Chapter 3

Long-Term Assets

116

Application Questions Group B

AP-1B (

2

)

On March 1, 2016, Lindt Corp. bought machinery for $250,000 on credit from Super Machines

Inc. Prepare the journal entry to record the transaction.

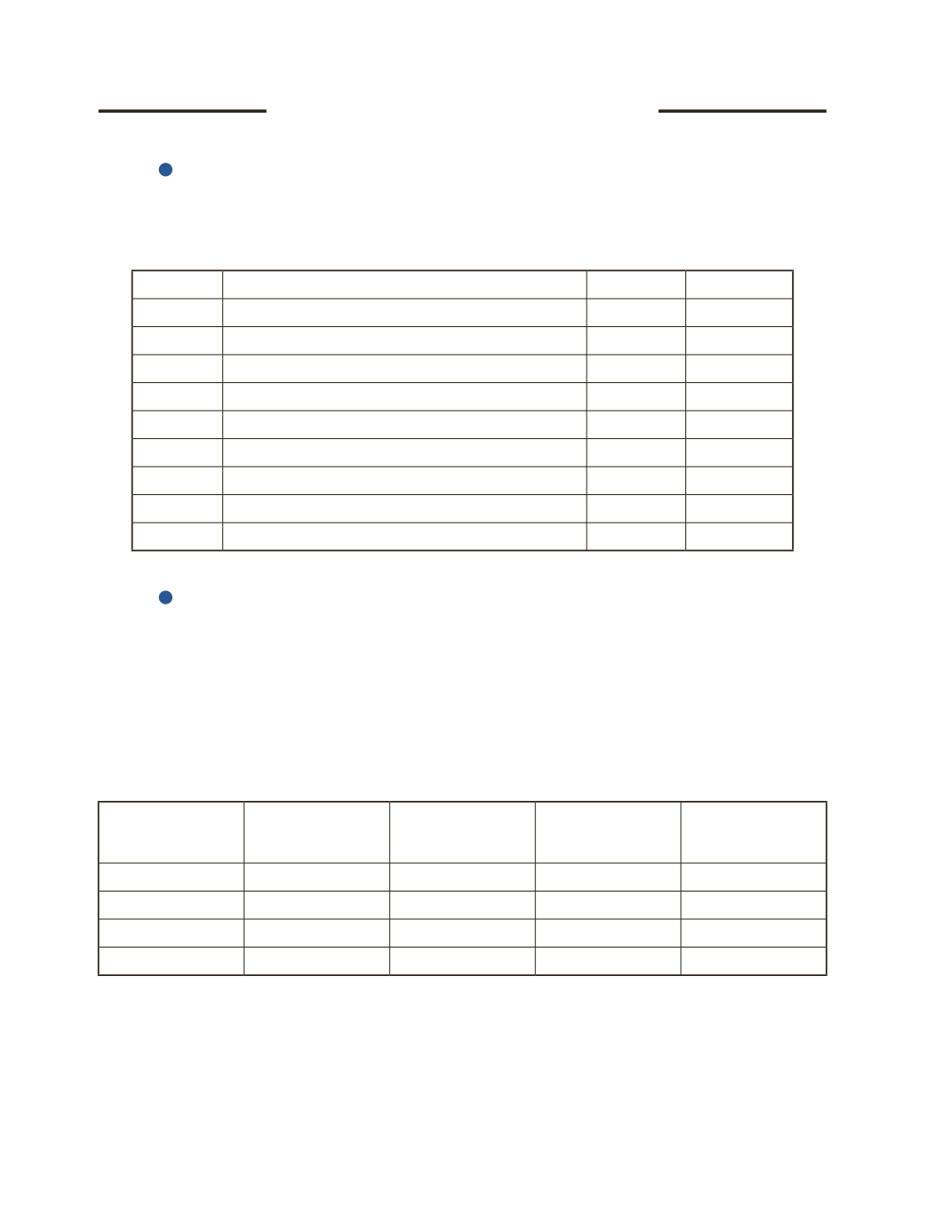

Date

Account Title and Explanation

Debit

Credit

AP-2B (

3

)

On June 1, 2013, new equipment was purchased for use in the factory. The equipment cost

$1,200,000 and has a salvage value of $180,000. The equipment has an estimated production

capacity of 800,000 units. The equipment produced the following number of units over the

past four years: 2013—224,000 units, 2014—216,000 units, 2015—208,000 units, and

2016—168,000 units. Assuming the company uses the units-of-production method, complete

the following table. Do not round the per unit cost of depreciation in your calculations.

