Chapter 11

Financial Statement Analysis

597

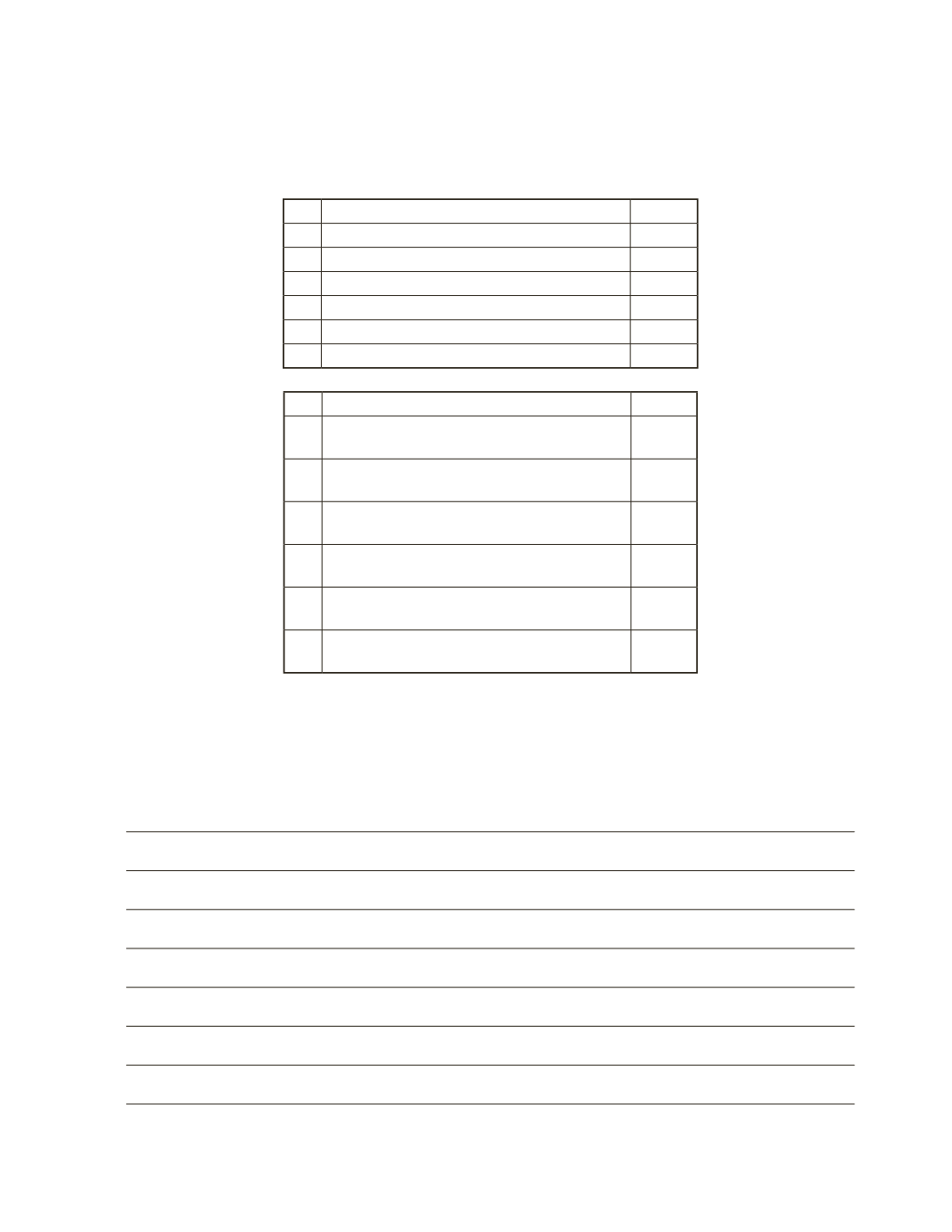

Required

a) Given the data for Ivory Inc., calculate the following ratios for 2016 (round to two

decimal places). The company’s ratios for 2015 are given for comparison.

