Chapter 3

Long-Term Assets

120

b) At the end of 2018, the company stopped using this machine. Since no one was interested

in buying it, the machine was simply discarded. Prepare a journal entry to record the

machine's retirement.

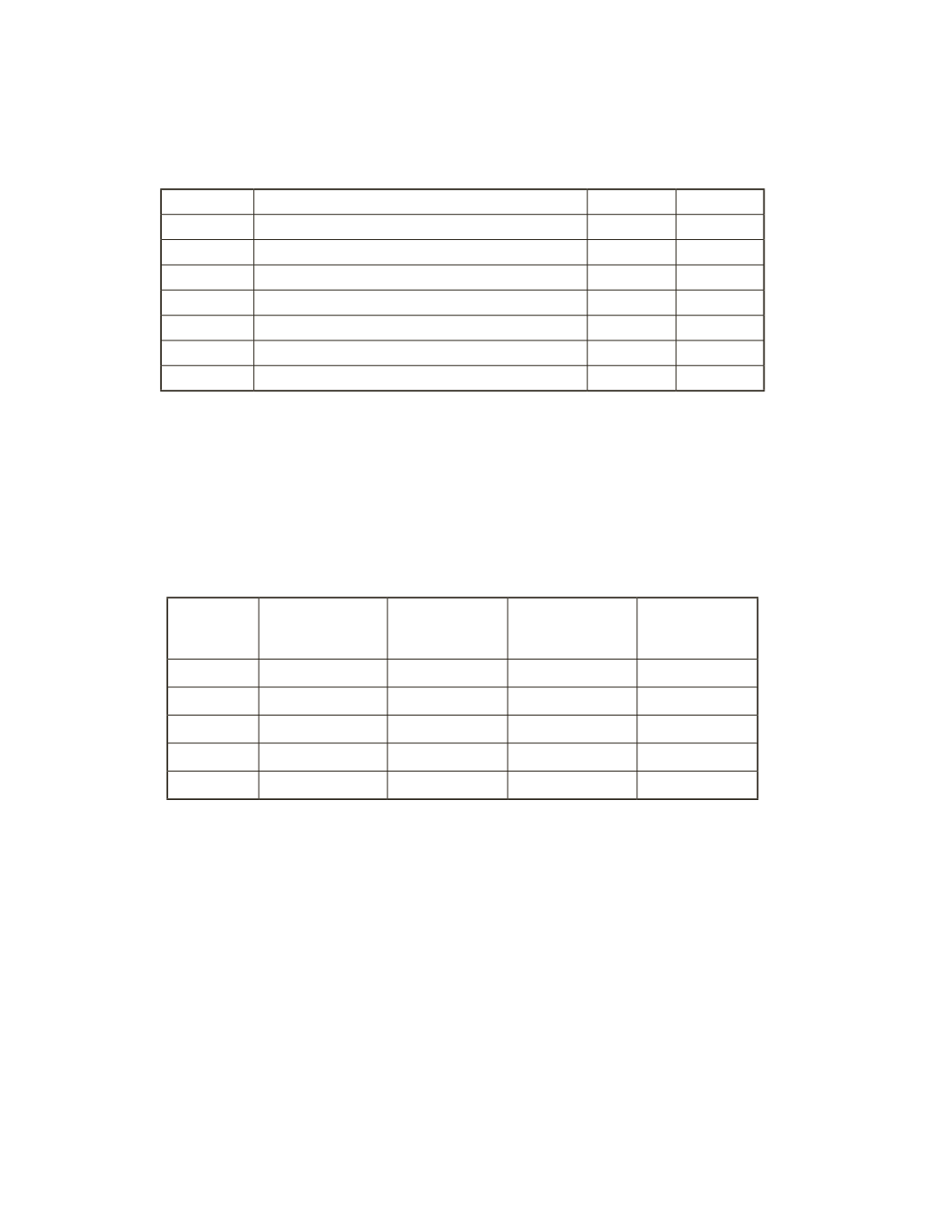

Date

Account Title and Explanation

Debit

Credit

c) Assume that South Company uses the double-declining-balance depreciation method

and the machine has no residual value. At the end of 2018, new technology emerged,

making the product manufactured by this machine obsolete. After testing for impairment,

South Company determines that the fair value of the machine has permanently declined

to $50. Prepare a depreciation schedule for the machine’s useful life using the following

table. Determine whether impairment has incurred, and if so, calculate the amount of

impairment loss.

