Chapter 3

Long-Term Assets

98

b) On June 30, 2016, Tiesto Company sold the equipment for $3,000. Prepare a journal entry

to record the depreciation on the disposal and the sale. You will need to recalculate the

depreciation expense for 2016 from part a) to account for the sale part-way during the

year.

Date

Account Title and Explanation

Debit

Credit

Analysis

The owner of Tiesto Company believes that the loss on sale of equipment indicates that the

company has made a mistake while calculating depreciation. Do you agree or disagree?

Explain.

AP-8A (

3

4

)

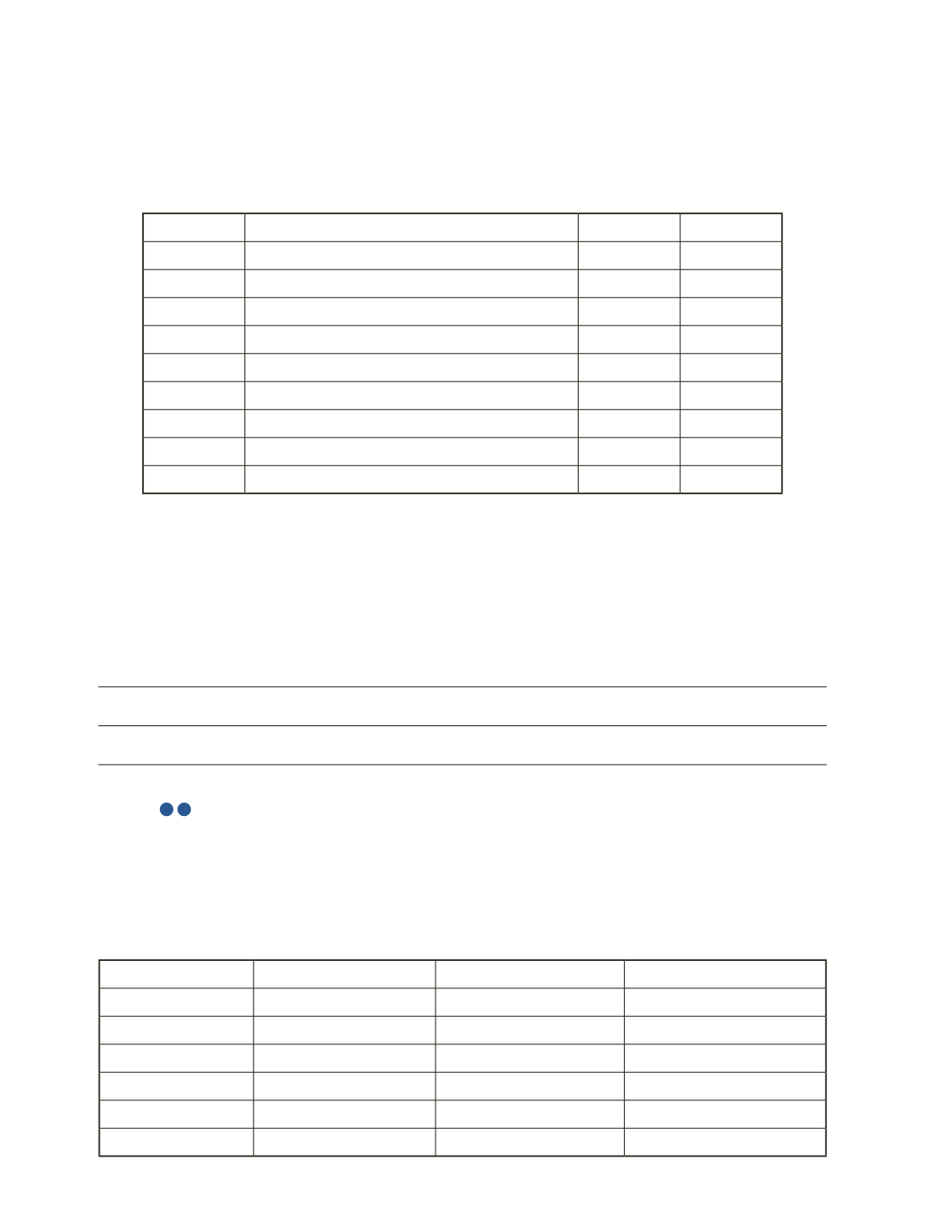

At the beginning of 2015, an entrepreneur purchased a group of assets as a “bulk purchase”

at an auction sale. The entrepreneur paid $250,000 “as is” for two automobiles, a widget

machine, a forklift truck and a trailer. The items were valued by a professional appraiser as

follows.

Item

Estimated Value

Percentage

Estimated Remaining Life

Auto 1

$10,000

3.22%

3 Years

Auto 2

15,000

4.84%

5 Years

Widget Machine

258,000

83.23%

15 Years

Forklift

15,000

4.84%

5 Years

Trailer

12,000

3.87%

10 Years

Total

310,000

100%