Chapter 3

Long-Term Assets

118

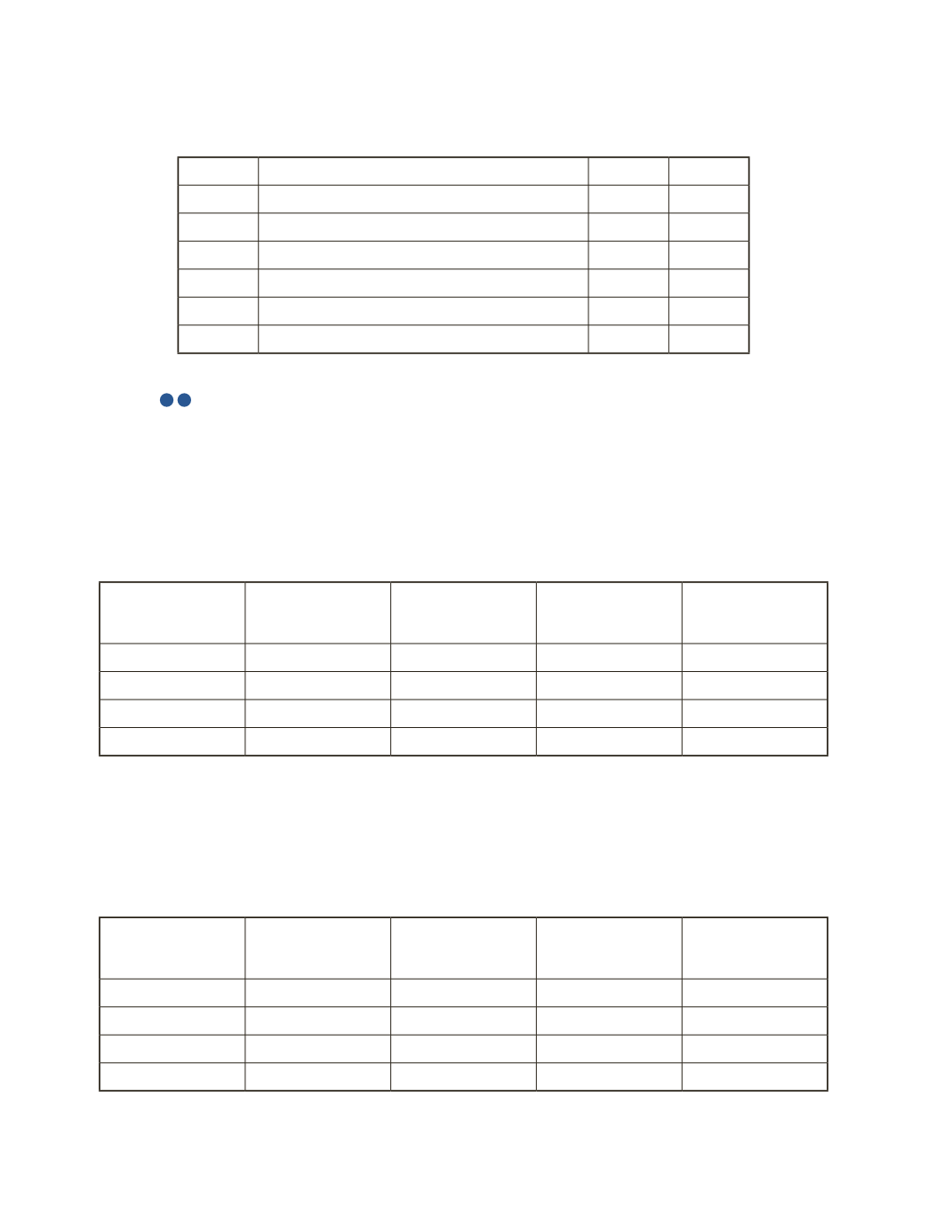

b) Record the journal entry for the sale, assuming that the depreciation for 2016 has already

been recorded.

Date

Account Title and Explanation

Debit

Credit

AP-5B (

3

4

)

Equipment was purchased on January 1, 2016 for $86,000. The asset is expected to last for

four years, at which time the estimated residual value will be $7,000.