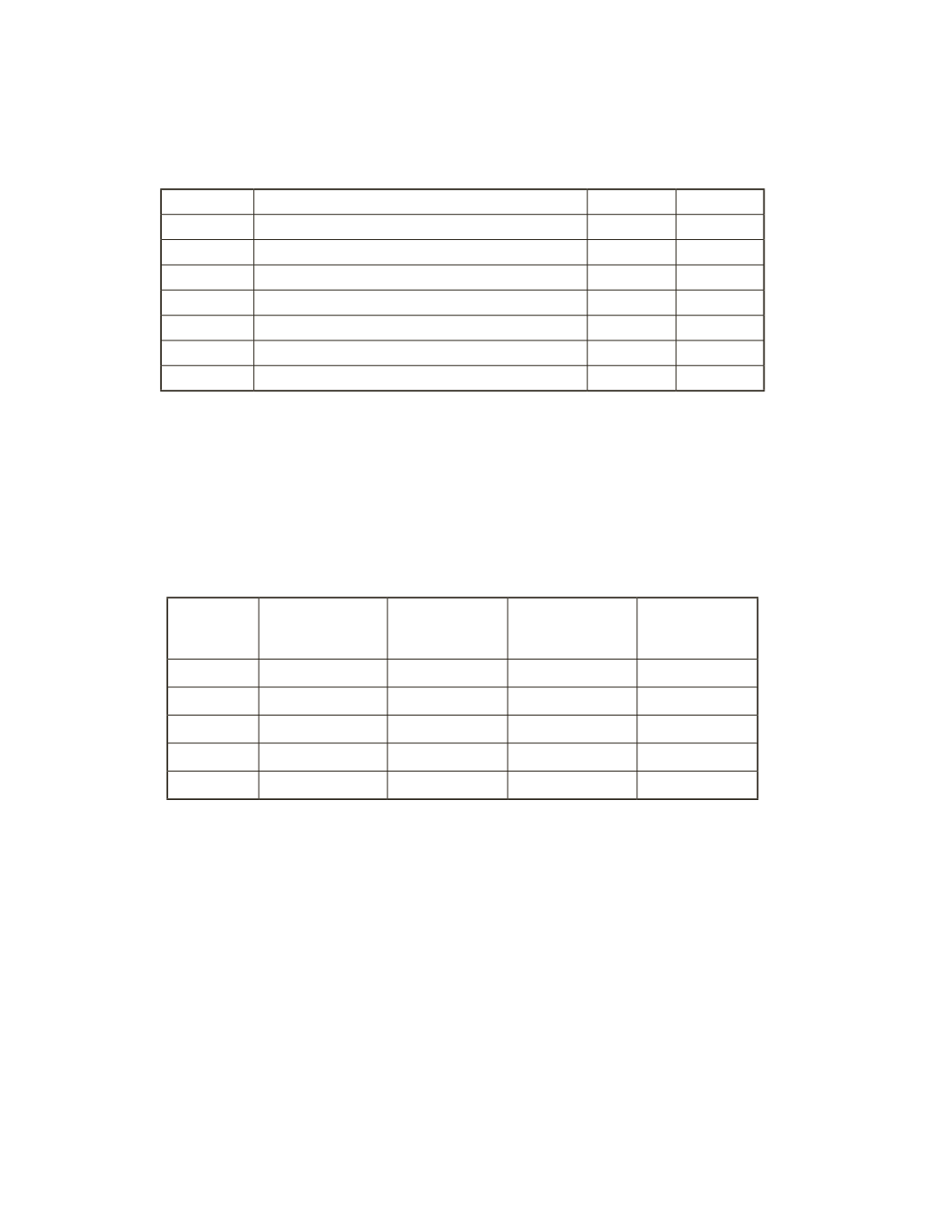

Year

Net Book Value

at the beginning

of the year

Depreciation

Expense

Accumulated

Depreciation To

Date

Net Book Value

at the end of

the year

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________