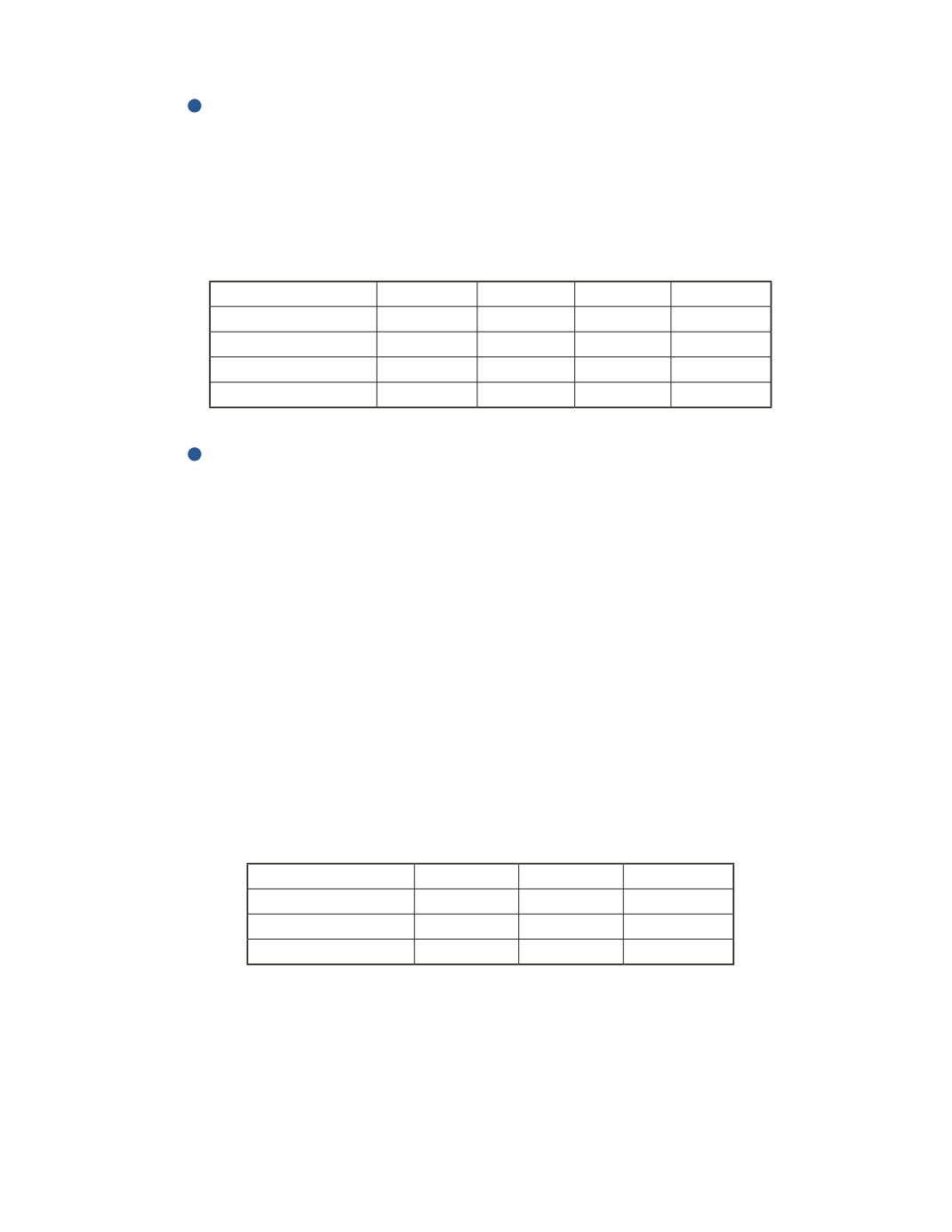

Brian, Miley and Adriana operate a business under partnership. It was decided that Brian,

Miley and Adriana will receive a salary of $65,000, $70,000 and $55,000 respectively. The

remaining profit will be equally divided among the partners. During the year 2016, the

company made a net income of $160,000. Calculate the amount of net income each partner

will receive.

