Chapter 11

Financial Statement Analysis

595

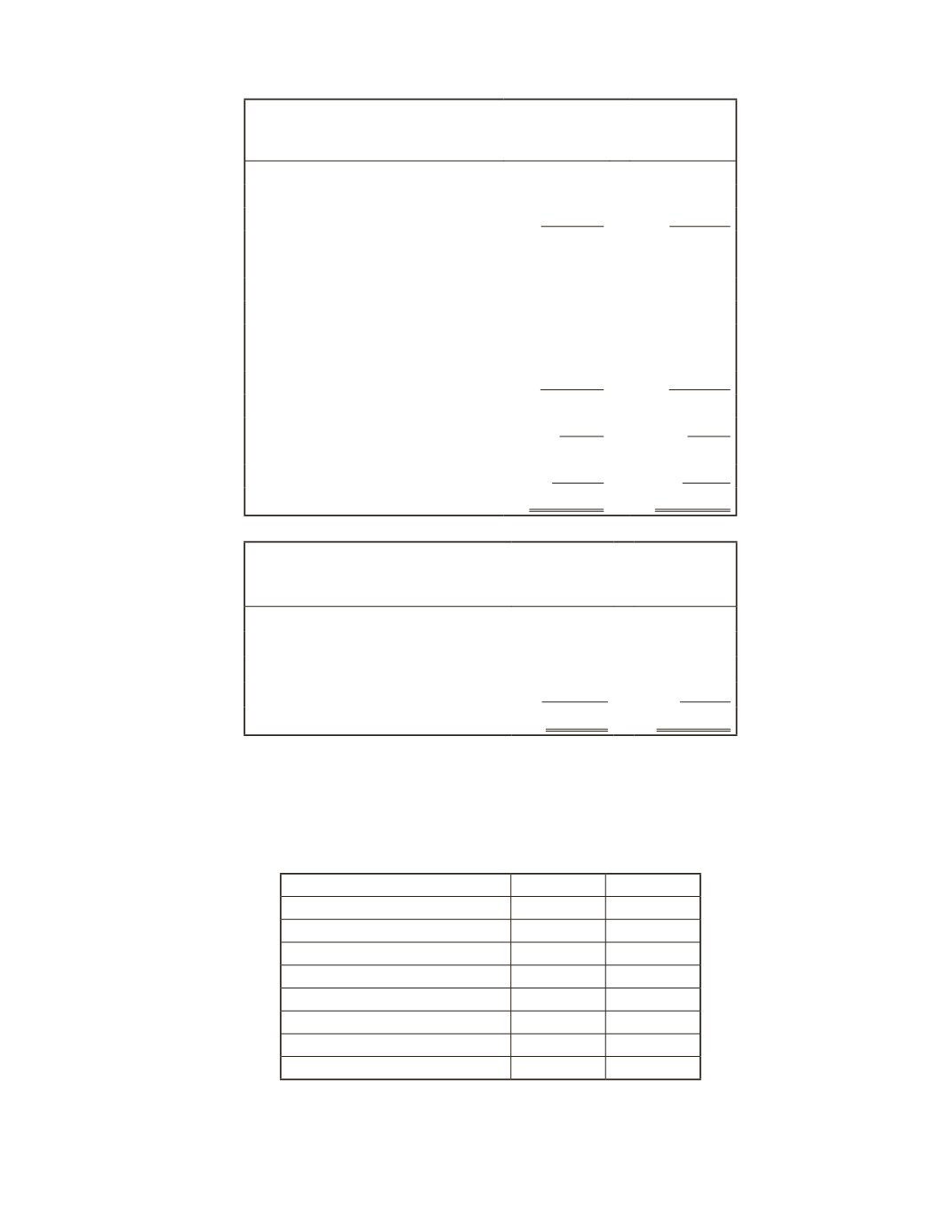

Research in Motion

Consolidated Income Statement (in thousands)

