Chapter 3

Long-Term Assets

142

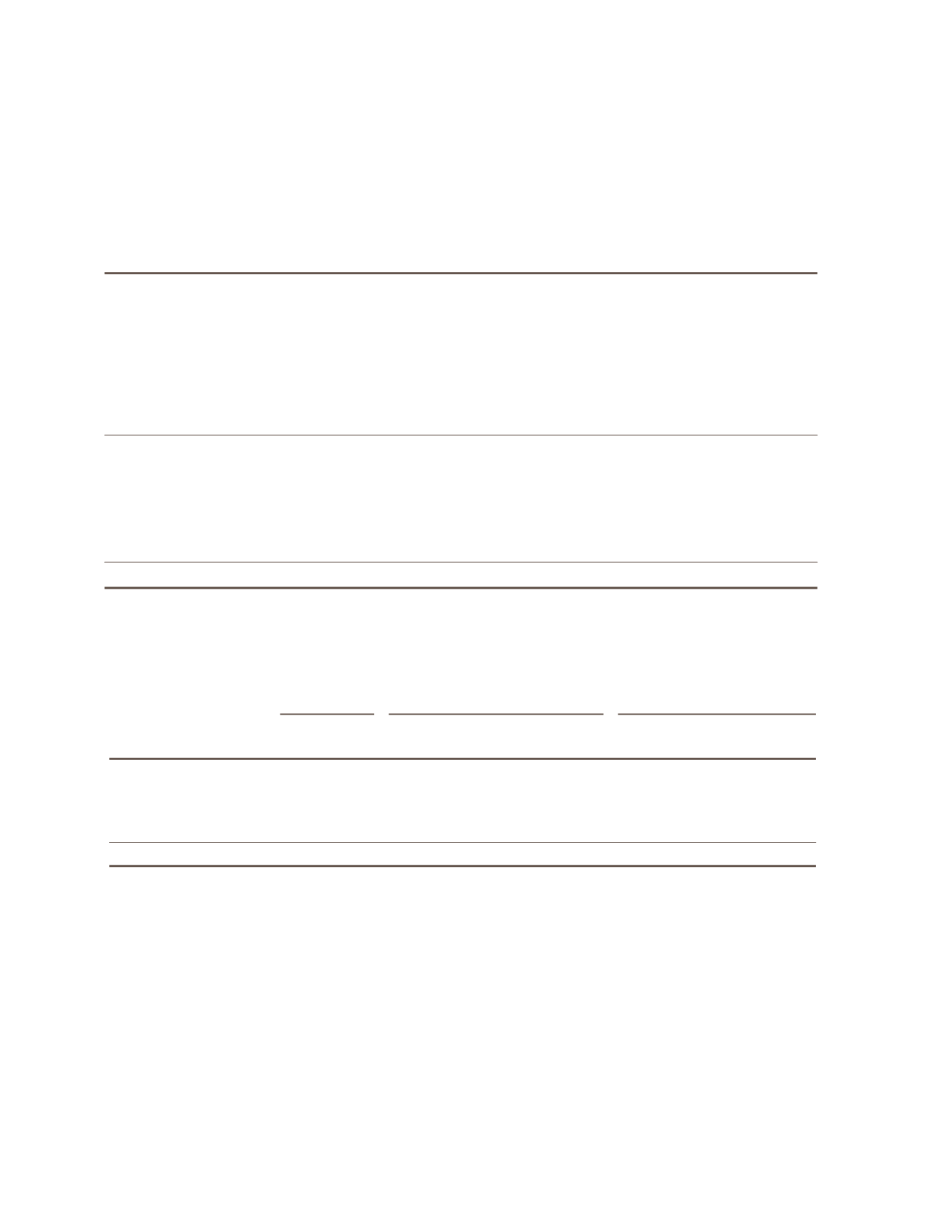

Canadian Pacific Railway

The long-term asset portion of Canadian Pacific Railway’s Balance Sheet is presented

underneath the current asset portion, as shown below.

