Chapter 11

Financial Statement Analysis

594

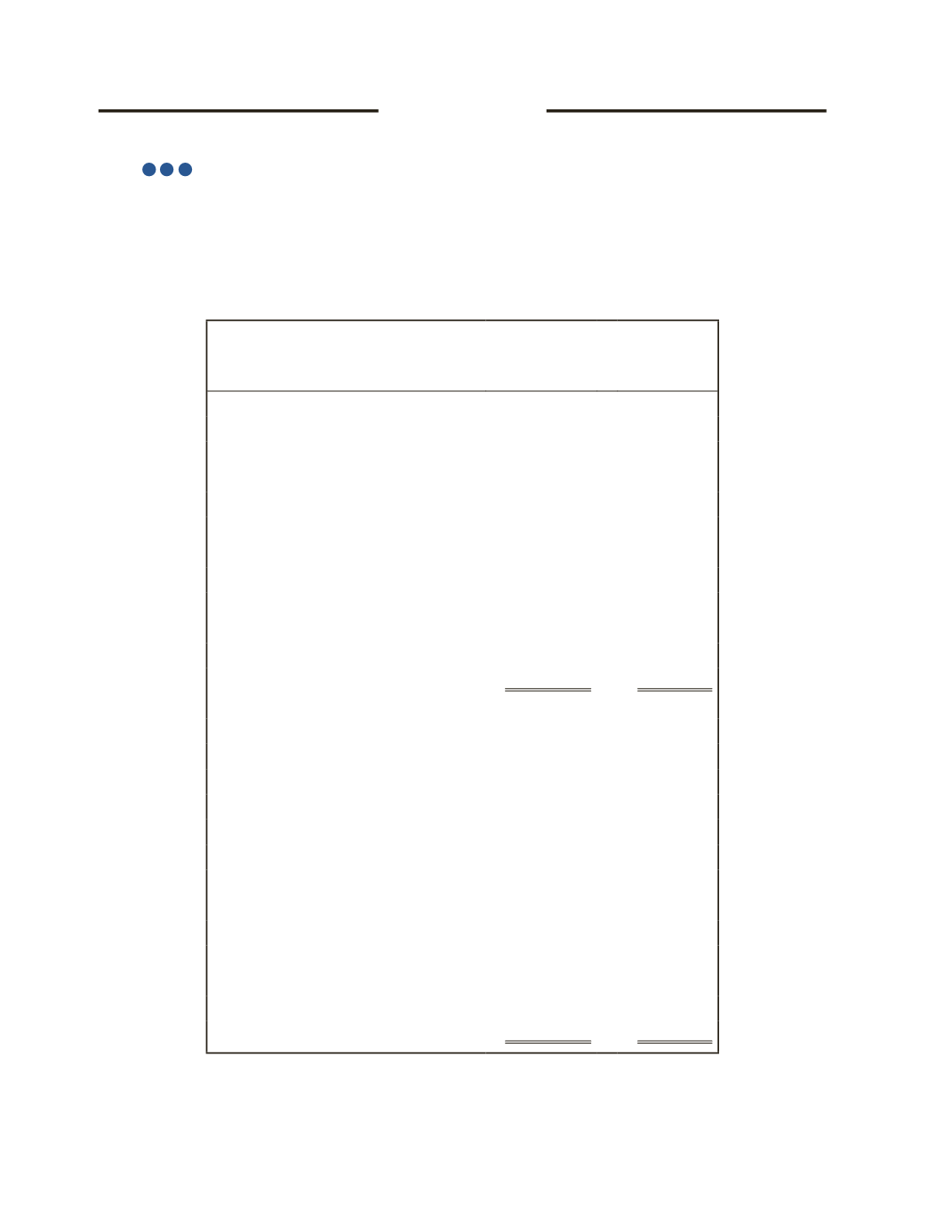

Case Study

CS-1(

3

4

5

)

Suppose that you have decided to invest some money in the stock market. After some

research online, you come across the financial statements of Research in Motion. Before you

can make a decision to invest in the company, you will need to calculate some key financial

ratios and then analyze them. The statements are presented below.

Research in Motion

Consolidated Balance Sheet (in thousands)

As at February 29, 2016 and February 28, 2015

2016

2015

Assets

Cash

$1,550,861

$835,546

Short-term Investments

360,614

682,666

Accounts Receivable

2,800,115

2,269,845

Inventory

621,611

682,400

Other Current Assets

479,455

371,129

Total Current Assets

5,812,656

4,841,586

Long-Term Investment

958,248

720,635

Property, Plant and Equipment

1,956,581

1,334,648

Intangible Assets

1,476,924

1,204,503

Total Assets

$10,204,409

$8,101,372

Liabilities

Accounts Payable

$615,620

$448,339

Accrued Liabilities

1,638,260

1,238,602

Income Taxes Payable

95,650

361,460

Other Current Liabilities

82,247

66,950

Total Current Liabilities

2,431,777

2,115,351

Non-Current Liabilities

169,969

111,893

Total Liabilities

2,601,746

2,227,244

Shareholders' Equity

Common Shares

2,113,146

2,208,235

Retained Earnings

5,489,517

3,665,893

Shareholders' Equity

7,602,663

5,874,128

Liabilities and Shareholders' Equity

$10,204,409

$8,101,372