Chapter 3

Long-Term Assets

132

AP-18B (

2

)

Patterson Inc. purchased land, land improvements and a building on May 15, 2016 from

StarGen Inc. The appraised values of the assets were $740,000 for land, $100,000 for land

improvements and $160,000 for the building. Patterson Inc. paid $530,000 in cash and signed

a note payable for the remaining balance of $370,000.

Required

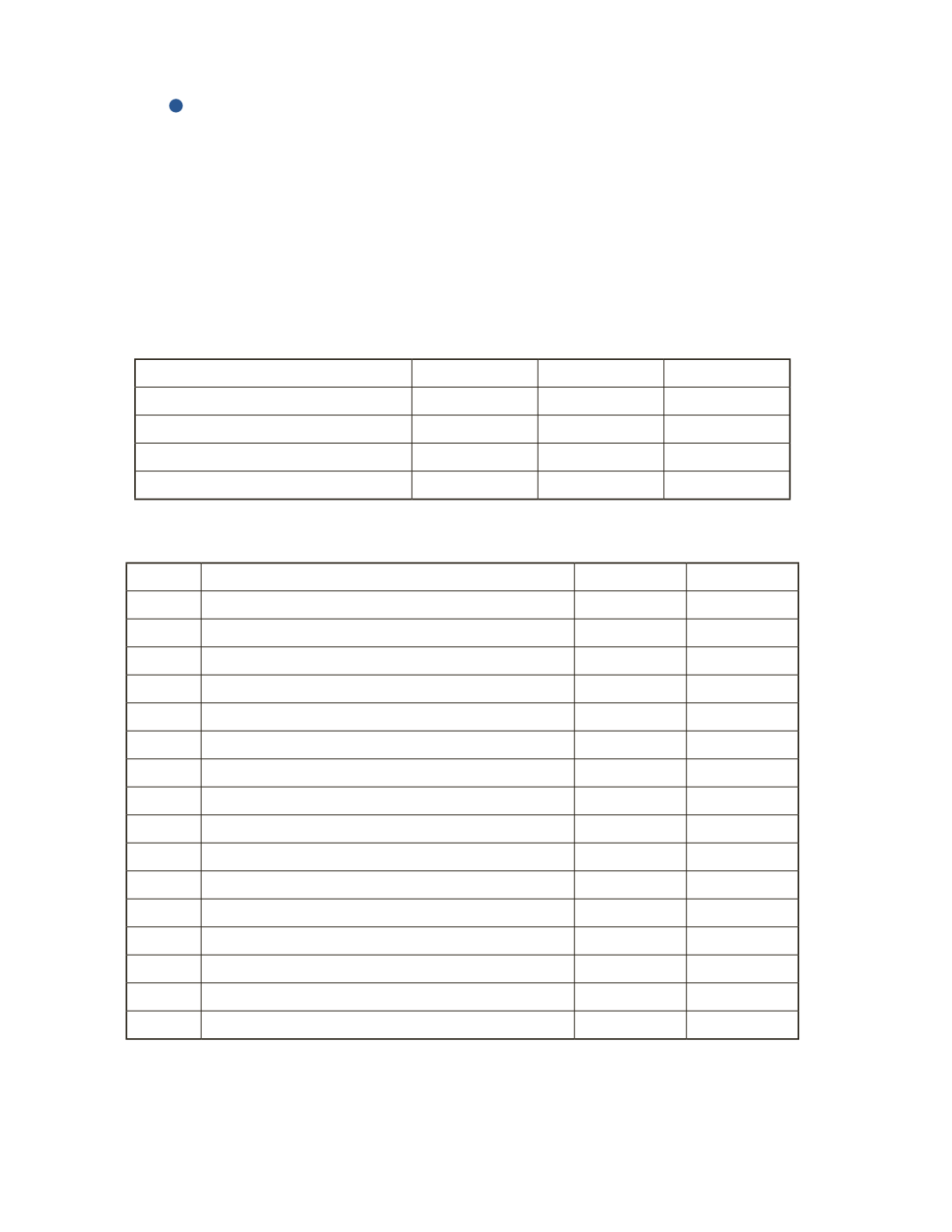

a) Complete the table to determine the cost of the assets.

