Chapter 3

Long-Term Assets

144

CS-2 (

3

6

)

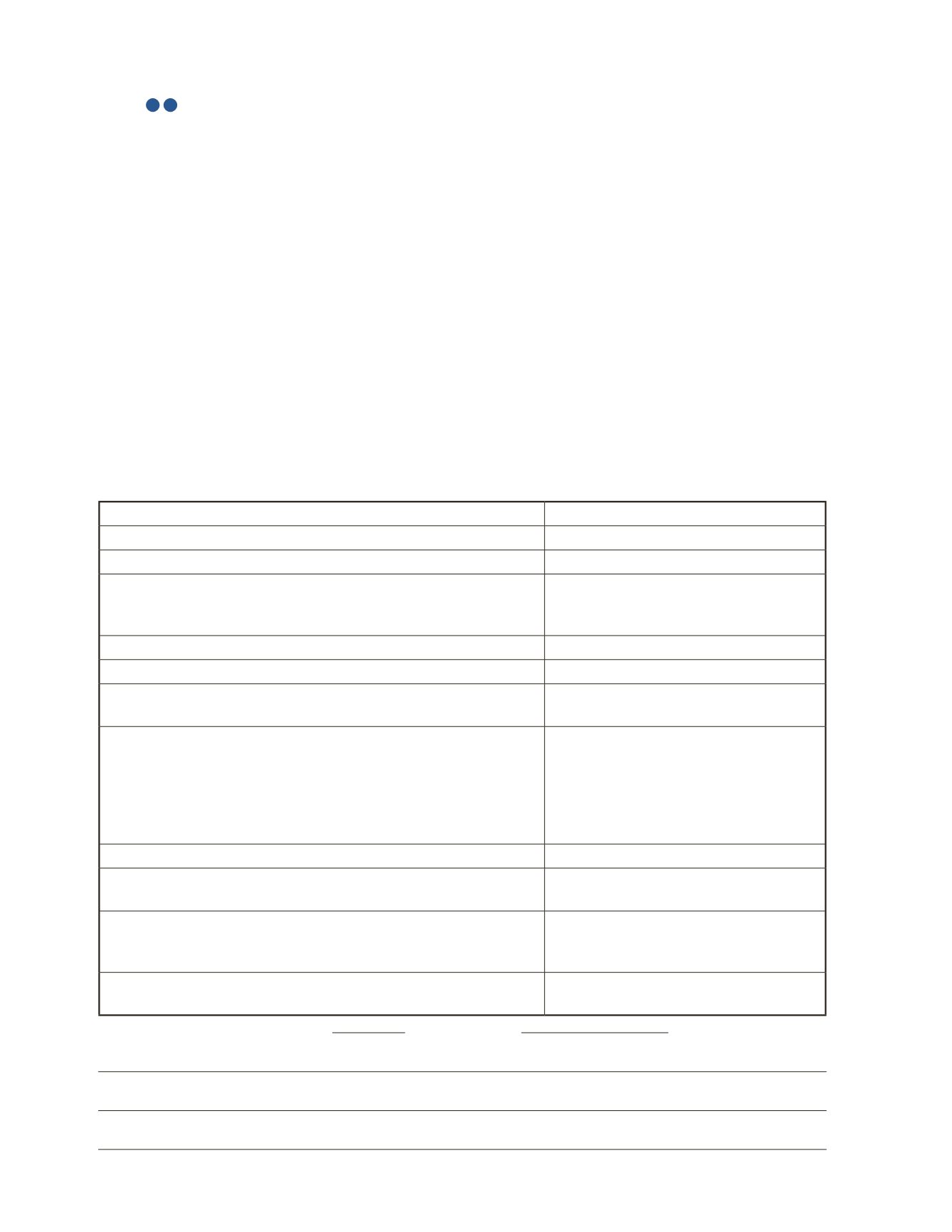

Locate the current financial statements of a company that owns intangible assets

1

, and supply

the following information. Information has been supplied for Pfizer, as an example.

)

Note: Most large-cap companies engaged in manufacturing industrial or consumer products

will have intangible assets of some sort. You can speed up your search by using a stock filter

such as that found at

.

Set the filter as follows.

Industry = industrial products or consumer products

Security = common

Market Capitalization = $5,000 million (minimum)

Example

Item

Answer

Name of company

Pfizer Inc.

Date of financial statements

December 31, 2014

Amount of intangible assets shown on balance sheet

Goodwill—$42,069 million

Identifiable Intangible Assets less accu-

mulated amortization—$35,166 million

Total assets

$169,274 million

Intangible assets expressed as a percent of total assets

(42,069 + 35,166) ÷ 169,274

=

46%

Where is there further information about intangibles found on the

financial statements?

Note 10

What types of intangible assets does the company own?

Goodwill

Developed technology rights

Brands

License agreements

In-process R&D

Other

Amount of amortization expense for intangibles for the year

$4,039 million (from income statement)

Amortization expense as percent of profit (continuing operations)

before taxes

amortization ÷ (profit + amortization)

= 4,039 ÷ (4,039 + 9,119) = 31%

Over what period are intangibles written off? State the source.

Significant accounting policies—note K

Identifiable Intangible Assets are written

off over their estimated useful life.

Was there any impairment of goodwill or intangibles? State the

source.

Yes—as per cash flow statement and

note 10.

1 For Canadian company financial statements go to

; for U.S. companies go to