Chapter 11

Financial Statement Analysis

583

b) Which company has stronger liquidity and leverage ratios? Which company would a bank

prefer to provide lending to based on the calculations in part a)?

AP-16B (

7

)

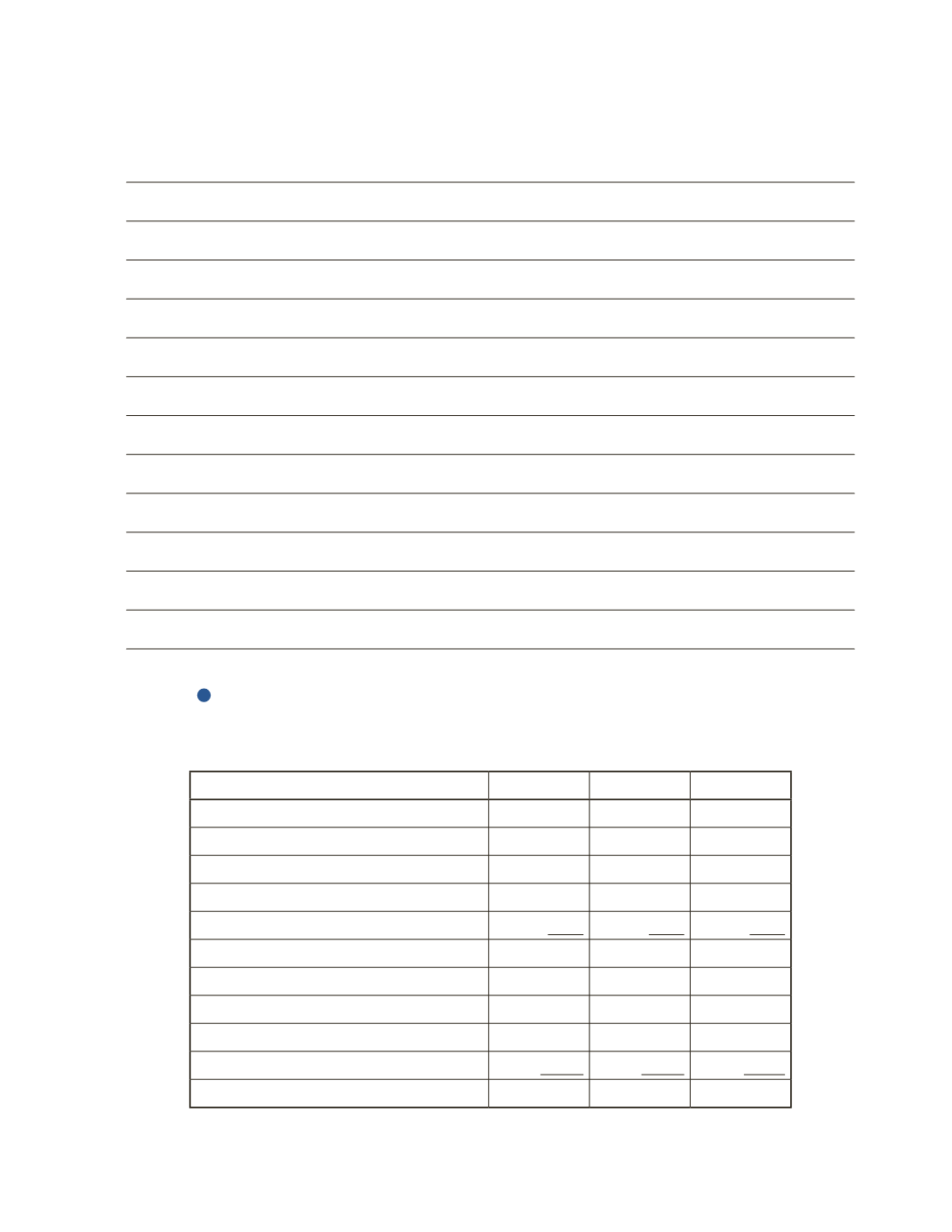

The following information is available for three different companies within the same industry.

Company A Company B Company C

Cash

$7,800

$7,020

$10,530

Short-Term Investments

2,000

1,800

4,700

Accounts Receivable

8,250

7,425

13,138

Prepaid Assets

1,500

1,350

3,025

Inventory

9,500

8,550

5,825

Total Assets

$29,050

$26,145

$37,218

Accounts Payable

$4,300

$4,515

$4,730

Deferred Revenue

7,500

7,875

8,250

Current Portion of Long-Term Debt

15,800

16,590

17,380

Total Liabilities

$27,600

$28,980

$30,360