Chapter 11

Financial Statement Analysis

568

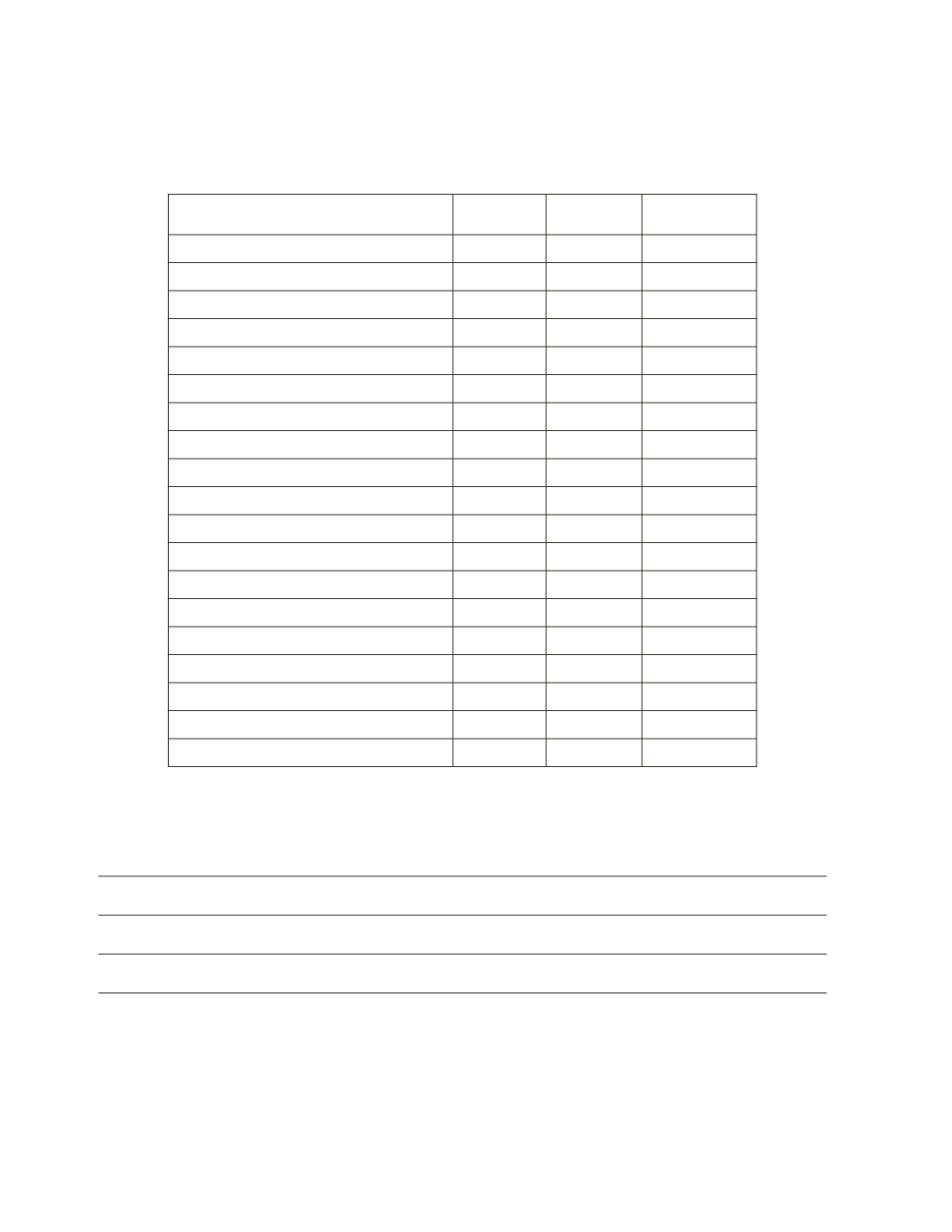

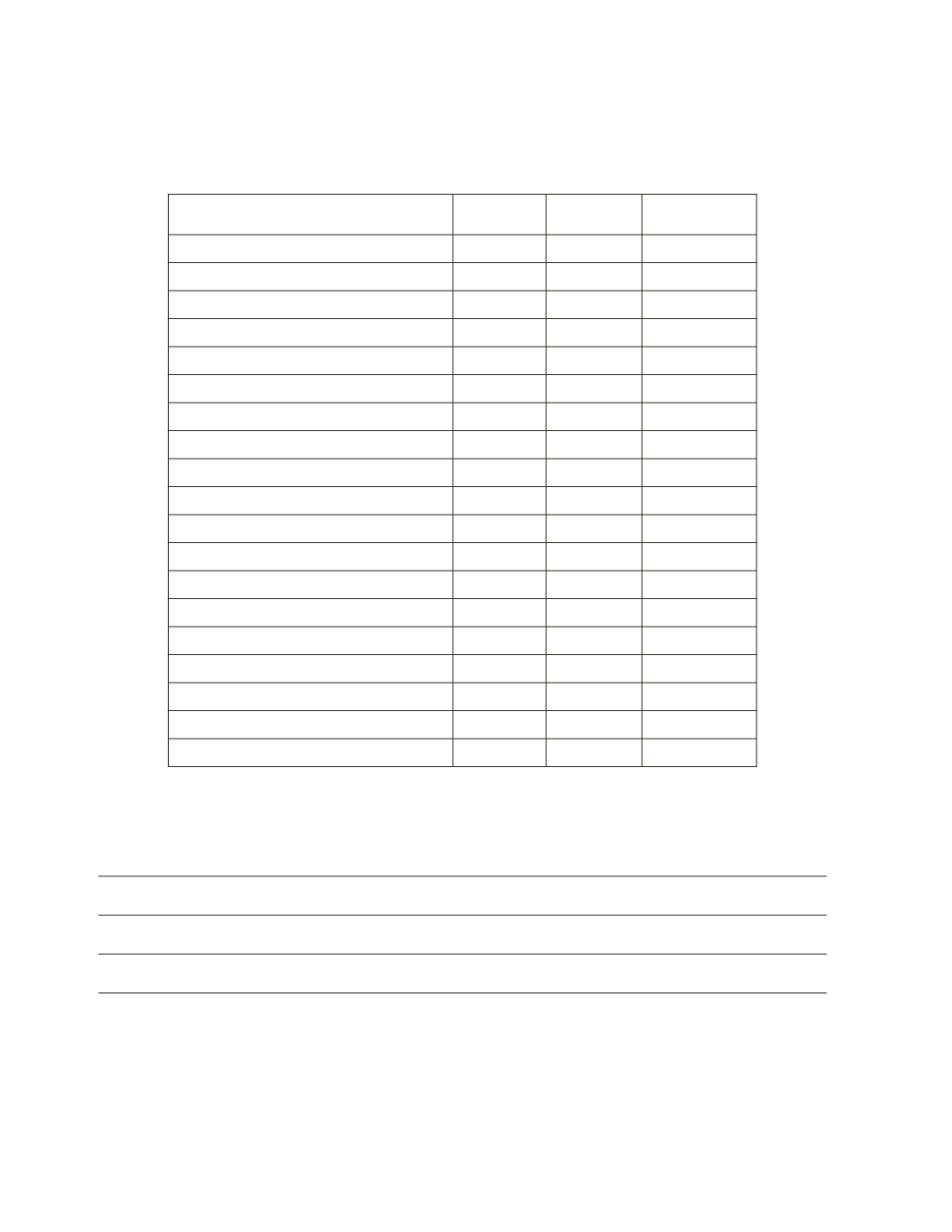

Required

a) Calculate the following ratios for Fallon Inc. for 2015 and 2016, and state whether the ratio

improved or weakened in 2016.

2016

2015

Improved or

Weakened

Gross Profit Margin

EBIT

EBIT Percentage to Sales

Interest Coverage Ratio

Net Profit Margin

Return on Equity (ROE)

Return on Assets (ROA)

Asset Turnover

Current Ratio

Quick Ratio

Debt-to-Equity Ratio

Debt-to-Assets Ratio

Days Sales Outstanding

Accounts Receivable Turnover

Inventory Days on Hand

Inventory Turnover

Book Value per Share

Dividend Payout Ratio

Earnings per Share

b) Fallon Inc. has a credit policy of 30 days. That is, it expects all customers to pay their bills

within 30 days from sale. Comment on the company's ability to enforce this policy.