Chapter 3

Long-Term Assets

134

AP-21B (

5

)

On January 1, 2015, WeOil Company installed an oil well at a purchase price of $40 million in

addition to an installation cost of $5 million, all for cash. The residual value of the oil well is

$3 million. WeOil Company estimates that the total predicted output is 75,000 barrels of oil. The

company only pumped out 2,000 barrels in 2015 and 3,500 barrels in 2016.

Required

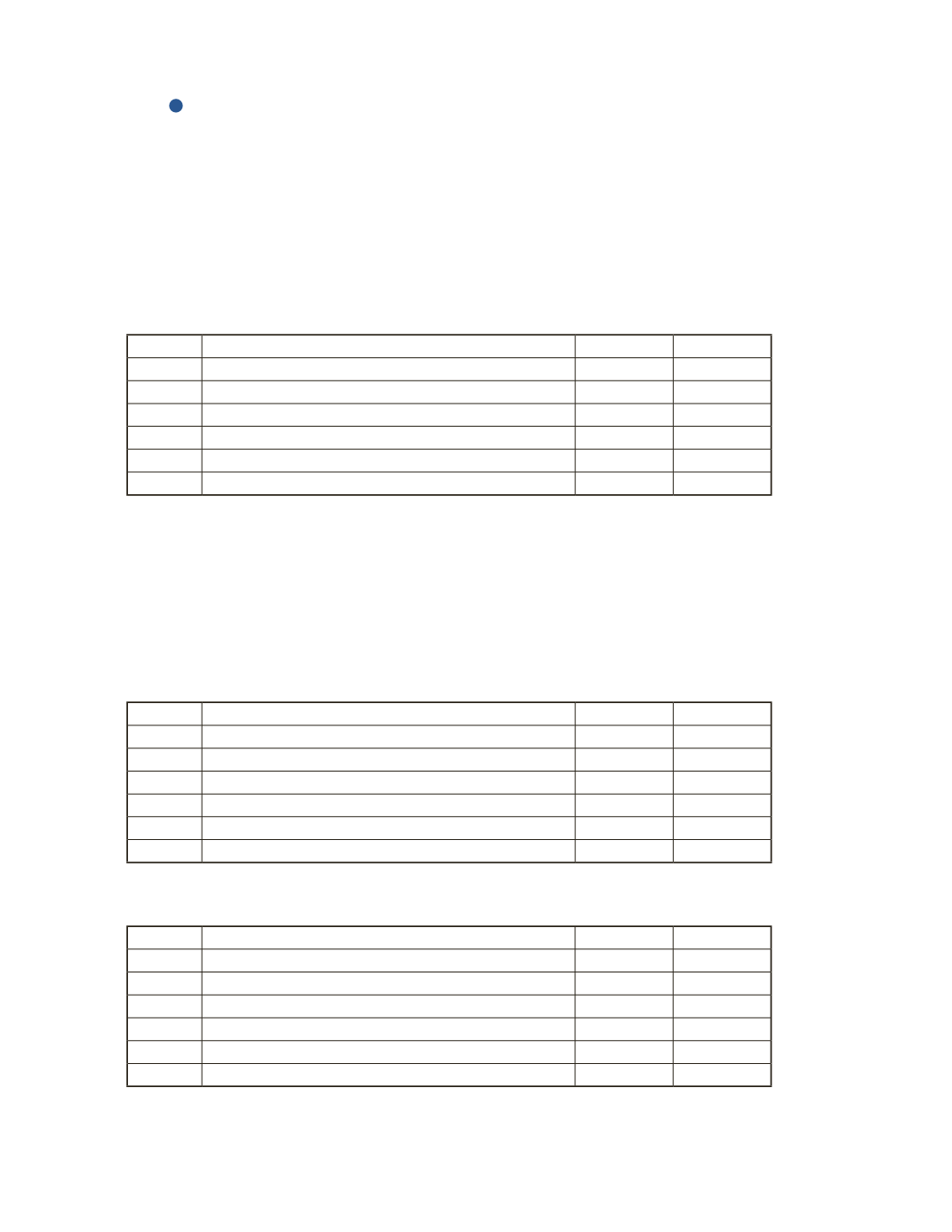

a) Prepare the journal entry to record the purchase of the oil well.

