Chapter 11

Financial Statement Analysis

575

AP-7B (

4

5

)

Presented below is the comparative income statement of JeansWear Company for 2016 and

2015.

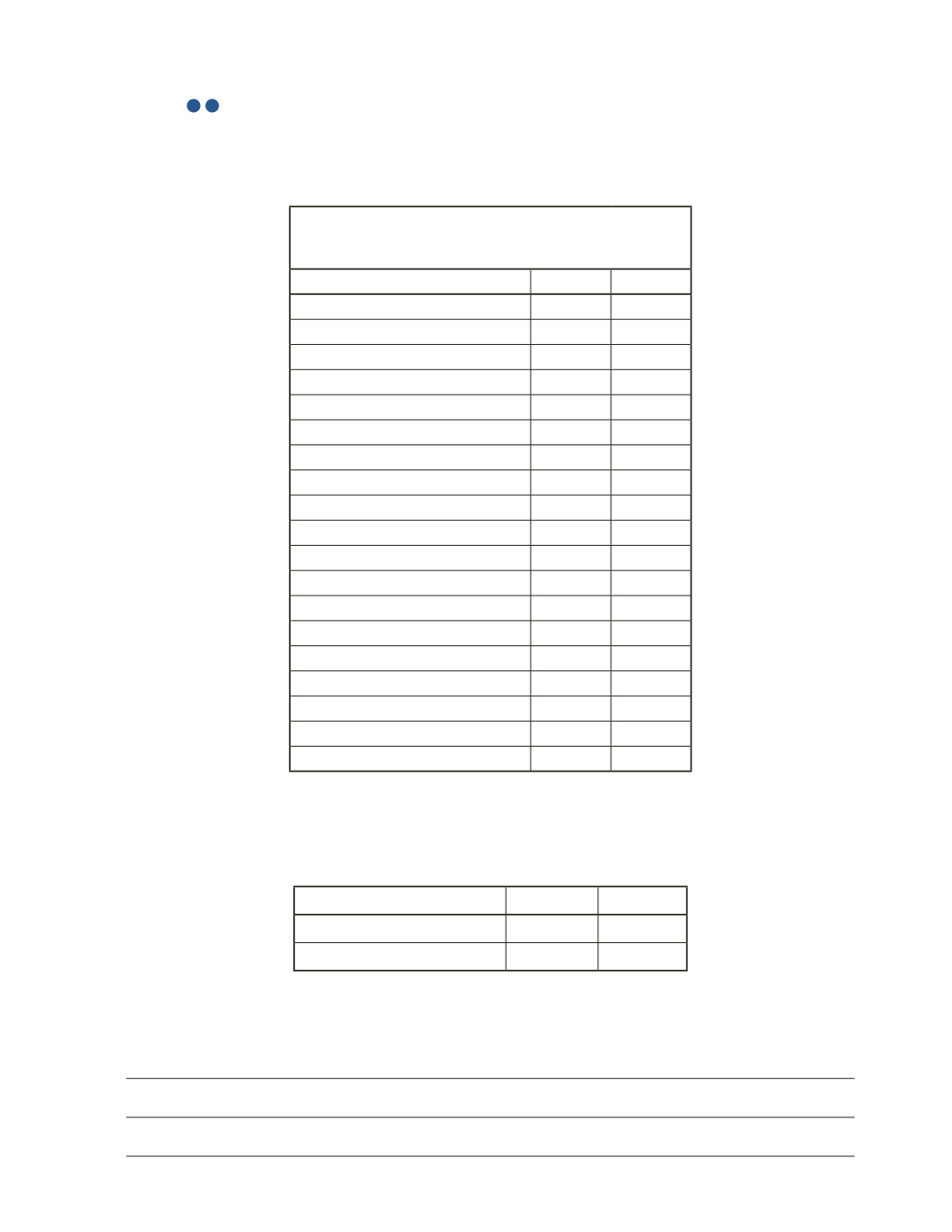

JeansWear Company

Income Statement

For the Year Ended January 31

2016

2015

Sales

$184,794 $107,933

Cost of Goods Sold

115,550 69,022

Gross Profit

69,244 38,911

Operating Expenses

Advertising Expense

3,040

1,490

Bank Charges Expense

556

24

Communication Expense

5,050

3,927

Legal and Professional Expense

5,540

3,010

Utilities Expense

3,074

1,754

Rent Expense

3,430

3,430

