Chapter 11

Financial Statement Analysis

582

AP-15B (

3

4

5

)

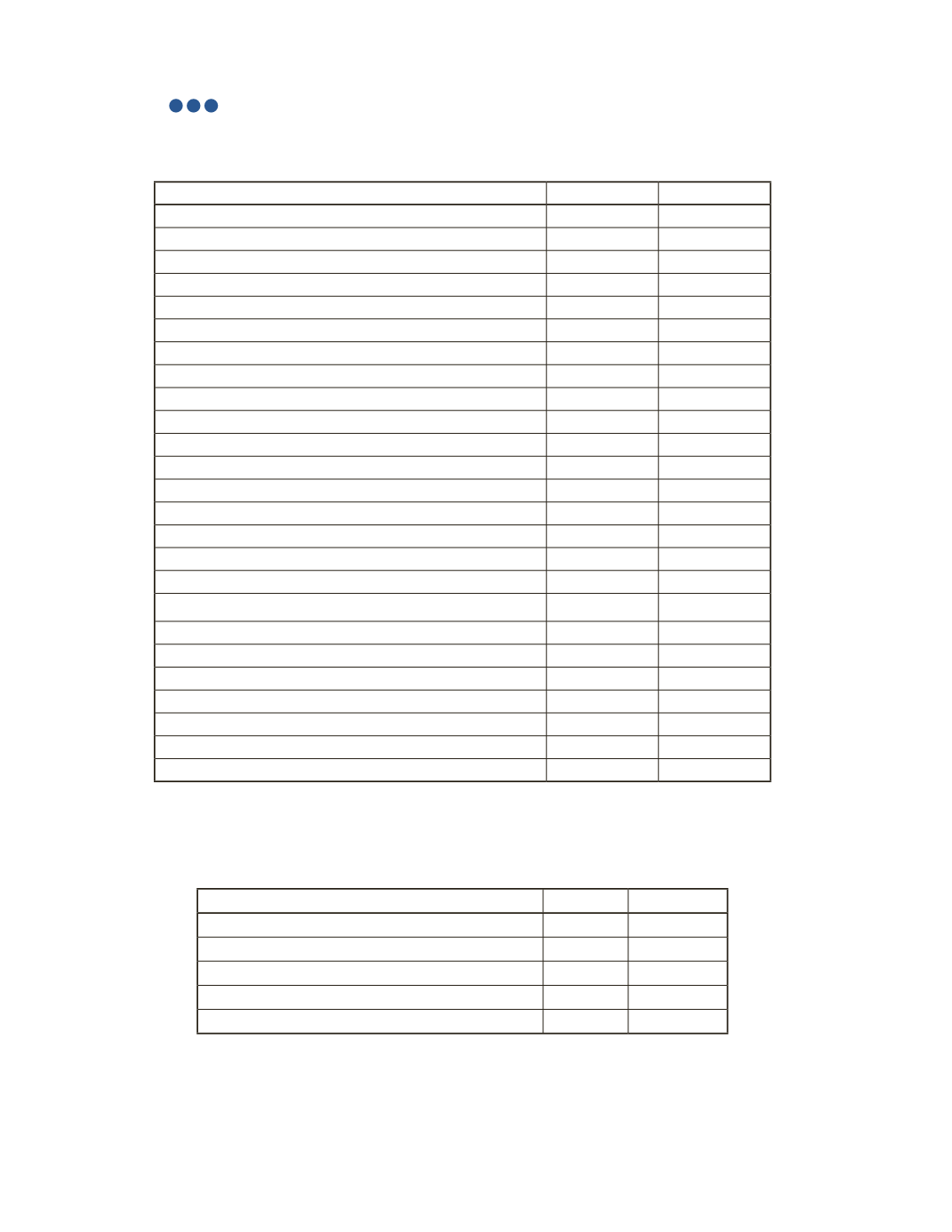

Below is select financial statement information for Alpha Inc. and Delta Corp.

Alpha Inc.

Delta Corp.