Required

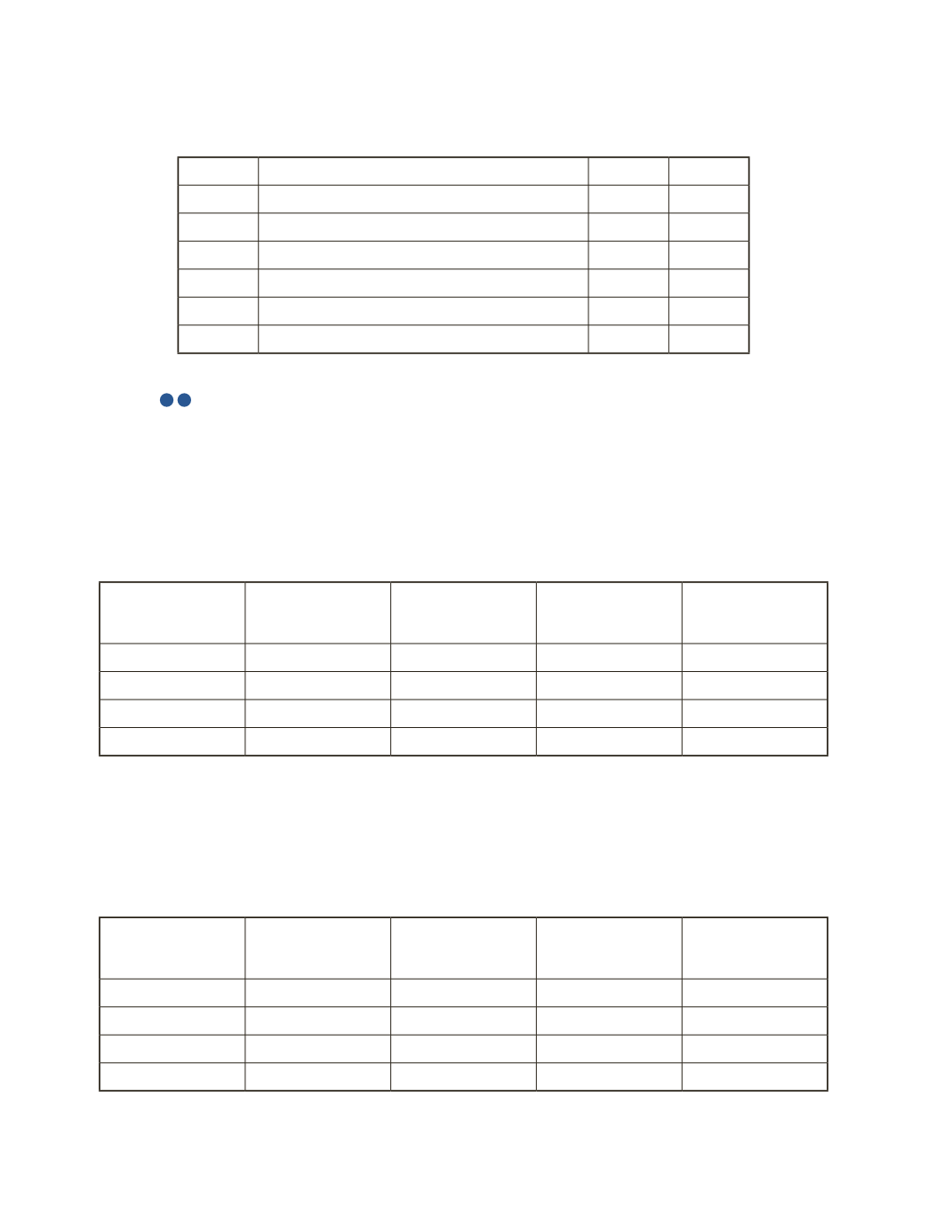

a) Fill in the following table, assuming the company uses straight‐line depreciation.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

DepreciationTo

Date

Net Book Value

b) Fill in the following table, assuming that the company uses the units‐of-production

method and that the estimated residual value will be $7,000. The asset is expected to

produce a total of 1,010,000 units over four years. The number of units that the asset is

expected to produce for each year is: year 2016—202,000 units; year 2017—252,500 units;

year 2018—303,000 units; year 2019—252,500 units.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

DepreciationTo

Date

Net Book Value