Chapter 11

Financial Statement Analysis

586

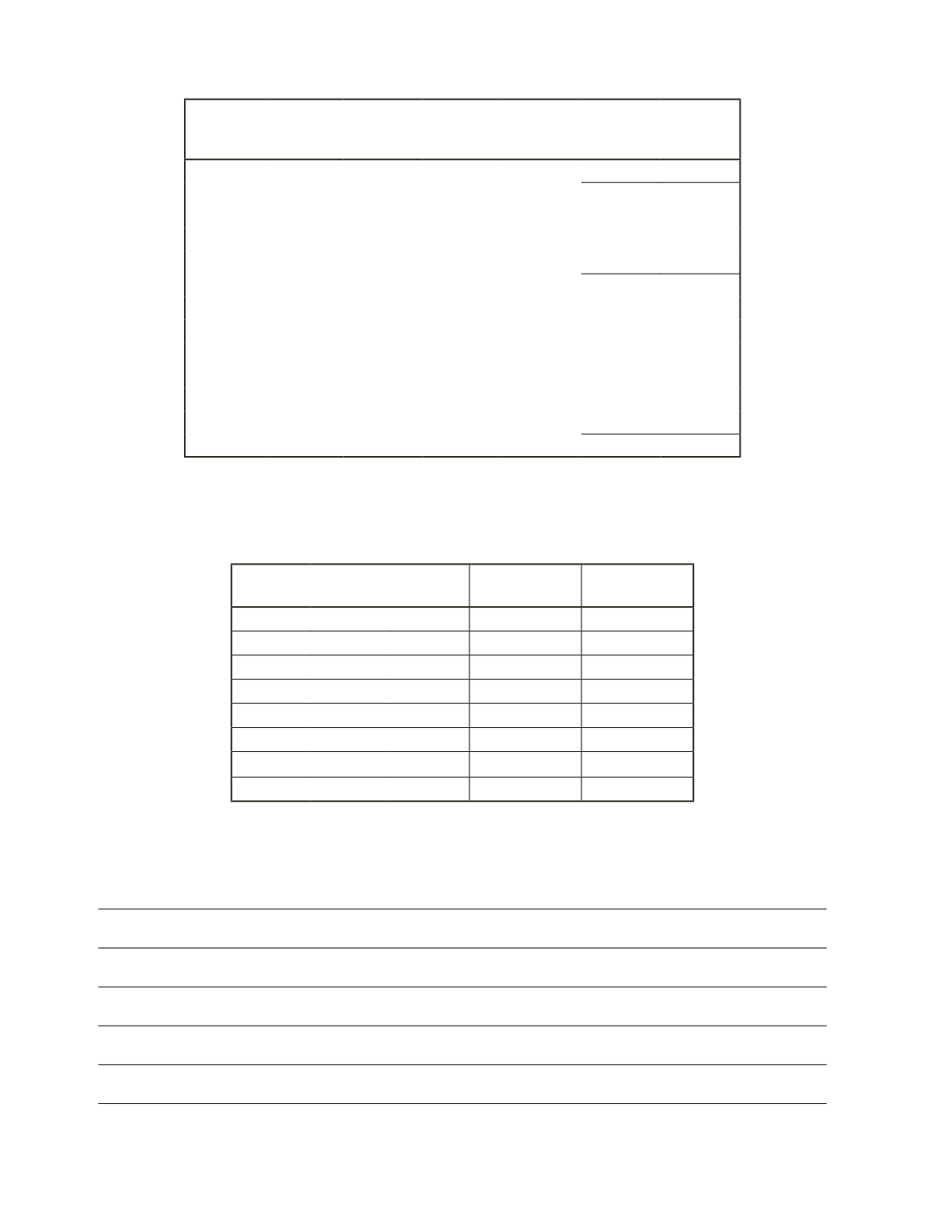

Midland Company

Balance Sheet

At the Year Ended

2016

2015

Cash

$76,540

$41,400

Accounts Receivable

37,000

44,400

Inventory

73,000

54,750

Equipment

110,000

158,000

Total Assets

$296,540 $298,550

Accounts Payable

$24,050

$28,860

Unearned Revenue

14,000

23,800

Long-Term Debt

60,000

60,000

Common Shares

50,000

50,000

Retained Earnings

148,490

135,890

Total Liabilities and Shareholders' Equity

