Chapter 3

Long-Term Assets

108

AP-17A (

3

4

)

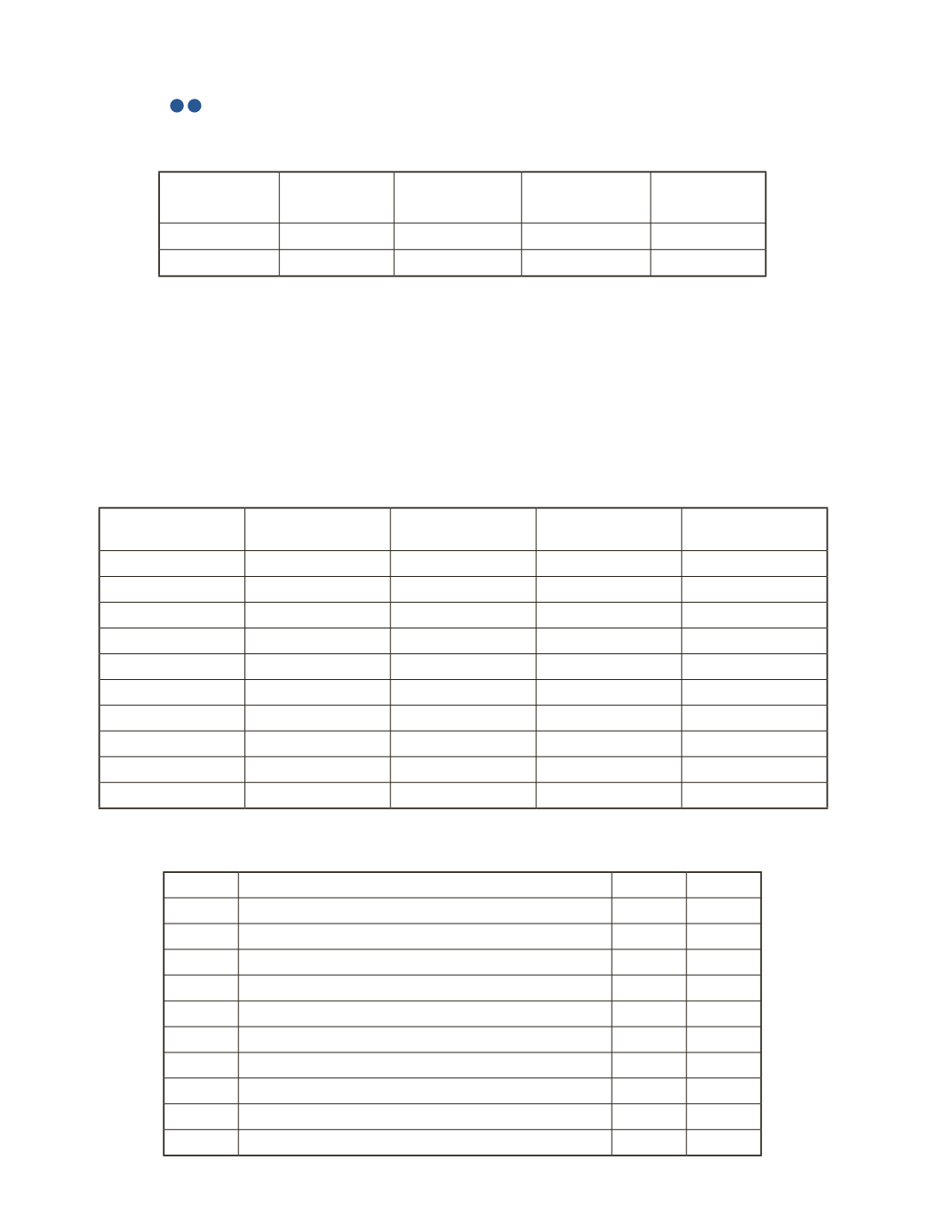

Details of some of Stark Corporation’s long-term assets are listed below.

Date of

Purchase

Asset

Cost

Residual

Value

Estimated

Useful Life

Feb 1, 2013 Building

$370,600

$25,000

8 years

Sep 1, 2013

Truck

$51,400

$4,600

6 years

On August 1, 2016, Stark Corporation decides to dispose of both of these assets. The total

proceeds received for the assets were $246,000. Both assets use the straight-line depreciation

method based on the number of months owned in the year. Stark Corporation has a

December 31 year-end. Round all answers to the nearest whole number.

