Chapter 3

Long-Term Assets

122

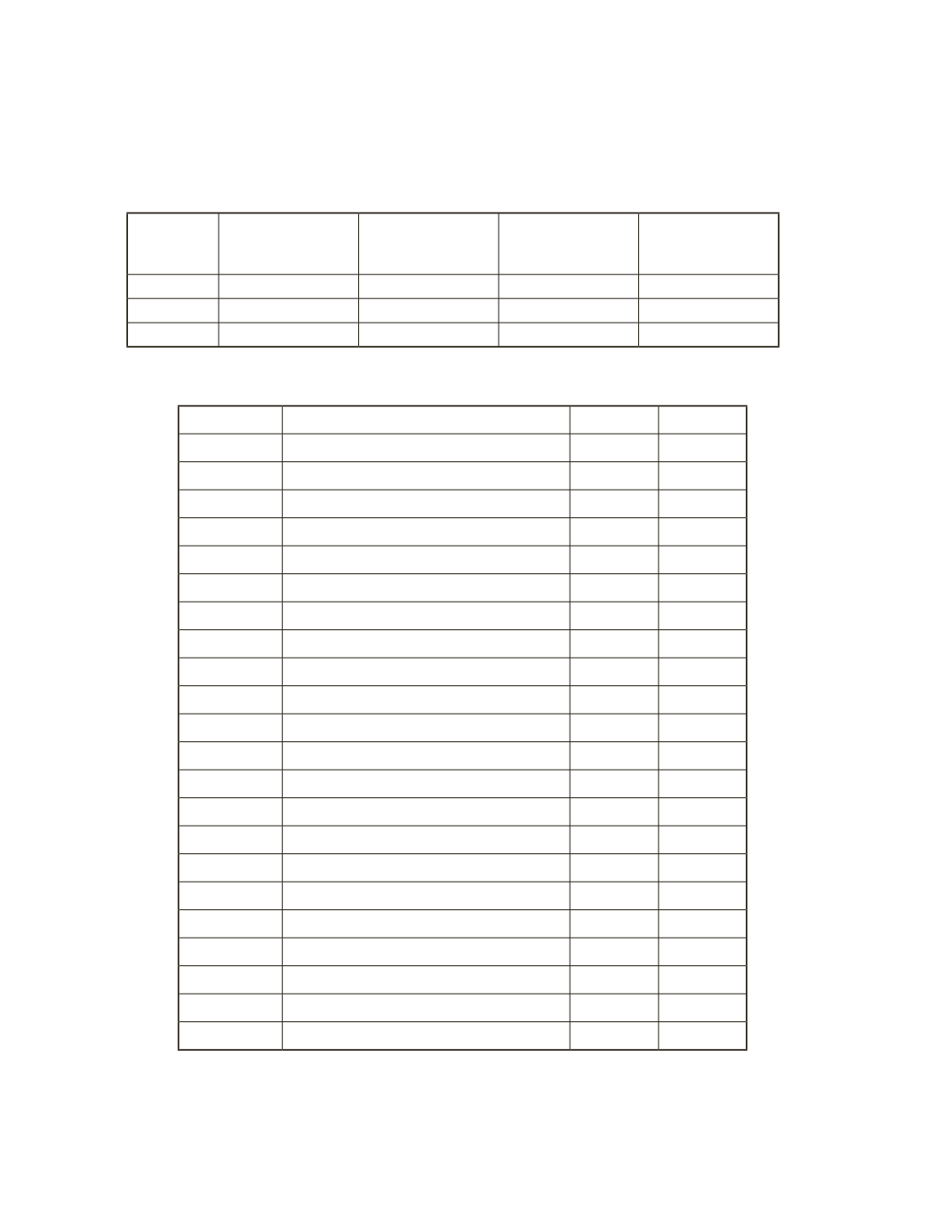

b) Assume that MNO Company’s depreciation policy recognizes only half a year’s

depreciation in the year of purchase and half a year’s depreciation in the year of disposal.