Ratio

2015

i)

Current Ratio

3.5

ii)

Interest Coverage Ratio

5.40

iii)

Debt to Equity

25.00%

iv)

Return on Assets

12.50%

v)

Return on Equity

20.20%

vi)

Net Profit Margin

8.60%

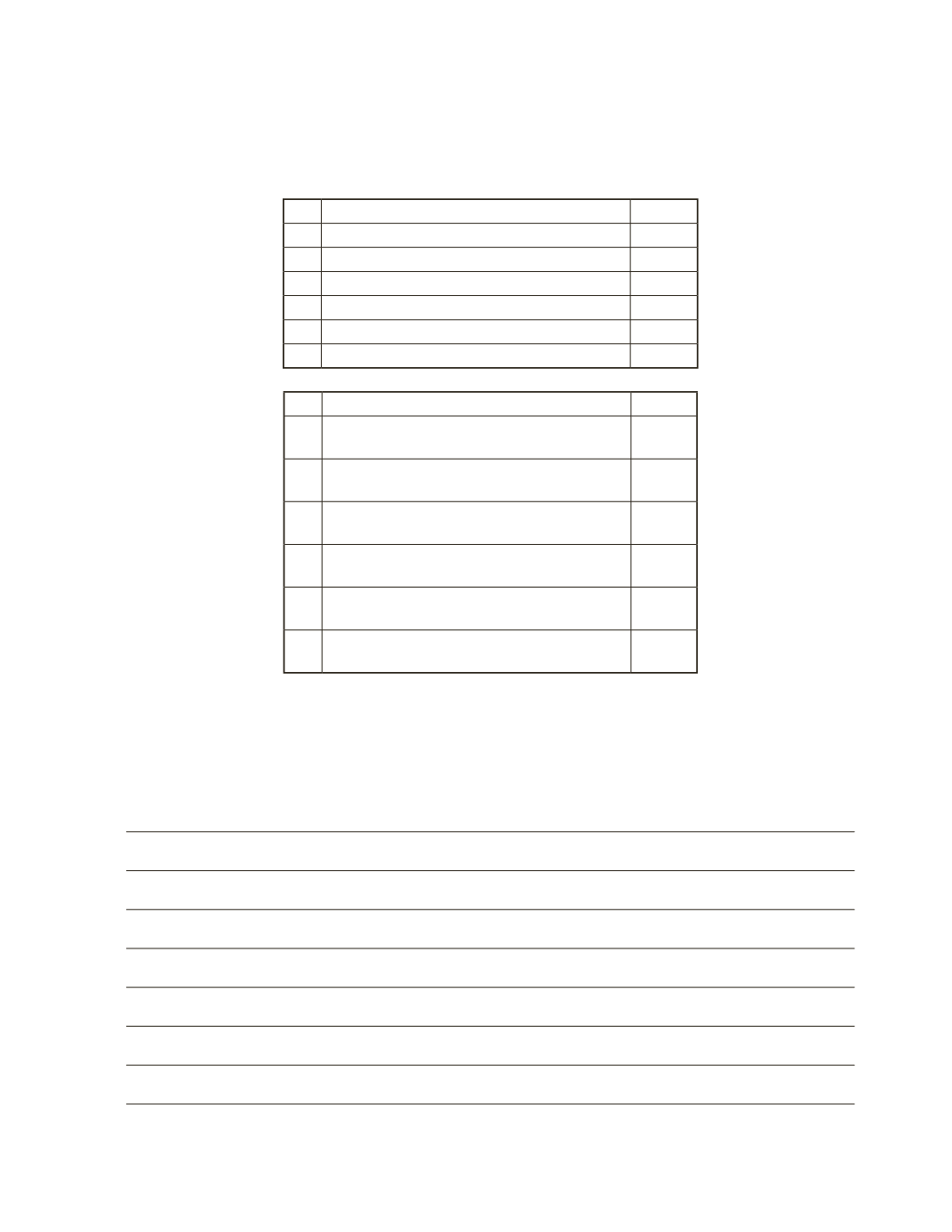

Ratio

2016

i)

ii)

iii)

iv)

v)

vi)

b) Using 2015 as a comparison, discuss whether the company improved or deteriorated

in its ability to (i) pay current liabilities as they come due, (ii) meet its non-current debt

obligations and (iii) profitability. Be sure to make reference to specific ratios in your

answers.