Item

Appraised

Percent

Applied to Cost

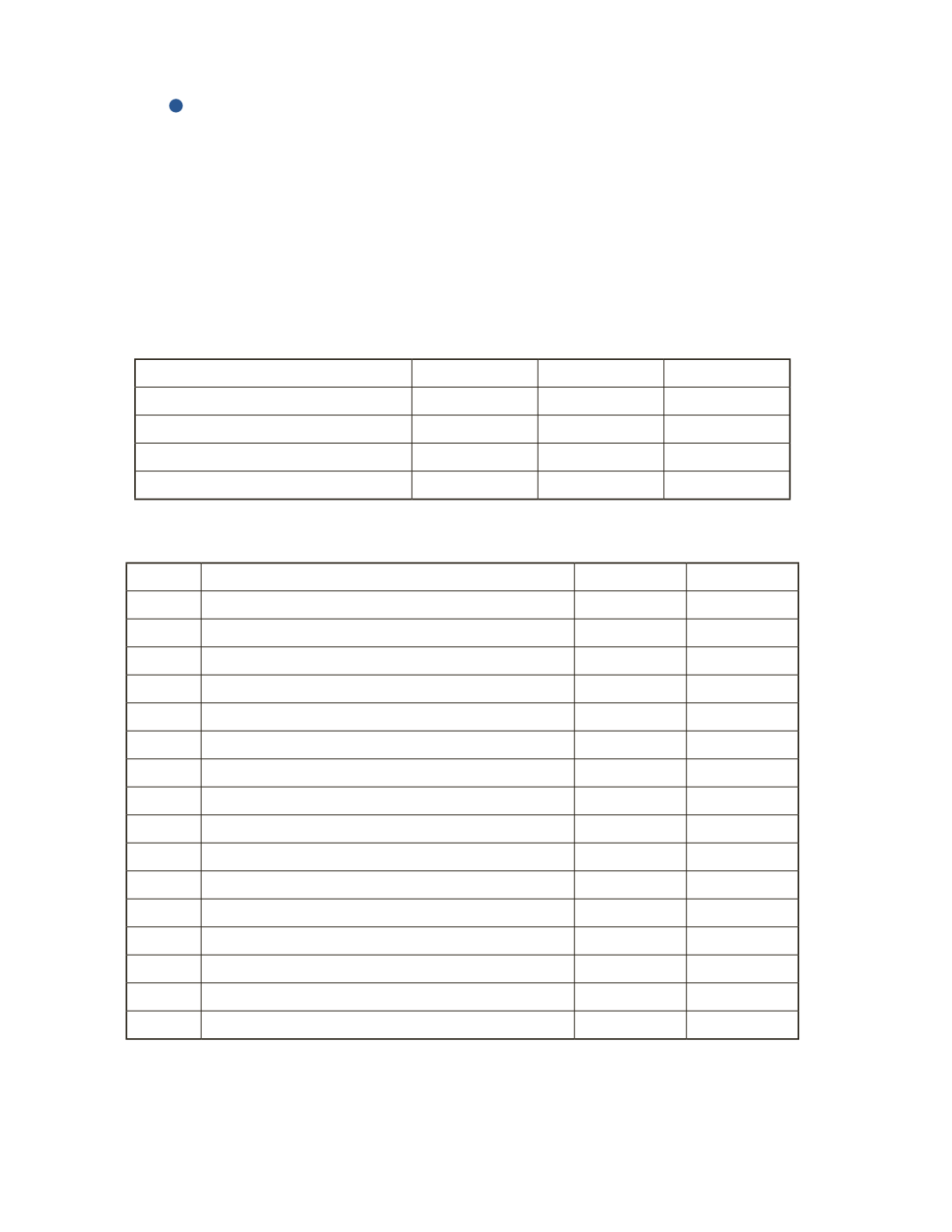

b) Prepare the journal entry to record the purchase.

Date

Account Title and Explanation

Debit

Credit