Required

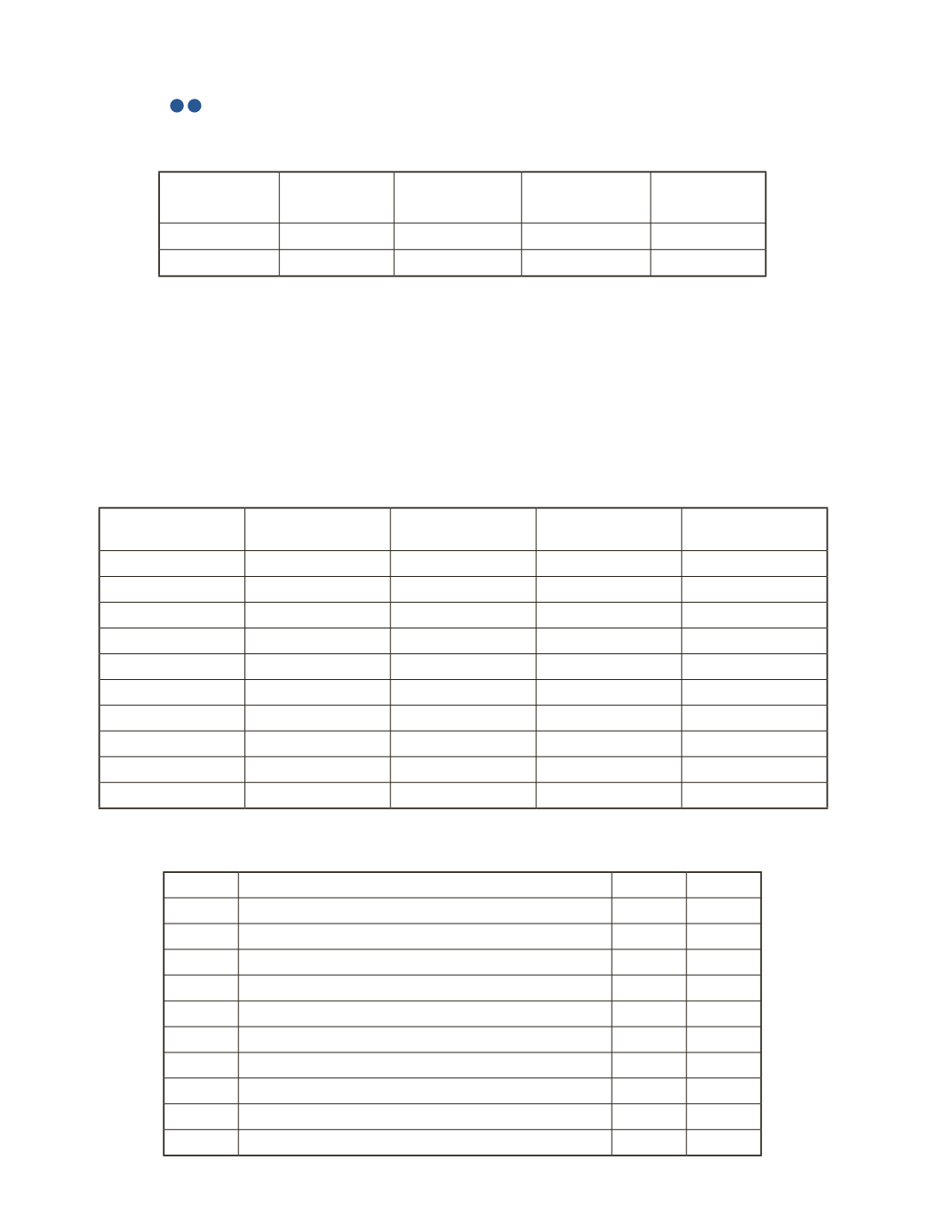

a) Prepare the depreciation table.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation

Net Book Value

Building

2013

2014

2015

2016

Truck

2013

2014

2015

2016

b) Prepare the journal entry to record the disposal of the assets.

Date

Account Title and Explanation

Debit

Credit