Chapter 11

Financial Statement Analysis

557

Analysis

Book value per share is rarely equal to the selling price of the share on the stock market. What

are some factors that could cause the market value to differ from the book value?

AP-15A (

4

)

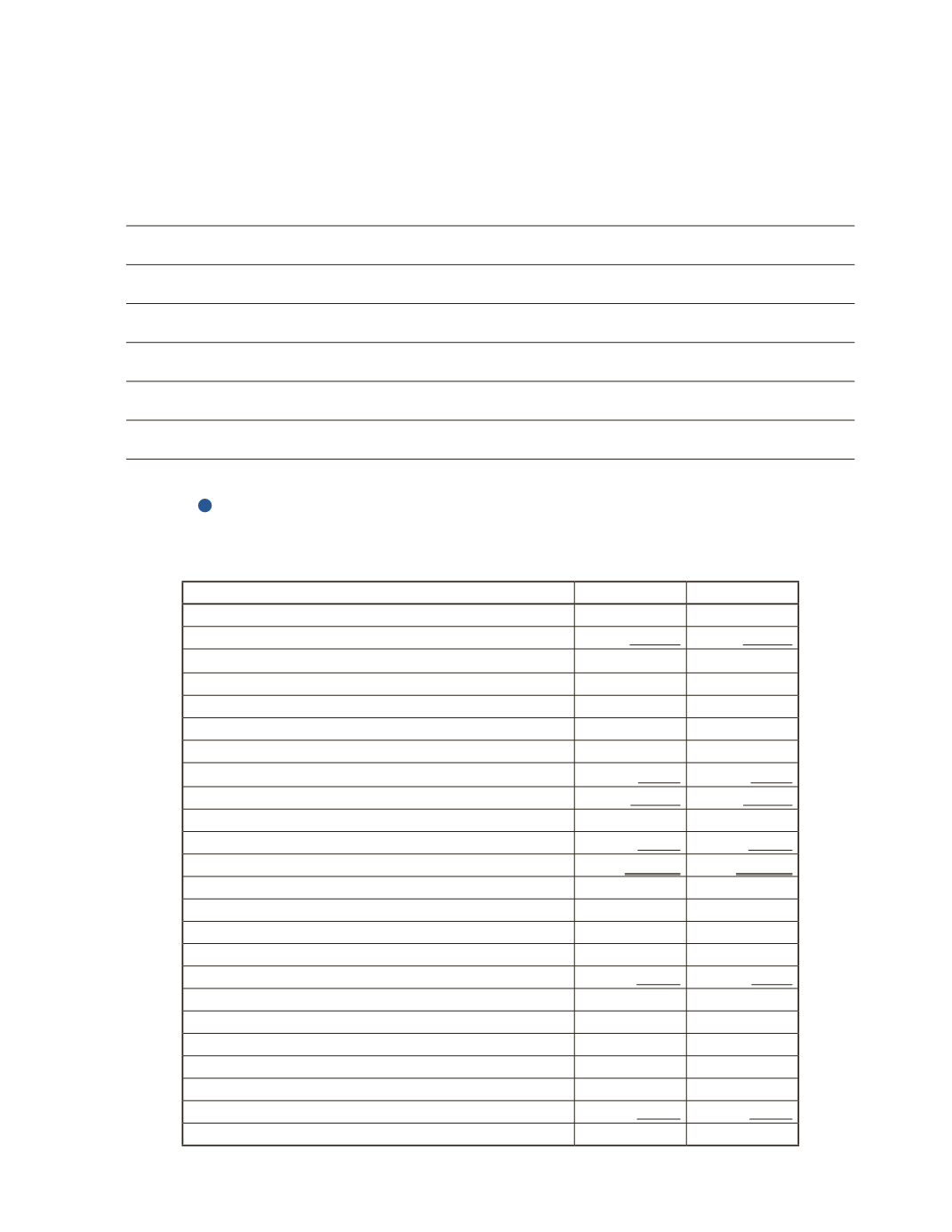

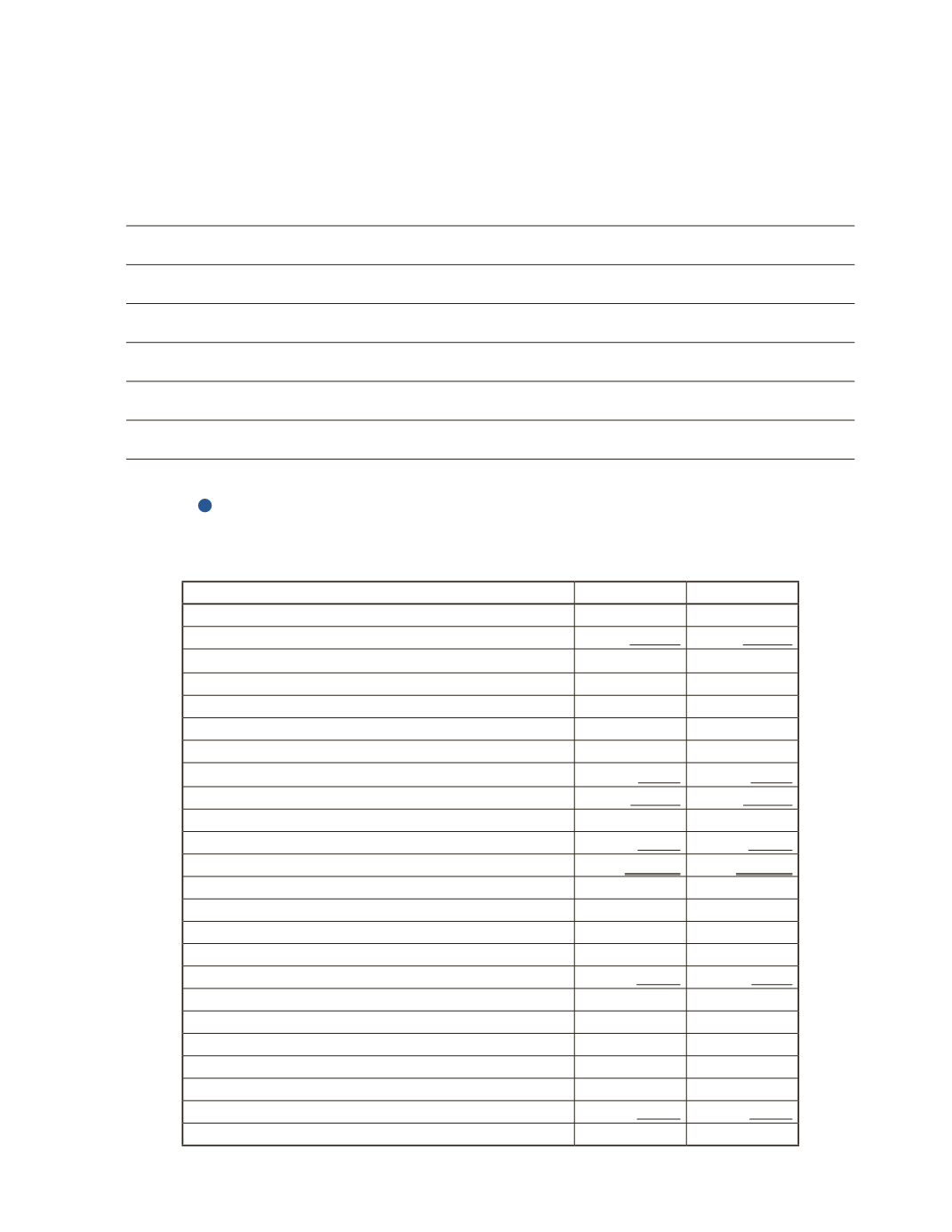

Below is select financial statement information for Rock Co. and Roll Inc.

Rock Co.

Roll Inc.

Sales

$348,500

$465,800

Cost of Goods Sold

106,293

160,701

Gross Profit

242,208

305,099

Expenses

Operating Expense

52,275

69,870

Depreciation Expense

34,850

46,580

Advertising Expense

17,425

23,290

Interest Expense

15,683

37,264

Total Expenses

120,233

177,004

Net Income before Taxes

121,975

128,095

Income Tax Expense

62,730

83,844

Net Income

$59,245

$44,251

Cash

$14,850

$19,800

Accounts Receivable

25,000

22,500

Inventory

34,500

43,125

Equipment

85,800

81,510

Total Assets

$160,150

$166,935

Accounts Payable

$27,500

$24,750

Unearned Revenue

17,800

19,580

Long-Term Liabilities

29,350

62,925

Shareholders' Equity

85,500

59,680

Total Liabilities and Shareholders' Equity

$160,150

$166,935