For the Year Ended February 29, 2016 and February 28, 2015

2016

2015

Revenue

$14,953,224

$11,065,186

Cost of Sales

8,368,958

5,967,888

Gross Profit

6,584,266

5,097,298

Operating expenses

Research and Development

964,841

684,702

Selling, Marketing and Admin

1,907,398

1,495,697

Amortization Expense

310,357

194,803

Litigation Expense

163,800

0

Total Expenses

3,346,396

2,375,202

Operating Income Before Tax

3,237,870

2,722,096

Investment Income

28,640

78,267

Income Before Income Tax

3,266,510

2,800,363

Income Tax Expense

809,366

907,747

Net Income

$2,457,144

$1,892,616

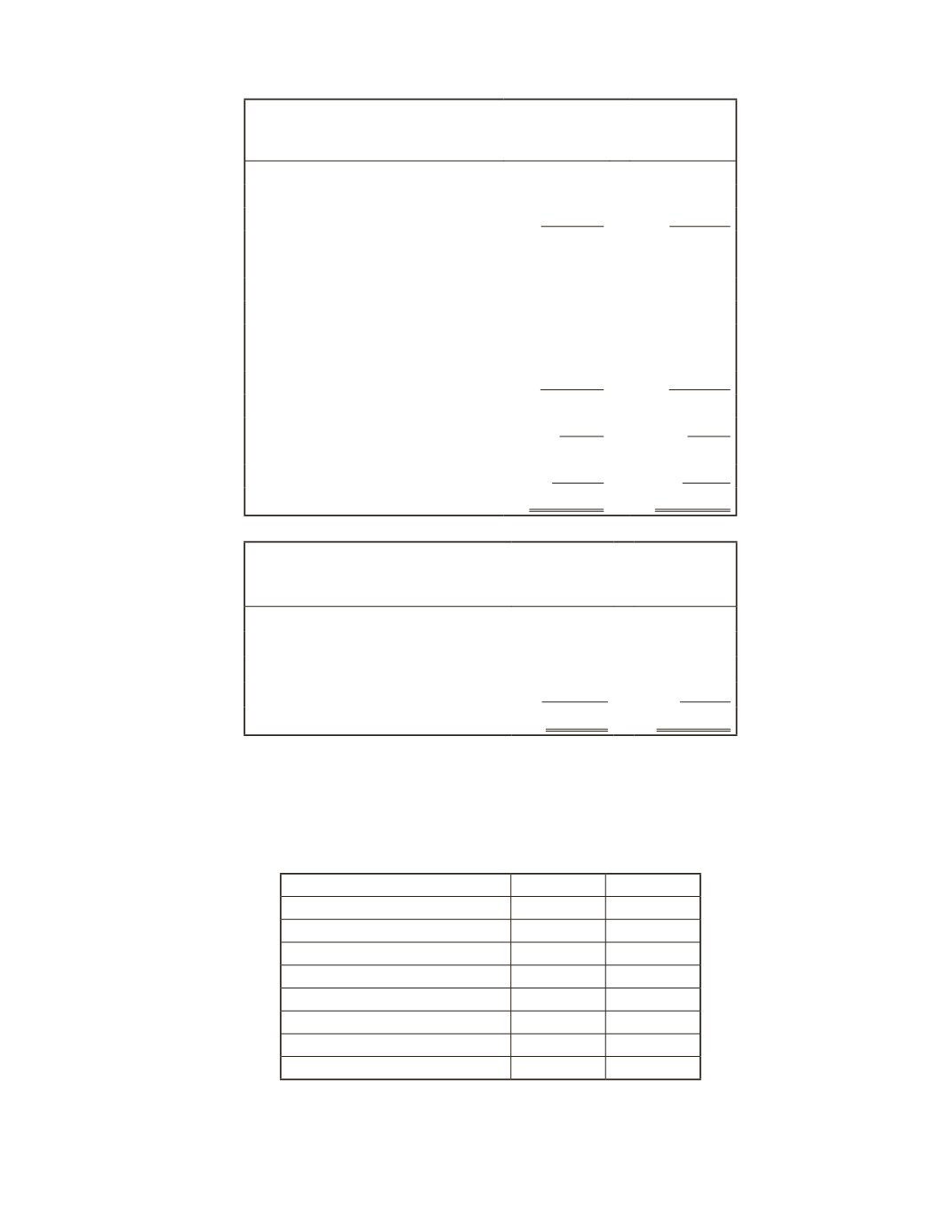

Research in Motion

Summary of the Cash Flow Statement (in thousands)

For the Year Ended February 29, 2016 and February 28, 2015

2016

2015

Net Cash Provided by Operations

$3,034,874

$1,451,845

Net Cash Used by Investing

($1,470,127)

($1,823,523)

Net Cash Used by Financing

($849,432)

$22,826

Net Increase (Decrease) in Cash

$715,315

($348,852)

Required

a) Calculate the following ratios for Research in Motion for 2016 and 2015. For any ratios that

require an average (i.e. ROE), use the closing balance for the year.

2016

2015

Gross Profit Margin

Net Profit Margin

Return on Equity

Return on Assets

Asset Turnover

Current Ratio

Quick Ratio

Debt-to-Equity Ratio