Chapter 11

Financial Statement Analysis

591

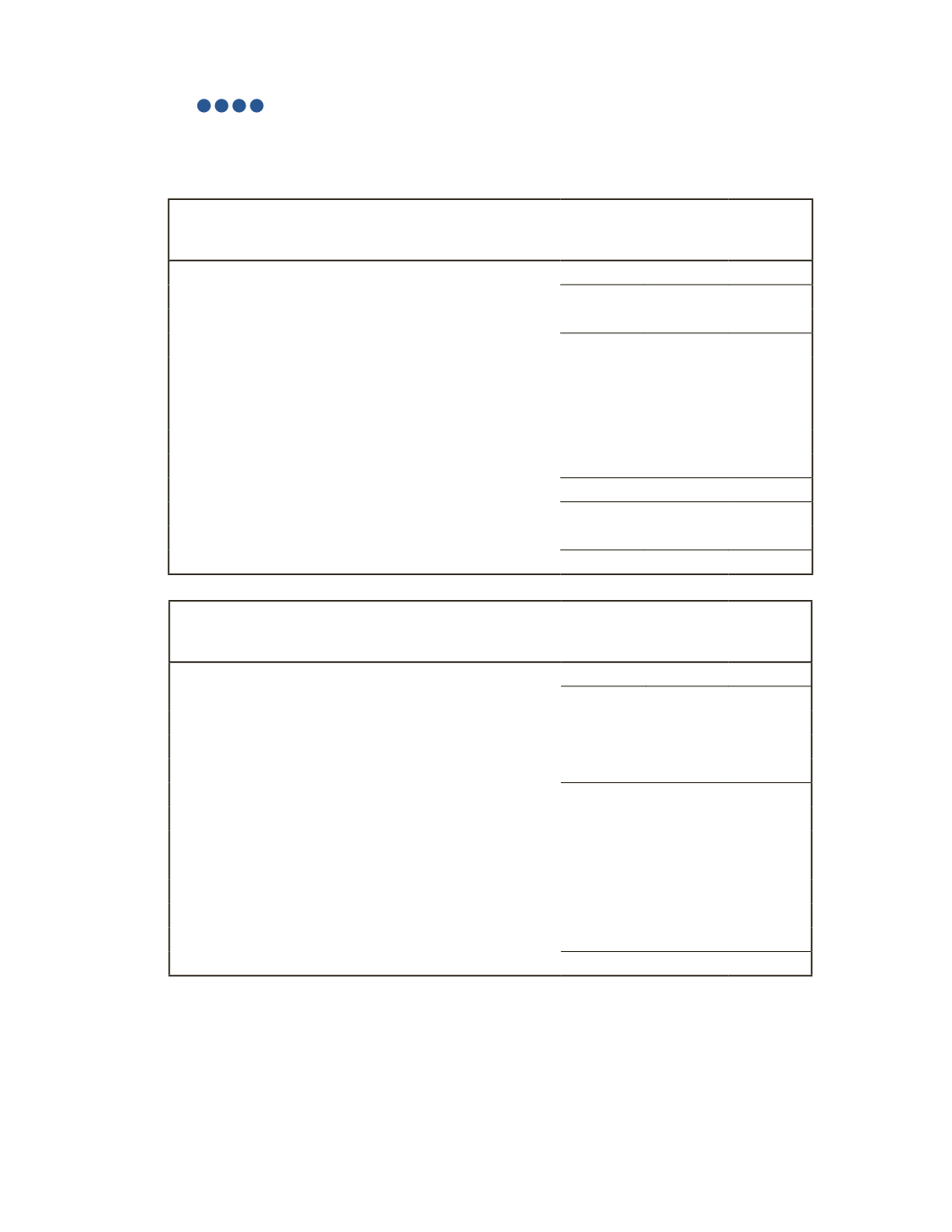

AP-21B (

3

4

5

6

)

The income statements and balance sheets for Hathaway Inc. are shown below for the last

three fiscal years. All sales are on credit.

Hathaway Inc.