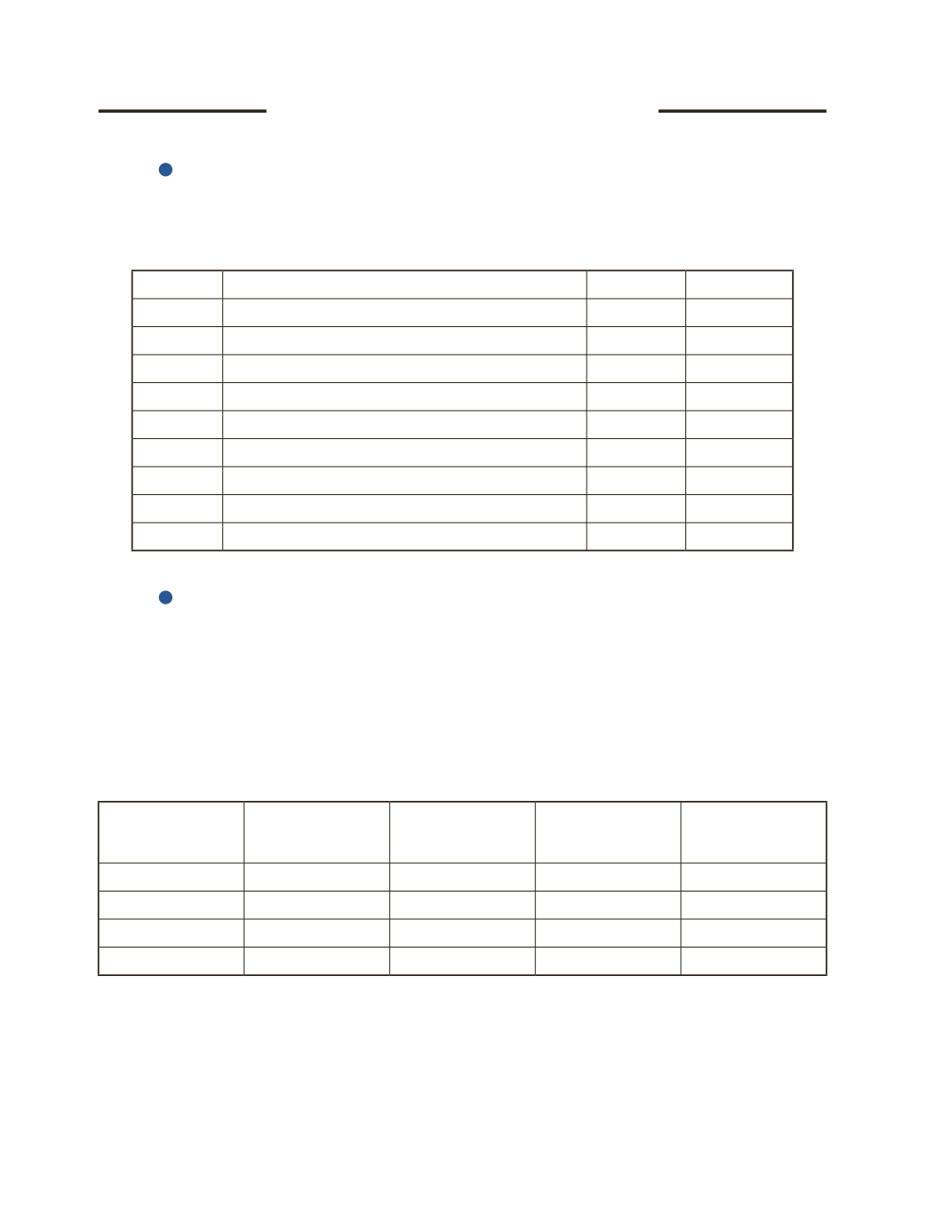

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation

To Date

Net Book Value