Chapter 3

Long-Term Assets

119

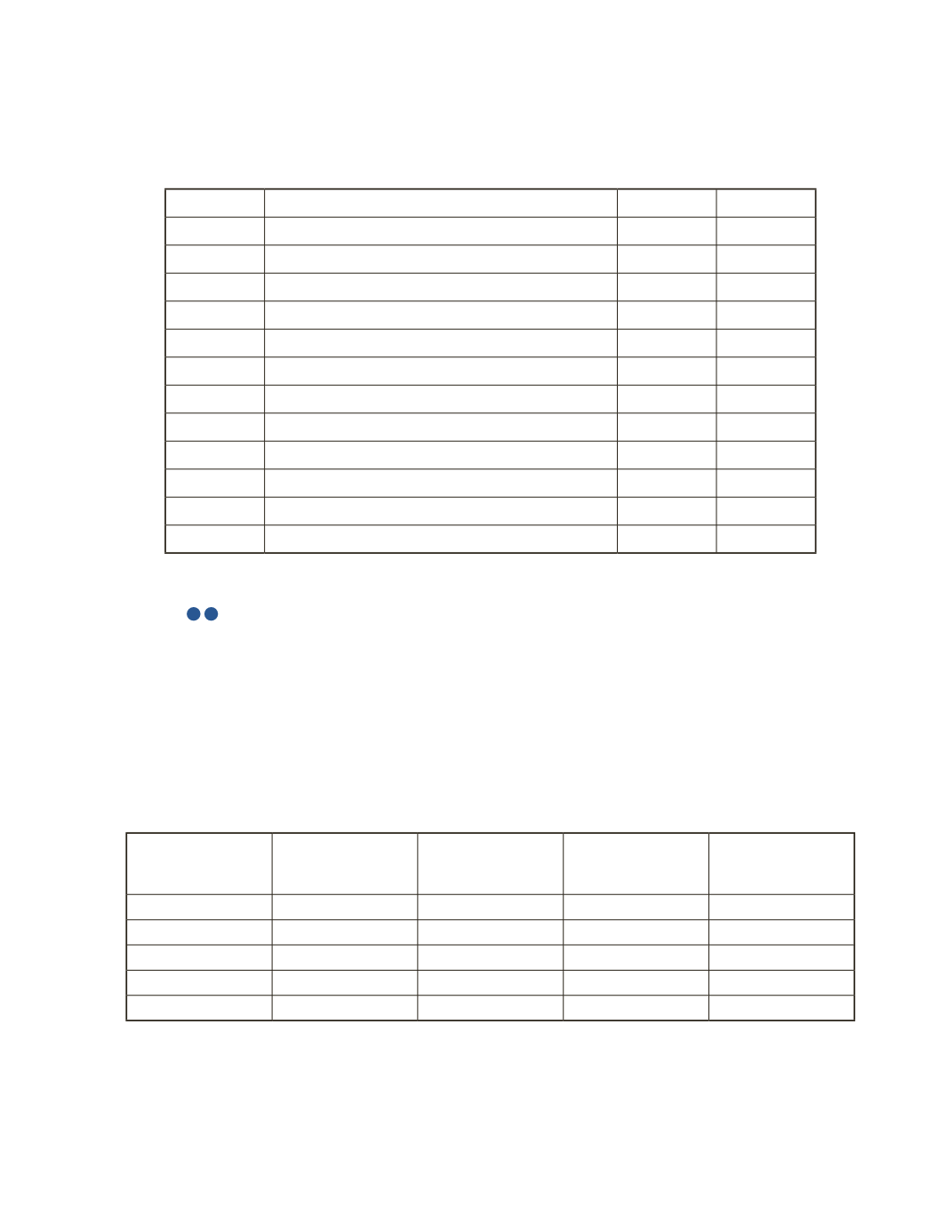

c) Continuing from part b), the business sold the equipment on December 31, 2019 for

$9,000 cash. The sale happened after the journal entry to record the year’s depreciation.

Prepare the journal entry to record the sale of the equipment.

