Chapter 5

Partnerships

221

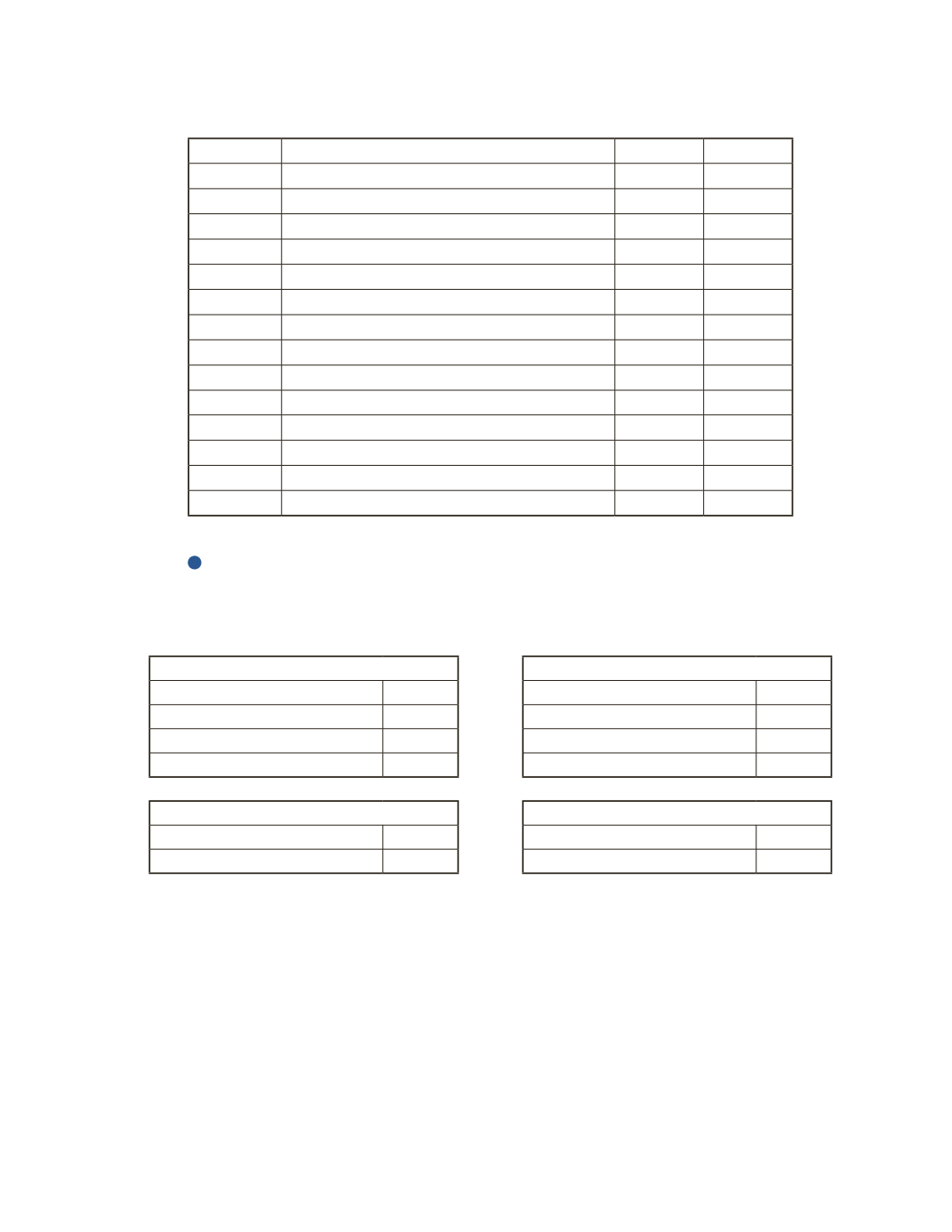

b) Prepare a journal entry to set up the partnership, and to record the additional investment.