CONSOLIDATED BALANCE SHEETS

As at December 31 (in millions of Canadian dollars except common shares)

2014

2013

Assets

Current assets

Cash and cash equivalents (Note 11)

$ 226

$ 476

Restricted cash and cash equivalents (Note 19)

–

411

Accounts receivable, net (Note 12)

702

580

Materials and supplies

177

165

Deferred income taxes (Note 7)

56

344

Other current assets

116

53

1,277

2,029

Investments (Note 14)

112

92

Properties (Note 15)

14,438

13,327

Assets held for sale (Notes 3 and 13)

182

222

Goodwill and intangible assets (Note 16)

176

162

Pension asset (Note 24)

304

1,028

Other assets (Notes 17 and 32)

151

200

Total assets

$ 16,640

$ 17,060

Liabilities and shareholders’ equity

Current liabilities

Accounts payable and accrued liabilities (Note 18)

$ 1,277

$ 1,189

Long-term debt maturing within one year (Note 19)

134

189

1,411

1,378

Pension and other benefit liabilities (Note 24)

755

657

Other long-term liabilities (Note 21)

432

338

Long-term debt (Note 19)

5,659

4,687

Deferred income taxes (Note 7)

2,773

2,903

Total liabilities

11,030

9,963

Shareholders’ equity

Share capital (Note 23)

2,185

2,240

Authorized unlimited common shares without par value. Issued and outstanding are 166.1 million and 175.4 million

at December 31, 2014 and 2013, respectively.

Authorized unlimited number of first and second preferred shares; none outstanding.

Additional paid-in capital

36

34

Accumulated other comprehensive loss (Note 9)

(2,219)

(1,503)

Retained earnings

5,608

6,326

5,610

7,097

Total liabilities and shareholders’ equity

$ 16,640

$ 17,060

Commitments and contingencies (Note 27)

See Notes to Consolidated Financial Statements.

Approved on behalf of the Board:

