Chapter 3

Long-Term Assets

138

AP-24B (

3

4

)

A company purchased equipment for $50,000 on March 1, 2015. It is expected to last for four

years and have a residual value of $10,000. Assume that the company has adopted a partial-

year depreciation policy, wherein half a year's depreciation is taken in the year of purchase,

and half a year's depreciation is recorded in the year of disposal. The asset is sold on

January 18, 2017 for $20,000.

Required

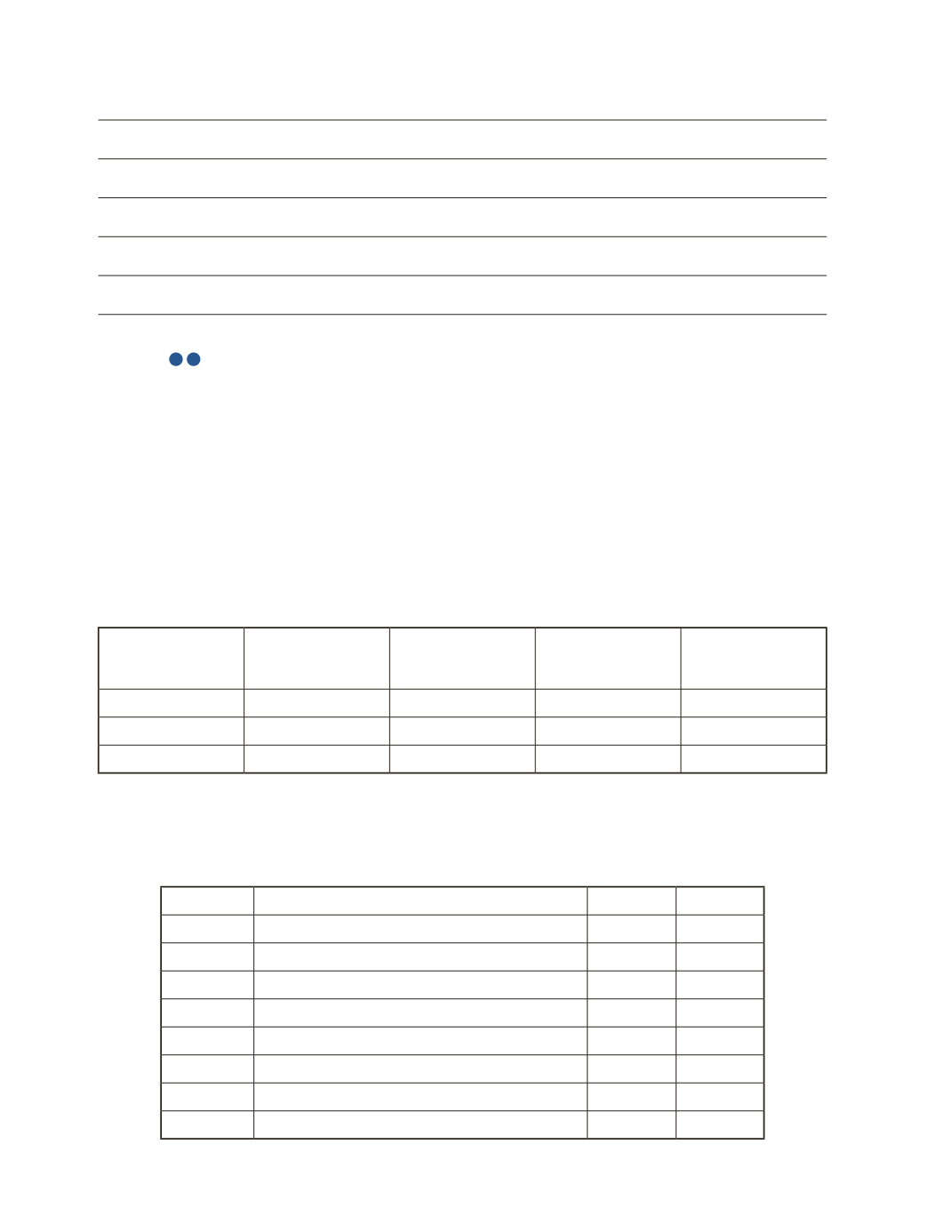

a) Prepare the depreciation table. The company uses straight-line depreciation.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation

To Date

Net Book Value

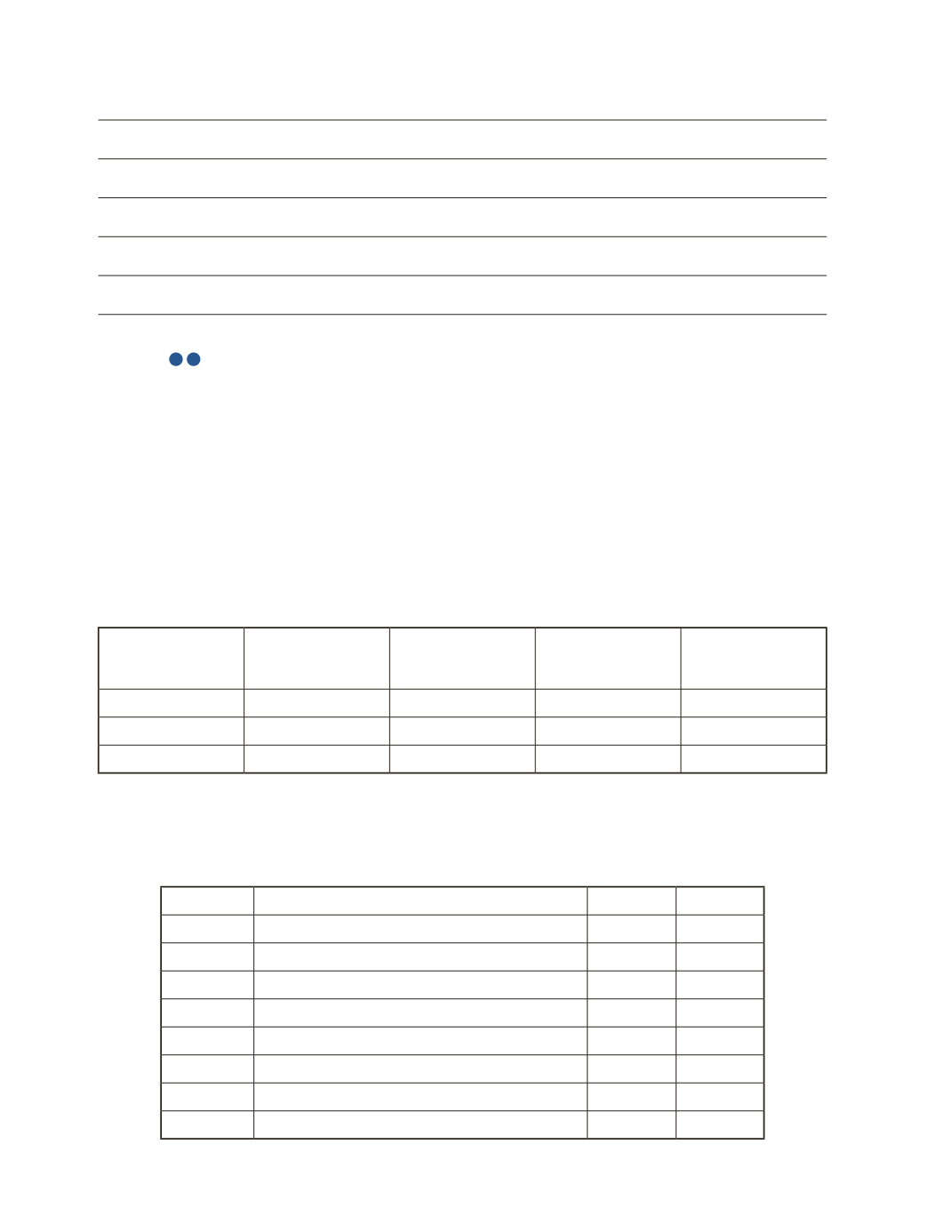

b) Prepare the journal entry to record the sale.

Date

Account Title and Explanation

Debit

Credit