The company uses the straight-line method. The asset was sold for $15,000 on May 15,

2018. Prepare a depreciation schedule using the following table.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation To

Date

Net Book

Value

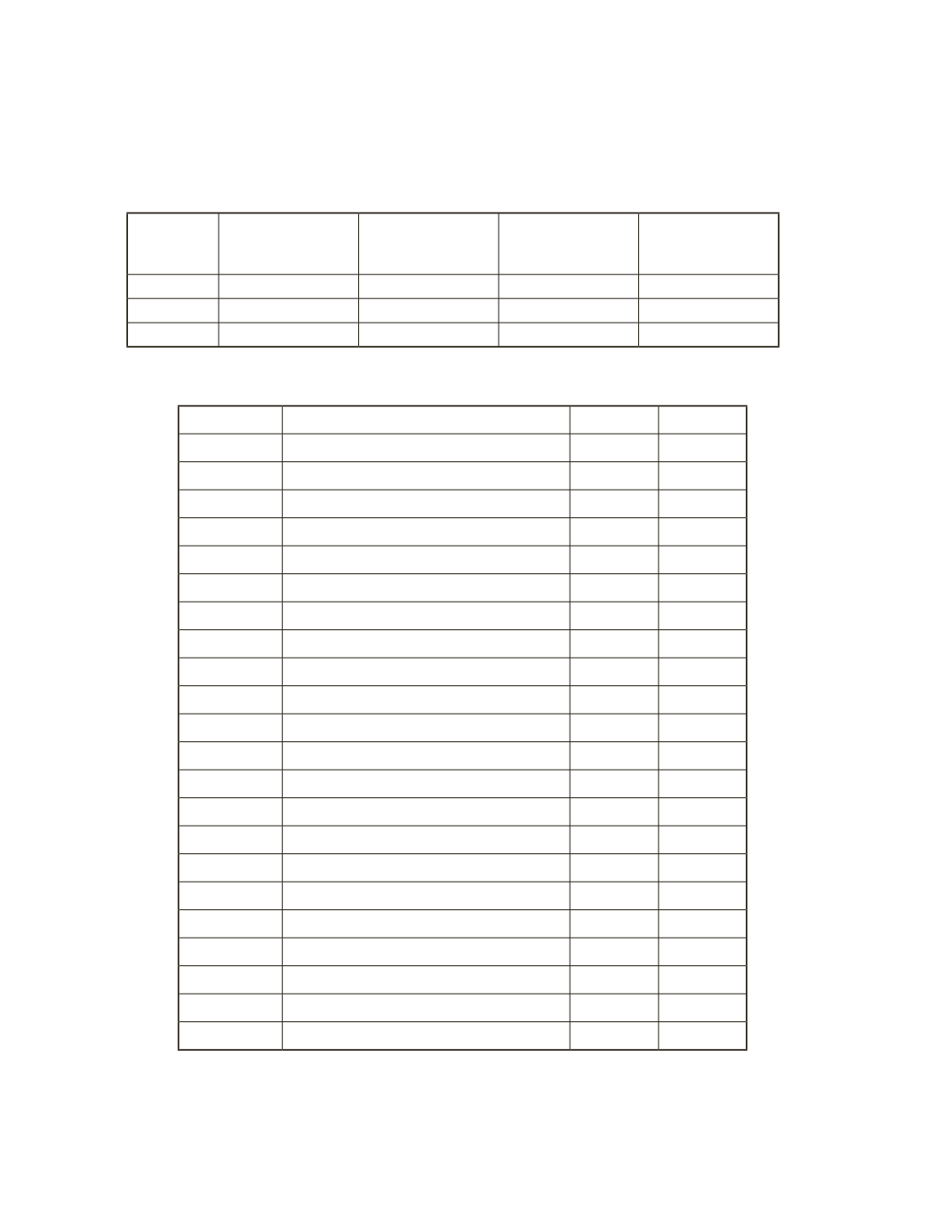

c) Prepare the journal entry to record the depreciation on the disposal and sale.

Date

Account Title and Explanation

Debit

Credit