Date

Account Title and Explanation

Debit

Credit

AP-6B (

3

4

)

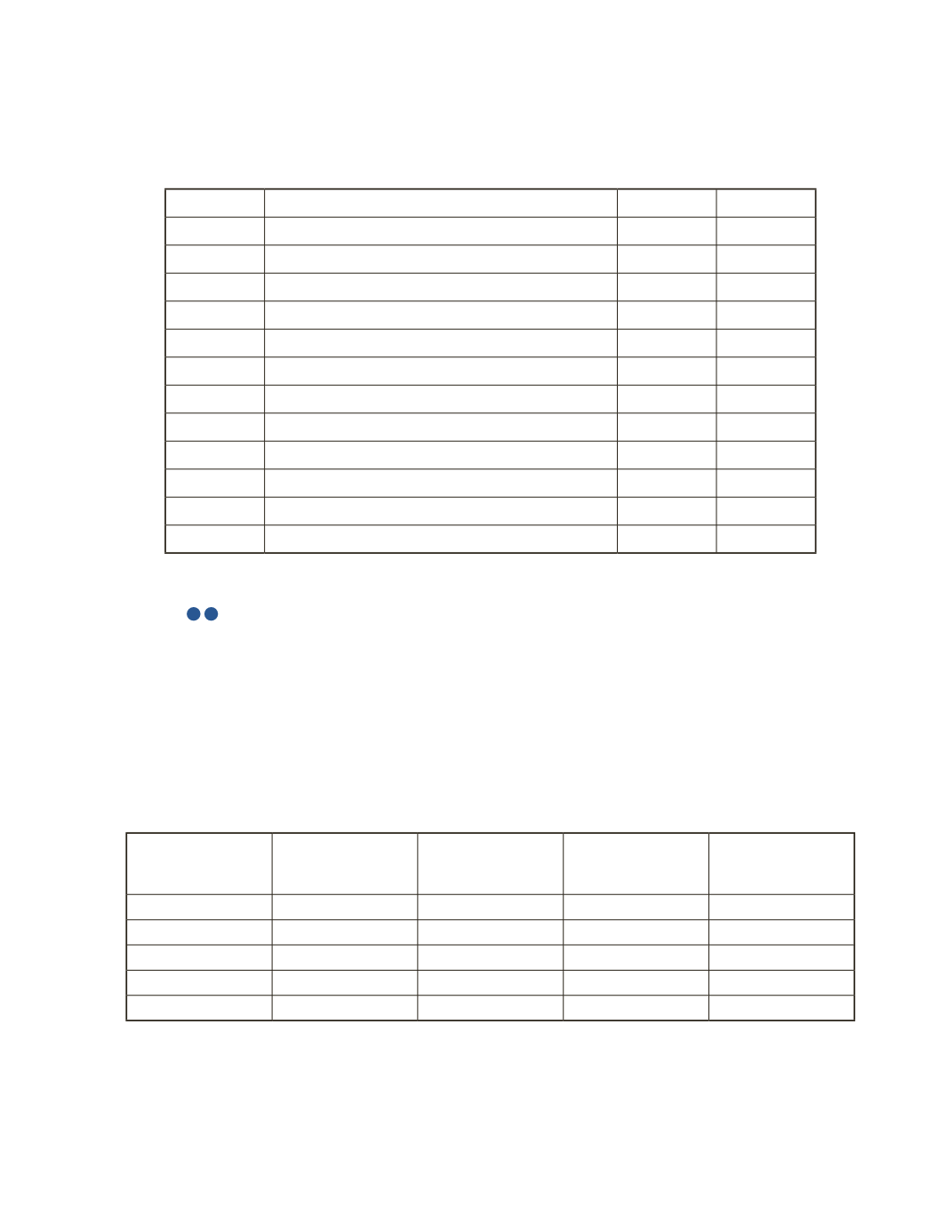

On January 1, 2014, South Company purchased a machine for $40,000. The residual value was

estimated to be $5,000. The machine will be depreciated over five years using the straight-line

method. The company’s year-end is December 31.

Required

a) Prepare a depreciation schedule for the machine’s useful life using the following table.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation To

Date

Net Book

Value