Total

Brian

Miley

Adriana

AP-6A (

4

)

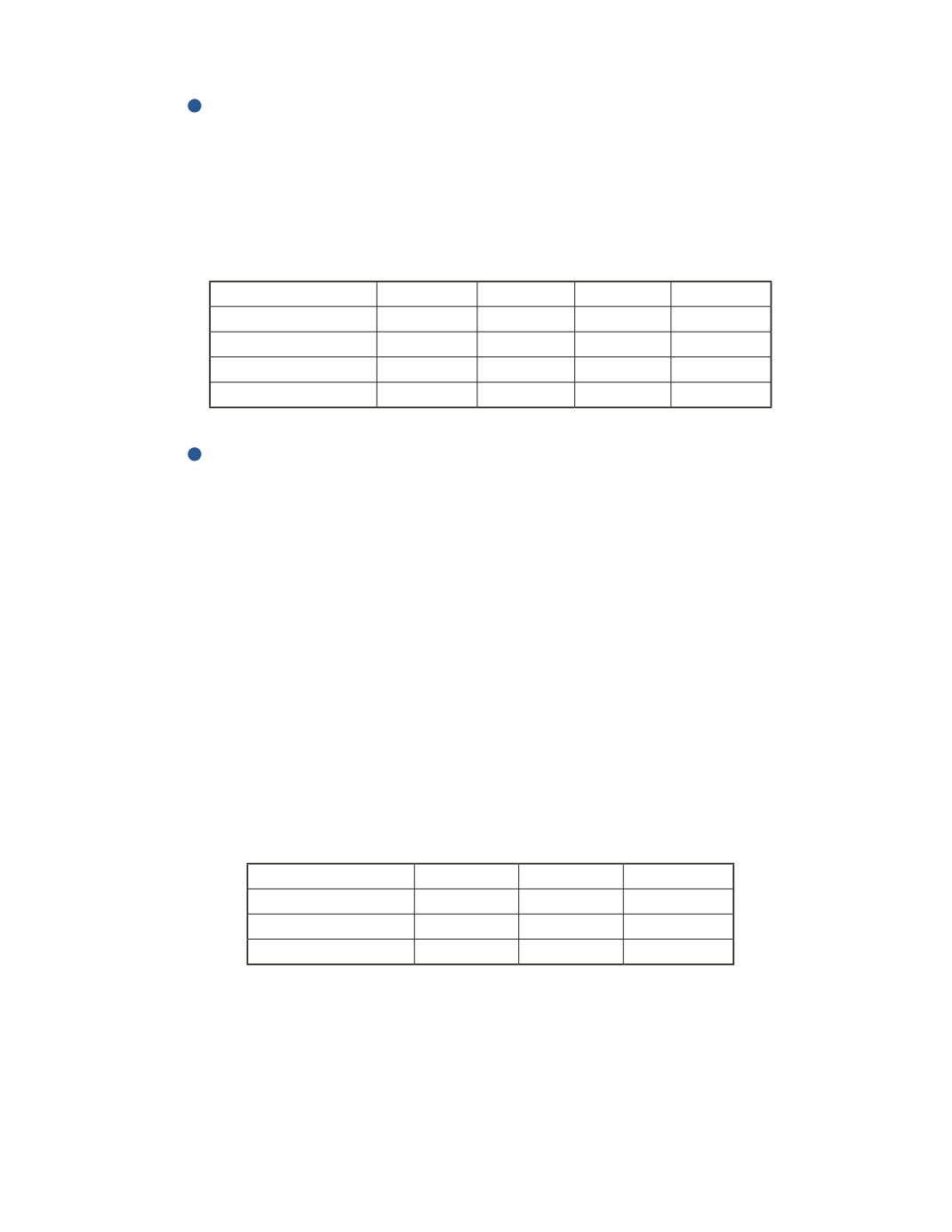

A. Anna, P. Peter and J. Jackson formed a partnership in 2015. In 2017, the beginning capital

balance of each partner was $25,000, $35,000 and $30,000 respectively. During 2017, the

company earned a net income of $63,000, and A. Anna withdrew $25,000 while P. Peter and J.

Jackson withdrew $40,000 and $35,000 respectively.

Required

a) Calculate the amount of net income each partner will receive based on the following

independent scenarios.

(i) the earnings are divided equally

(ii) A. Anna receives 30%, P. Peter receives 40%, and J. Jackson receives 30% of the

earnings

(iii) the earnings are divided based on the partner’s capital balance at the beginning of

the year

(i)

(ii)

(iii)

A. Anna

P. Peter

J. Jackson