Chapter 3

Long-Term Assets

136

b) Calculate the recoverable amount of the machinery on December 31, 2018.

Analysis

How might AIT Company determine the recoverable amount of the machinery at December

31, 2018? Does the company need to test the assets for impairment every year?

AP-23B (

7

)

The following financial data is given for two companies, LIN andWOK. They both manufacture

and sell office furniture across the US and Canada. Both companies have a year-end of June 30.

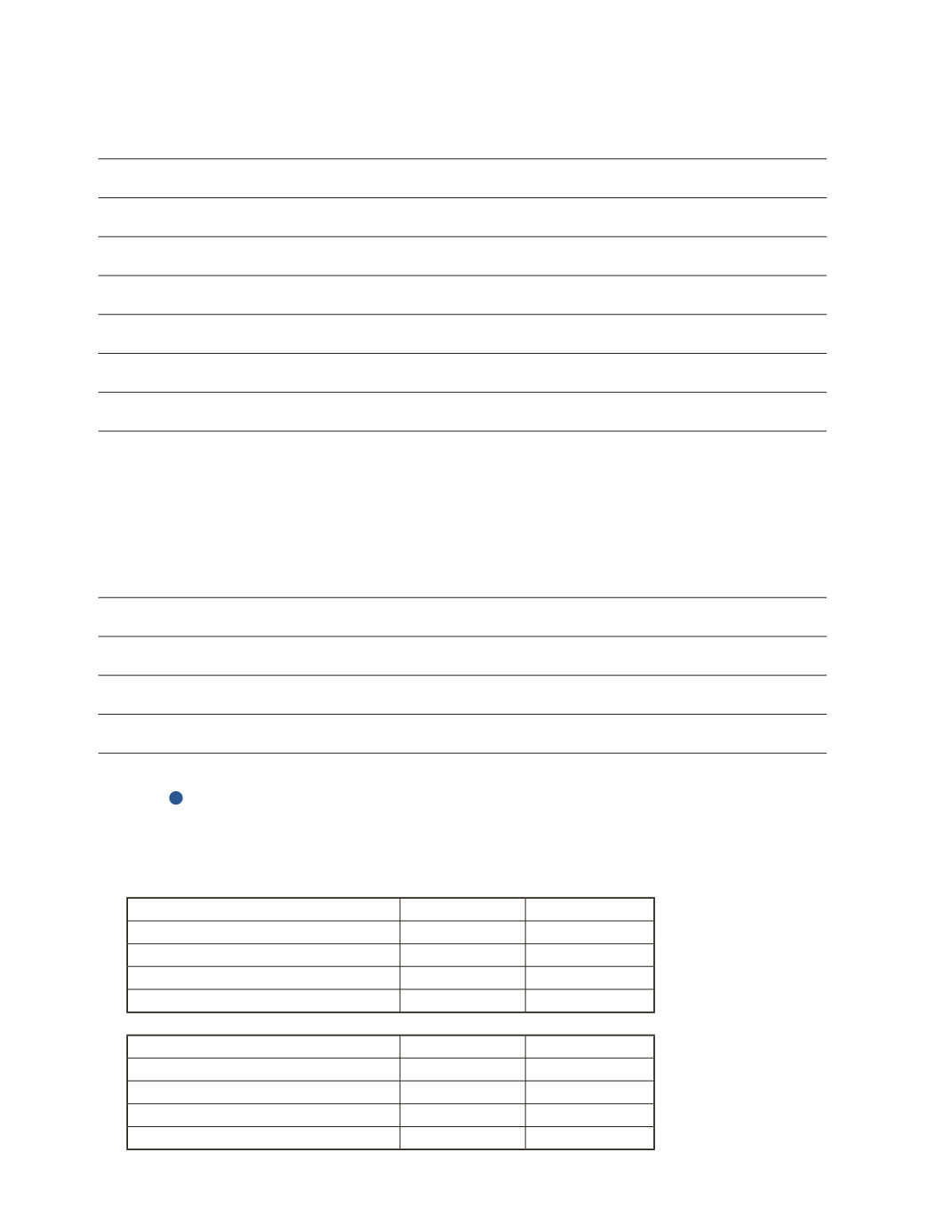

LIN Company

June 30, 2015 June 30, 2014

Net Sales

$3,500,000

$3,000,000

Total Assets

$2,200,000

$1,150,000

Net Income

$590,000

$500,000

Gross Profit

$1,575,000

$1,350,000

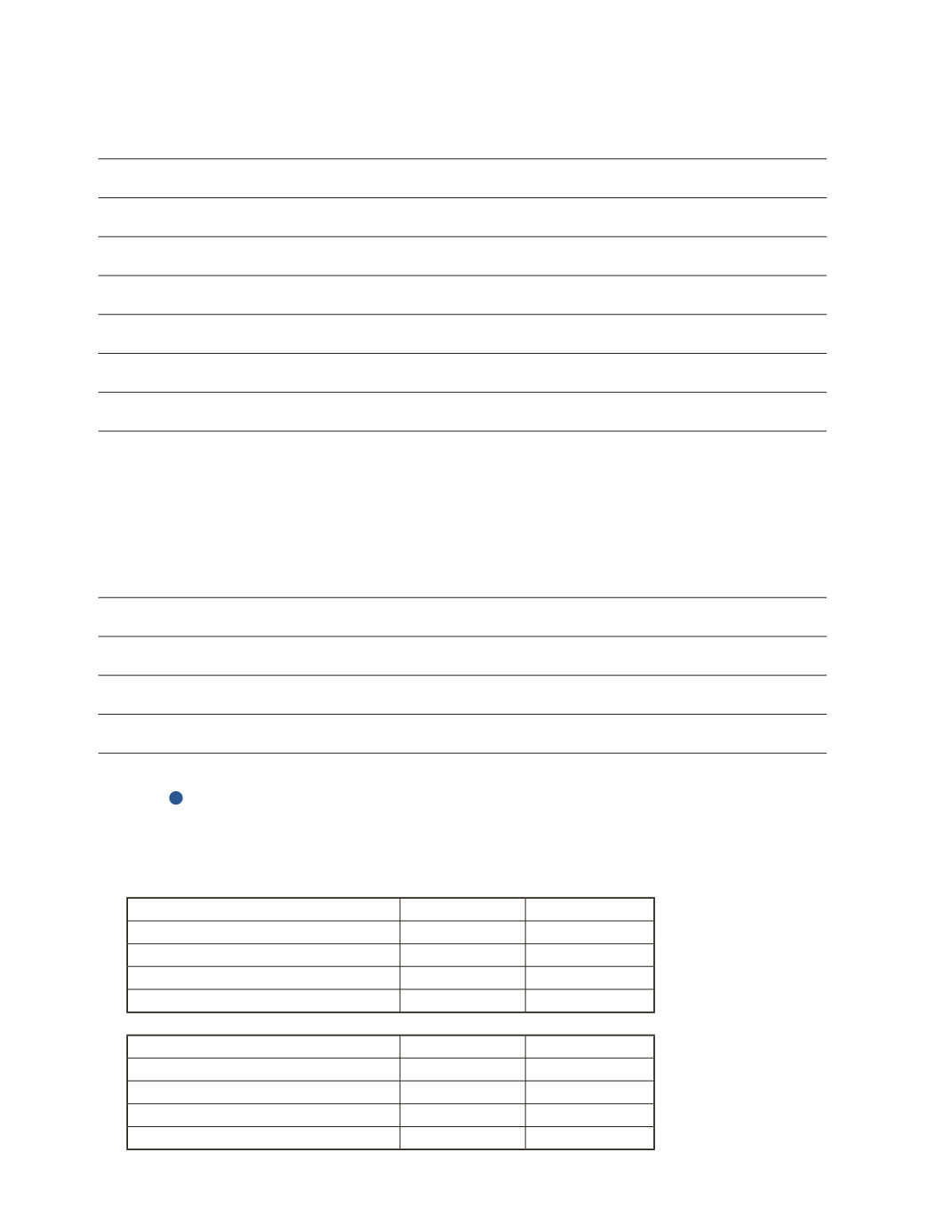

WOK Company

June 30, 2015 June 30, 2014

Net Sales

$4,500,000

$4,120,000

Total Assets

$5,500,000

$4,800,000

Net Income

$840,000

$620,000

Gross Profit

$1,575,000

$1,442,000