Chapter 11

Financial Statement Analysis

567

AP-21A (

3

4

5

6

)

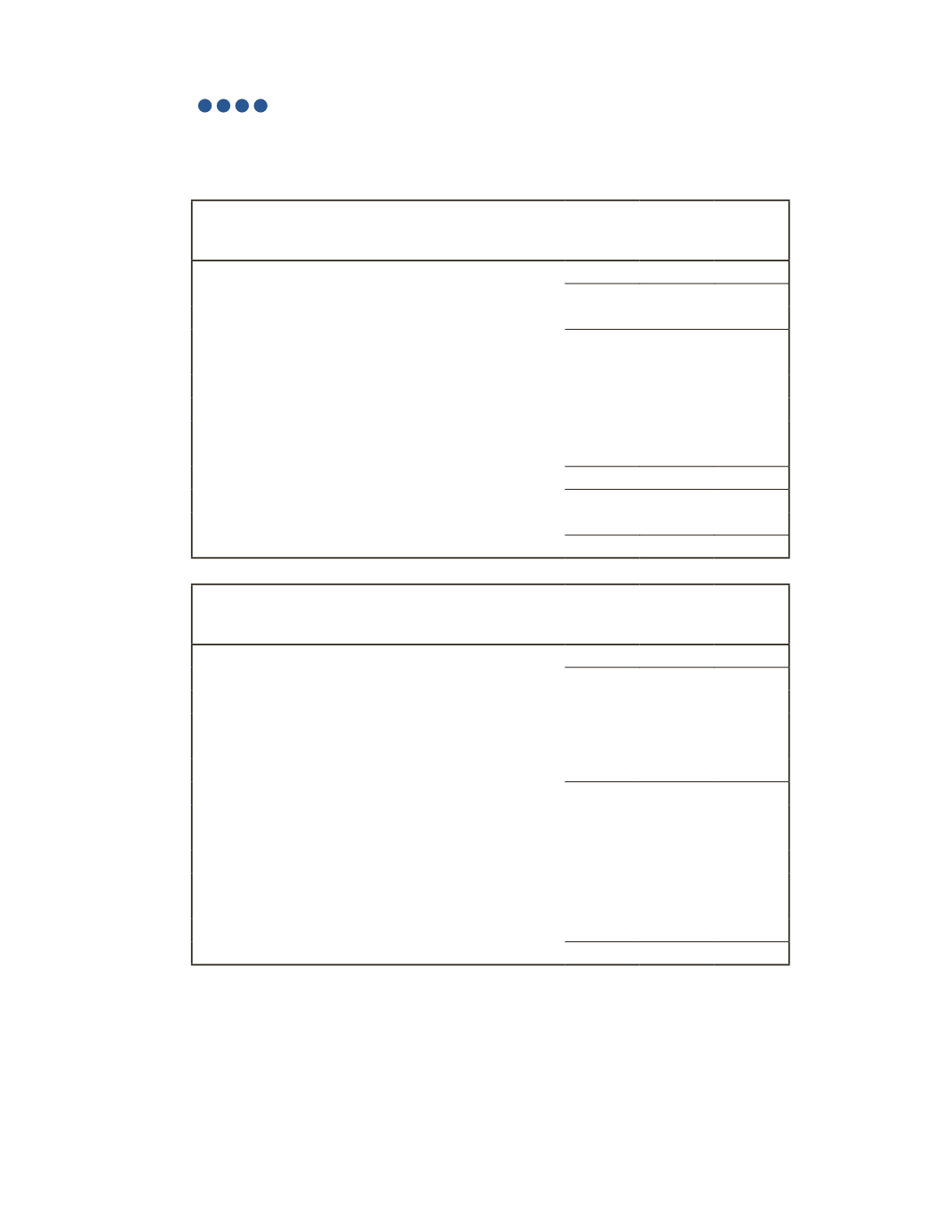

The income statements and balance sheets for Fallon Inc. are shown below for the last three

fiscal years.

Fallon Inc.