Date

Account Title and Explanation

Debit

Credit

b) Calculate the unit cost for each barrel to be extracted.

______________________________________________________________________________

______________________________________________________________________________

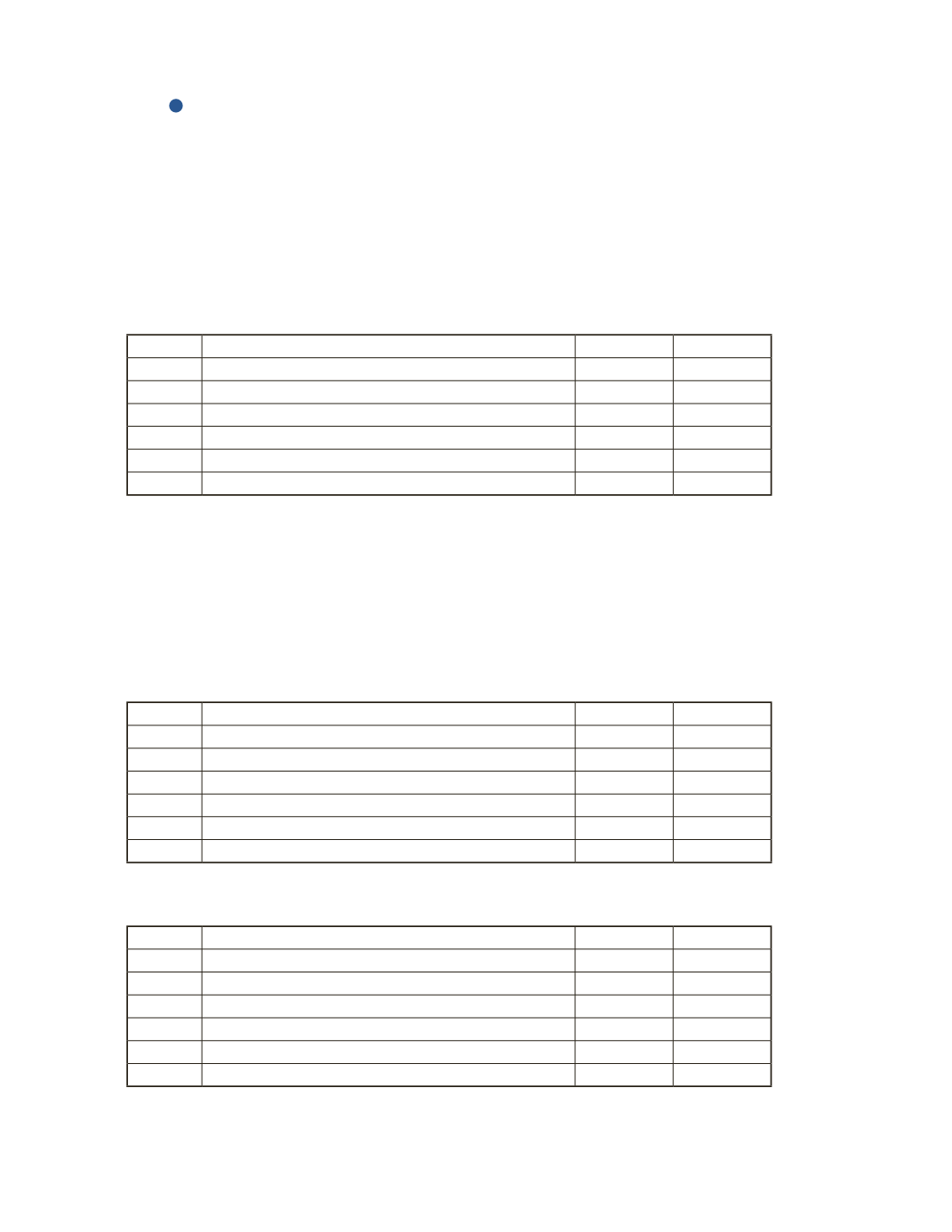

c) Prepare the journal entries to record the depletion for 2015.

Date

Account Title and Explanation

Debit

Credit

d) Prepare the journal entries to record the depletion for 2016.

Date

Account Title and Explanation

Debit

Credit