Repairs and Maintenance Expense

3,810

2,670

Salaries andWages Expense

2,780

1,510

Transportation Expense

3,170

1,920

Interest Expense

1,343

579

Depreciation Expense

1,320

750

Total Operating Expenses

33,113 21,064

Operating Profit before Tax

36,131

17,847

Income Tax

10,839

5,354

Net Income

$25,292 $12,493

Required

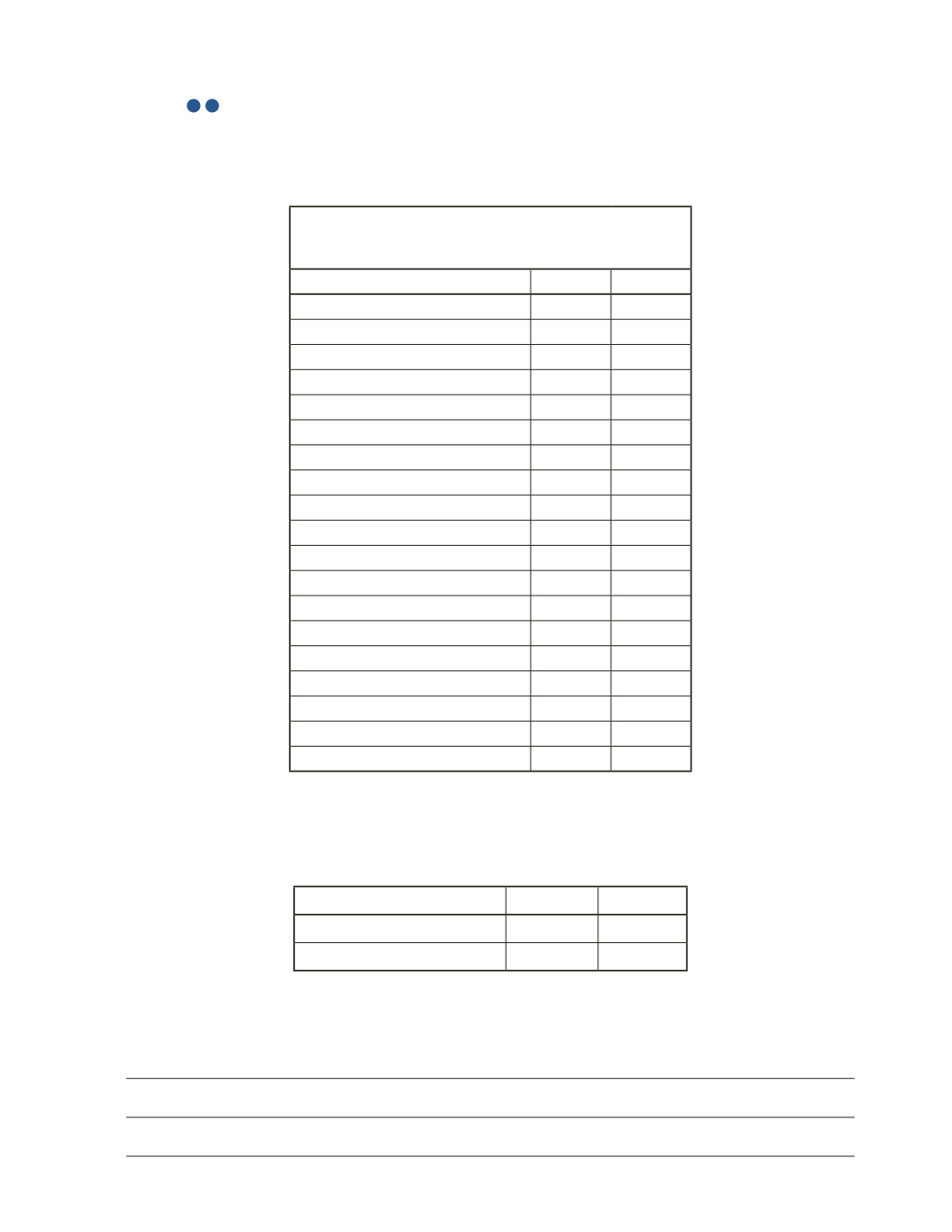

a) Calculate the following ratios for both years.

2016

2015

EBIT Percentage to Sales

Interest Coverage Ratio

b) In which year does the company have a better performance with respect to the EBIT

Percentage to Sales calculated in part a)?