/s/ Gary F. Colter

/s/ Isabelle Courville

Gary F. Colter, Director,

Isabelle Courville, Director,

Chair of the Board

Chair of the Audit Committee

CP ANNUAL REPORT | 2014

73

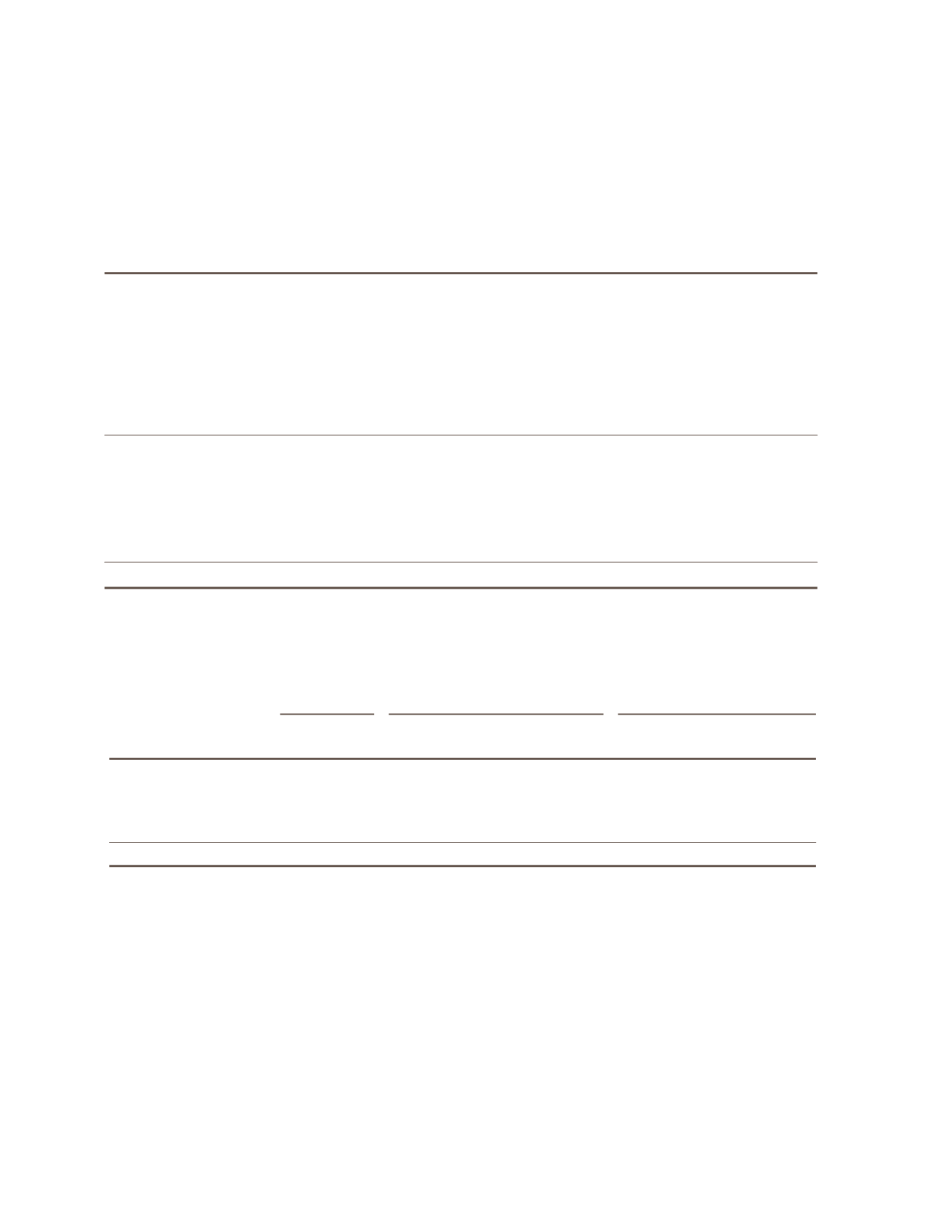

Below is Canadian Pacific Railway’s Note 15.

(in millions of Canadian dollars)

2014

2013

Cash

$ 226

$ 109

Short-term investments:

Deposits with financial institutions

–

367

Total cash and cash equivalents

$ 226

$ 476

12 Accounts receivable, net

(in millions of Canadian dollars)

2014

2013

Freight

$ 535

$ 408

Non-freight

189

192

724

600

Allowance for doubtful accounts

(22)

(20)

Total accounts receivable, net

$ 702

$ 580

The Company maintains an allowance for doubtful accounts based on expected collectability of accounts receivable. Credit losses are based on

specific identification of u collectible accounts, the application of historical percentages by aging category and an assessment of the current

economic environment. At December 31, 2014, allowances of $22 million (2013 – $20 million) were recorded in “Accounts receivable, net”. During

2014, provisions of $2 million of accounts receivable (2013 – $3 million; 2012 – $3 million) were recorded within “Purchased services and other”.

13 Assets held for sale

On Novemb r 17, 2014, the Company announced a proposed agreement with Norfolk Southern Corporation (“NS”) for the sale of approximately

283 miles of the Delaware and Hudson Railway Company, Inc.’s line between Sunbury, Pennsylvania, and Schenectady, New York. The assets

expected to be sold to NS upon completion of this transaction have been classified as “Assets held for sale” on the Company’s Consolidated

Balance Sheets. The assets continue to be reported at their carrying value as this is lower than their expected fair value. The sale to NS, when

agreed, will be subject to regulatory approval by the STB and is expected to close in 2015.

14 Investments

(in millions of Canadian dollars)

2014

2013

Rail inve tments accounted for on an equity basis

$ 82

$ 7

Other investments

30

25

Total inve tments

$ 112

$ 92

15 Properties

2014

2014

2013

(in millions of Canadian dollars)

Average

annual depreciation

rate

Cost

Accumulated

depreciation

Net book

value

Cost

Accumulated

depreciation

Net book

value

Track and roadway

2.5%

$ 14,515

$ 4,126 $ 10,389

$ 13,459 $ 3,877 $ 9,582

Buildings

3.1%

571

150

421

535

138

397

Rolling stock

2.3%

3,737

1,414

2,323

3,466

1,338

2,128

Information systems

(1)

12.4%

631

297

334

679

338

341

Other

4.5%

1,489

518

971

1,372

493

879

Total

$ 20,943

$ 6,505 $ 14,438

$ 19,511 $ 6,184 $ 13,327

(1)

D ring 2014, CP capitalized costs attribut ble to the esign and development of internal-use software in the amount of $69 million (2013 – $85 million;

2012 – $105 million). Current year depreciation expense related to internal use software was $70 million (2013 – $84 million; 2012 – $78 million).

88