Income Statement

For the Year Ended

2016

2015

2014

Sales

$800,000

$720,000

$760,000

Cost of Goods Sold

260,000

288,000

266,000

Gross Profit

540,000

432,000

494,000

Expenses

Operating Expense

320,000

216,000

342,000

Depreciation Expense

64,000

72,000

76,000

Advertising Expense

80,000

72,000

114,000

Interest Expense

10,000

10,000

10,000

Total Expenses

474,000

370,000

542,000

Net Income (Loss) before Taxes

66,000

62,000

(48,000)

Income Tax Expense (Return)

29,700

27,900

(21,600)

Net Income (Loss)

$36,300

$34,100

($26,400)

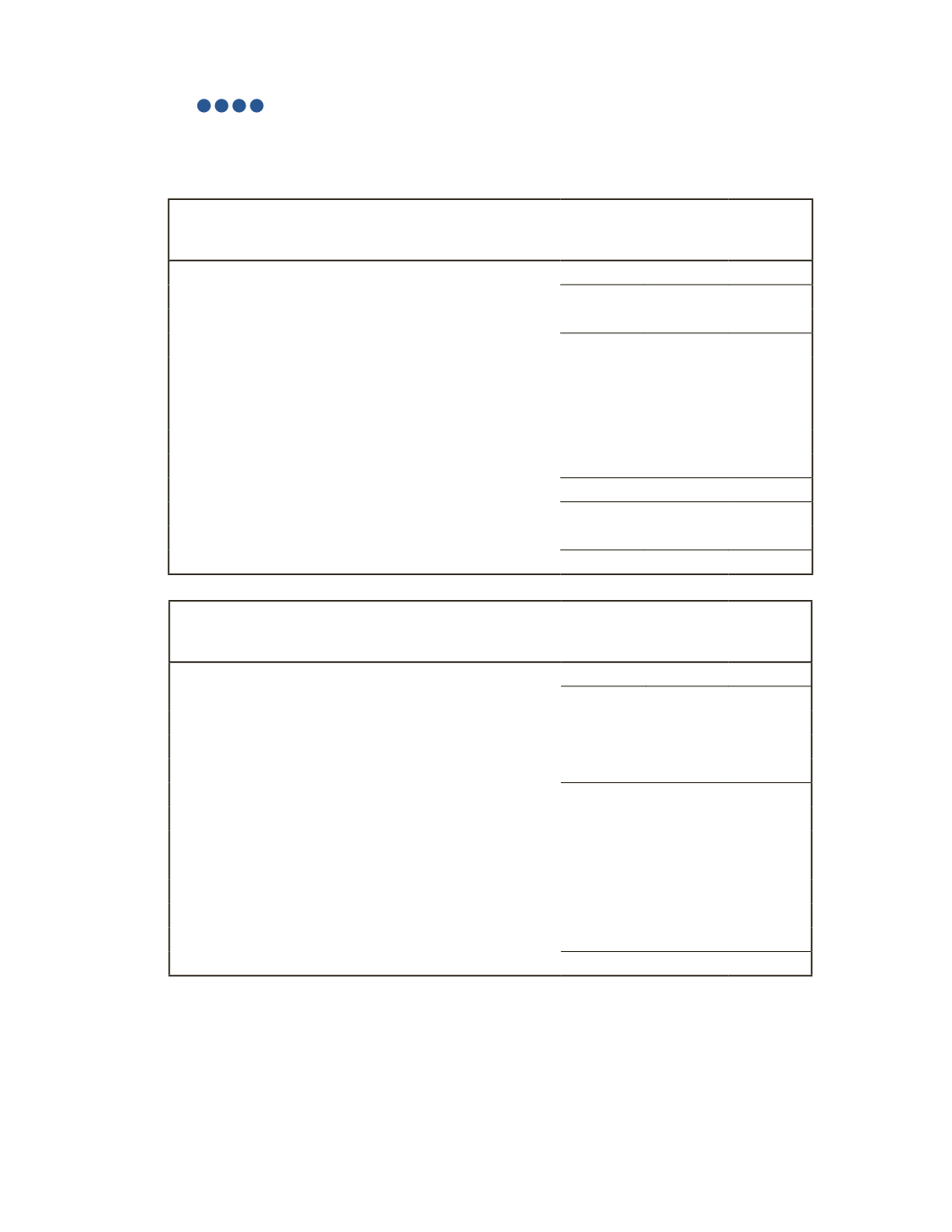

Hathaway Inc.

Balance Sheet

At the Year Ended

2016

2015

2014

Cash

$234,400

$149,600

$80,000

Accounts Receivable

84,000

70,000

56,000

Inventory

136,000

102,000

61,200

Equipment

110,000

174,000

246,000

Total Assets

$564,400 $495,600 $443,200

Accounts Payable

$54,600

$45,500

$36,400

Unearned Revenue

21,000

23,100

18,900

Long-Term Debt

50,000

50,000

50,000

Common Shares

85,500

60,000

55,000

Retained Earnings

353,300

317,000

282,900

Total Liabilities and Shareholders' Equity

$564,400 $495,600 $443,200

Other Information

Hathaway Inc. has an unlimited number of shares authorized; the following common shares

were outstanding in each year for the entire year: 2016—60,000, 2015—40,000,

2014—30,000.