$296,540 $298,550

Required

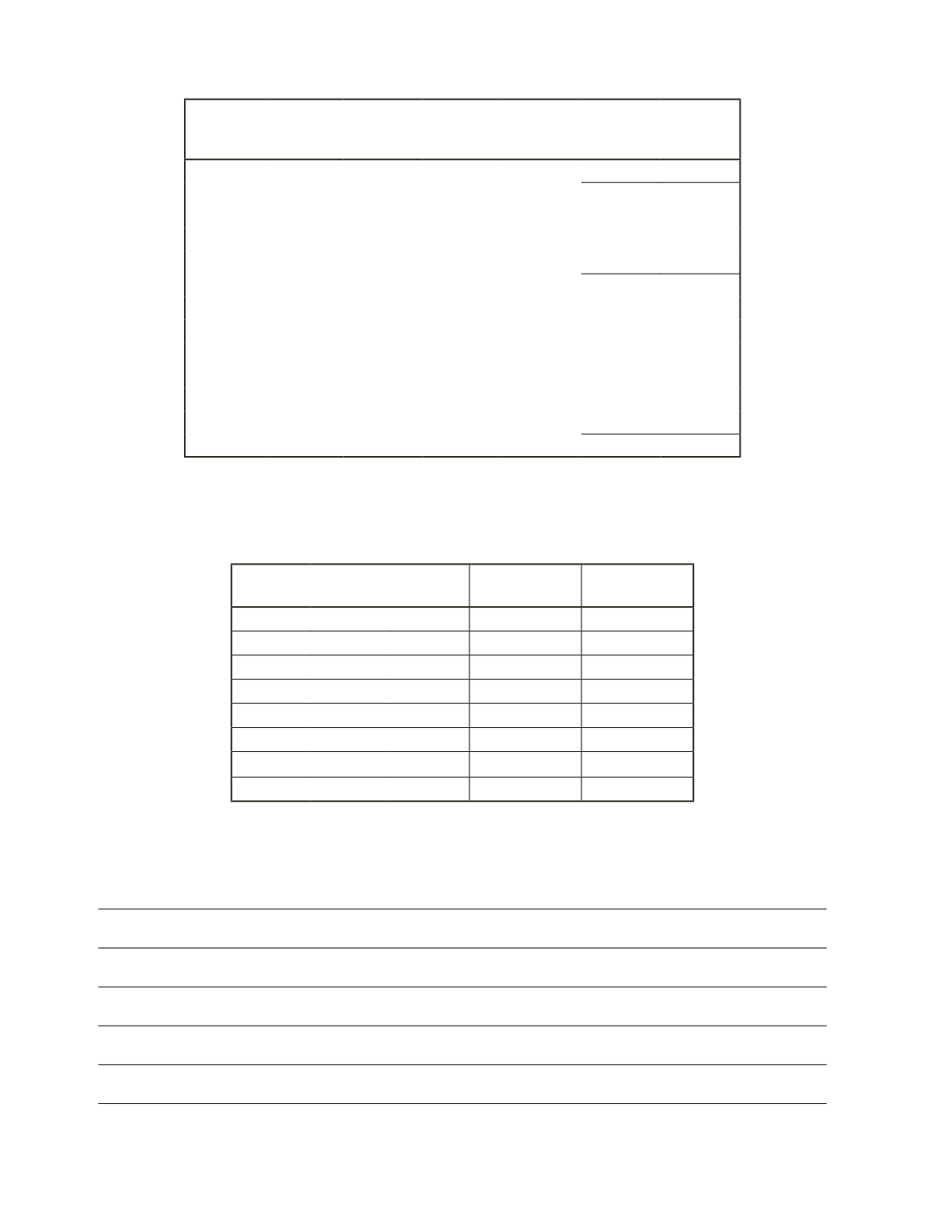

a) Calculate the following ratios for Midland Company for its 2016 fiscal year.

Industry

Average

Midland

Company

Gross Profit Margin

40.0%

Net Profit Margin

5.0%

Return on Equity (ROE)

8.0%

Return on Assets (ROA)

6.9%

Quick Ratio

1.2

Debt-to-Equity Ratio

0.75

Days-Sales-Outstanding

40.0

Inventory Turnover

6.1

b) Perform some ratio analysis to determine how Midland Company has performed in 2016

compared to the industry average.