Income Statement

For the Year Ended

2016 2015 2014

Sales

360,000

324,000

342,000

Cost of Goods Sold

108,000

89,100

85,500

Gross Profit

252,000

234,900

256,500

Expenses

Operating Expense

54,000

48,600

51,300

Depreciation Expense

36,000

32,400

34,200

Advertising Expense

18,000

16,200

17,100

Interest Expense

6,800

7,650

8,500

Total Expenses

114,800

104,850

111,100

Net Income before Taxes

137,200

130,050

145,400

Income Tax Expense

72,000

64,800

68,400

Net Income

65,200

65,250

77,000

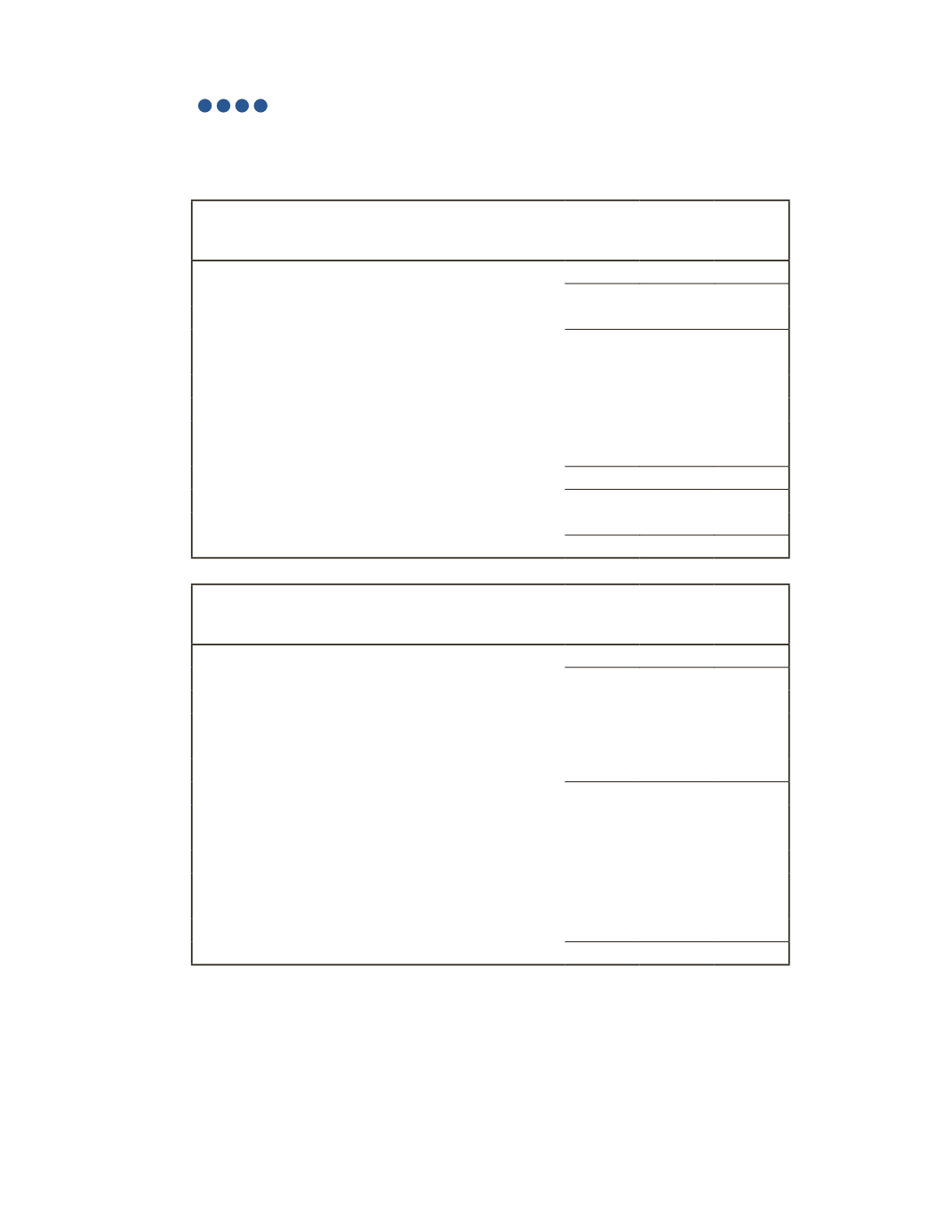

Fallon Inc.

Balance Sheet

At the Year Ended

2016 2015 2014

Cash

63,650

39,750

36,000

Short-Term Investments

11,000

10,000

8,000

Accounts Receivable

48,000

40,000

32,000

Inventory

18,000

22,500

27,000

Equipment

110,000

104,500

83,600

Total Assets

250,650 216,750 186,600

Accounts Payable

52,800

44,000

35,200

Current Portion of Long-Term Debt

8,500

8,500

8,500

Long-Term Debt

68,000

76,500

85,000

Common Shares

66,000

57,600 57,000

Retained Earnings

55,350

30,150

900

Total Liabilities and Shareholders' Equity

250,650 216,750 186,600

Other Information

1) Fallon Inc. has an unlimited number of shares authorized. The following number of

common shares were outstanding in each year for the entire year: 2016—50,000,

2015—48,000, 2014—47,000.

2) The following dividends were paid: $40,000 in 2016, $36,000 in 2015 and $38,000 in 2014.