Date

Account Title and Explanation

Debit

Credit

AP-3A (

3

)

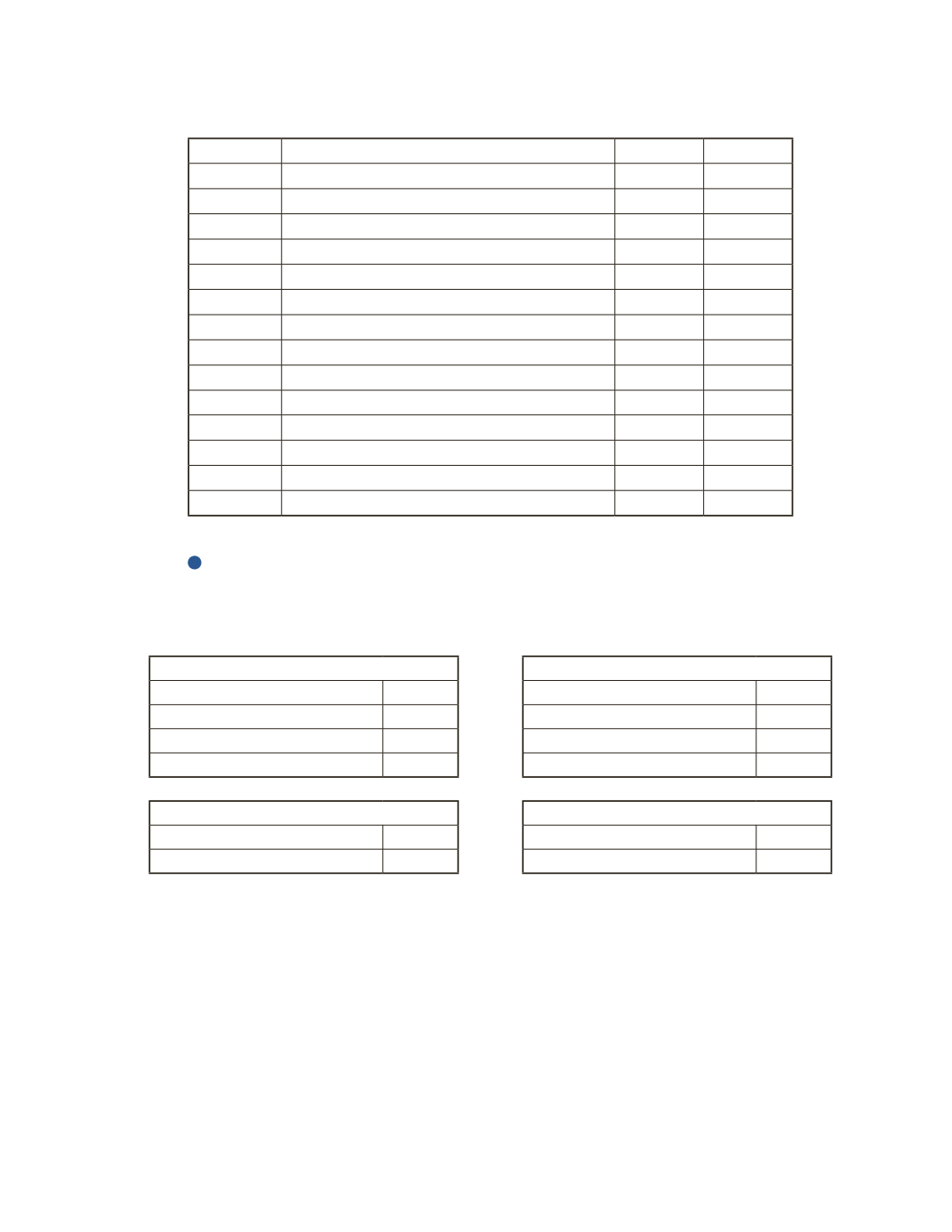

The following four people started a partnership and brought the assets and liabilities listed

into the new business.

Biyanka Lee

Cash

$14,000

Accounts Receivable

5,000

Allowance for Doubtful Accounts

800

Note Payable

2,500

Larry Ding

Cash

$28,000

Building

240,000

Bob Fire

Cash

$55,000

Equipment

11,000

Accumulated Depreciation

1,000

Bank Loan

8,000

Freeda Red

Cash

$60,000

Note: An independent appraiser determined that the allowance for doubtful accounts should

be $600. All other assets are recorded at their fair market values.