Sales

$105,000

$87,000

Cost of Goods Sold

34,125

29,580

Gross Profit

70,875

57,420

Expenses

Operating Expense

15,750

13,050

Depreciation Expense

10,500

8,700

Advertising Expense

5,250

4,350

Interest Expense

8,925

4,524

Total Expenses

40,425

30,624

Net Income before Taxes

30,450

26,796

Income Tax Expense

18,900

15,660

Net Income

$11,550

$11,136

Cash

$18,525

$24,700

Accounts Receivable

12,300

21,070

Inventory

34,500

30,125

Equipment

66,800

63,460

Total Assets

$132,125

$139,355

Accounts Payable

$43,530

$33,177

Unearned Revenue

17,800

29,580

Current Portion of Long-Term Debt

8,304

1,324

Long-Term Debt

27,680

8,825

Shareholders' Equity

34,811

66,449

Total Liabilities and Shareholders' Equity

$132,125

$139,355

Required

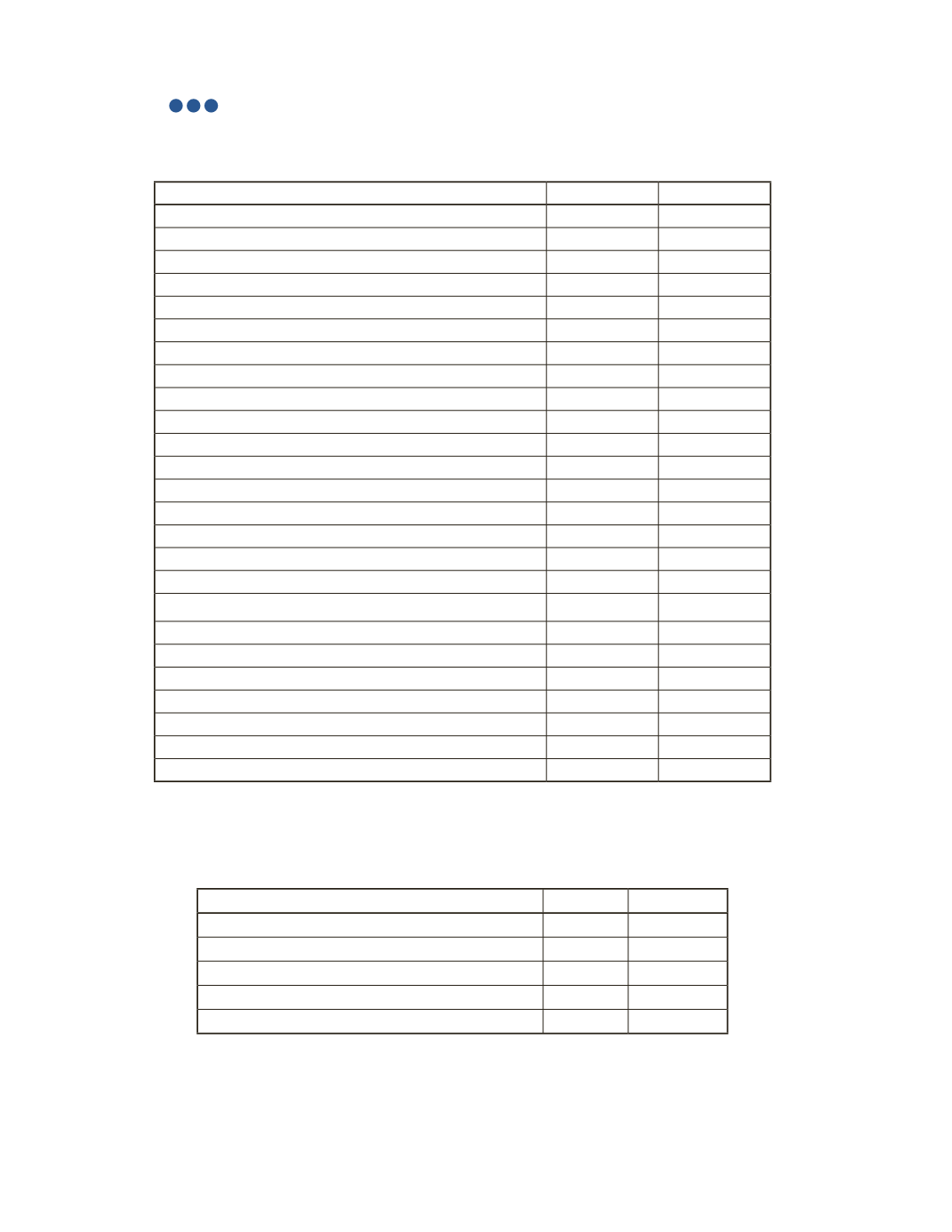

a) Calculate the liquidity and leverage ratios as shown in the table below.

Alpha Inc. Delta Corp.

EBIT

Interest Coverage Ratio

Current Ratio

Quick Ratio

Debt-to-Equity Ratio