Chapter 3

Long-Term Assets

121

d) Assume that the company uses the units-of-production method, and the machine can

produce 350,000 units. Record of production: 2014—20,000 units; 2015—60,000 units;

2016—70,000 units; 2017—100,000 units; 2018—100,000 units. Prepare a depreciation

schedule for the machine’s useful life using the following table. Compare the pattern of

depreciation expense resulting from three different depreciation methods in parts a), c)

and d).

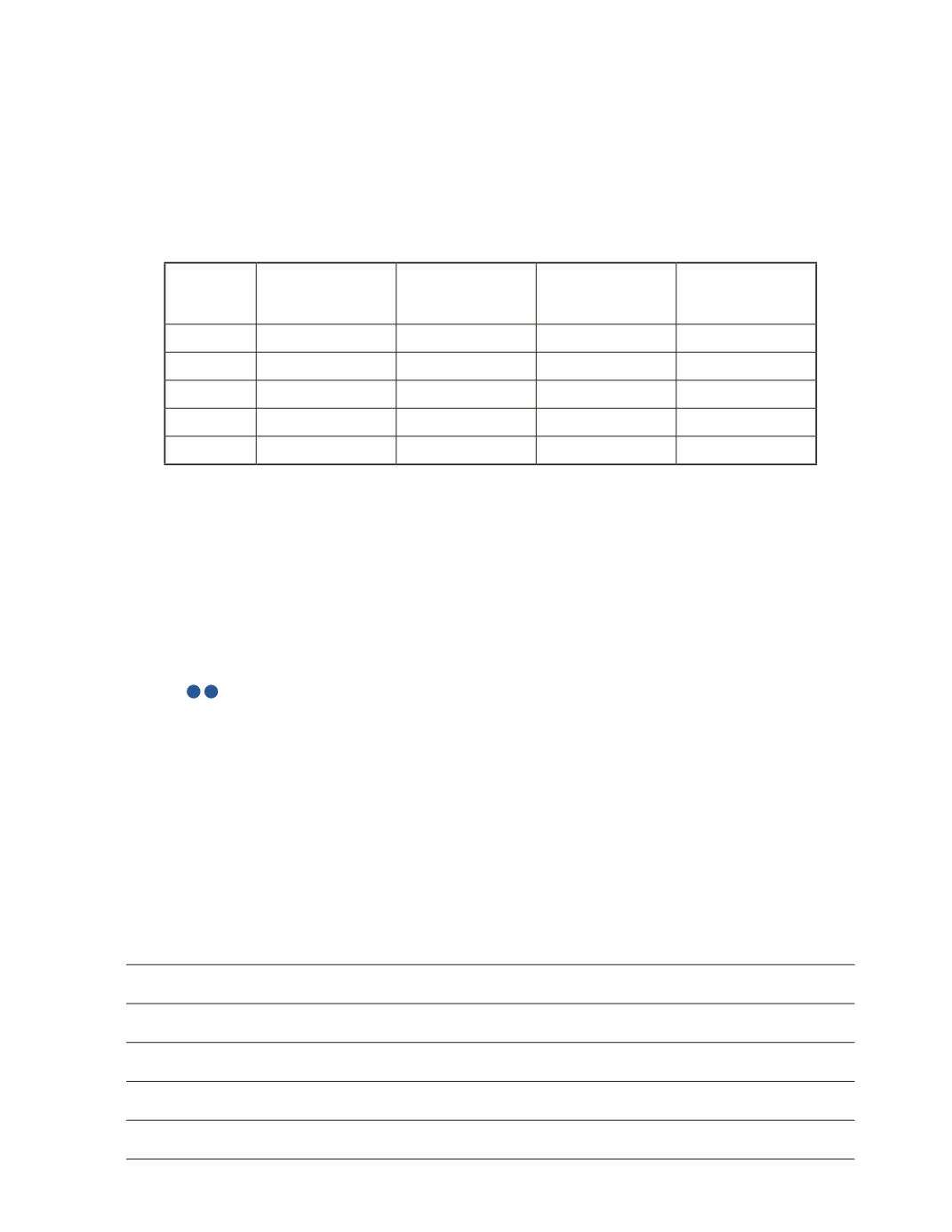

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation To

Date

Net Book

Value

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

AP-7B (

3

4

)

MNO Company purchased equipment worth $35,000 on January 1, 2016. The equipment

has an estimated five-year service life with no residual value. The company’s policy for

five-year assets is to use the double-declining-balance method for the first two years of the

asset’s life and then switch to the straight-line depreciation method. The company’s year-

end is December 31.

Required

a) Calculate the depreciation expense on December 31, 2018.