Chapter 3

Long-Term Assets

96

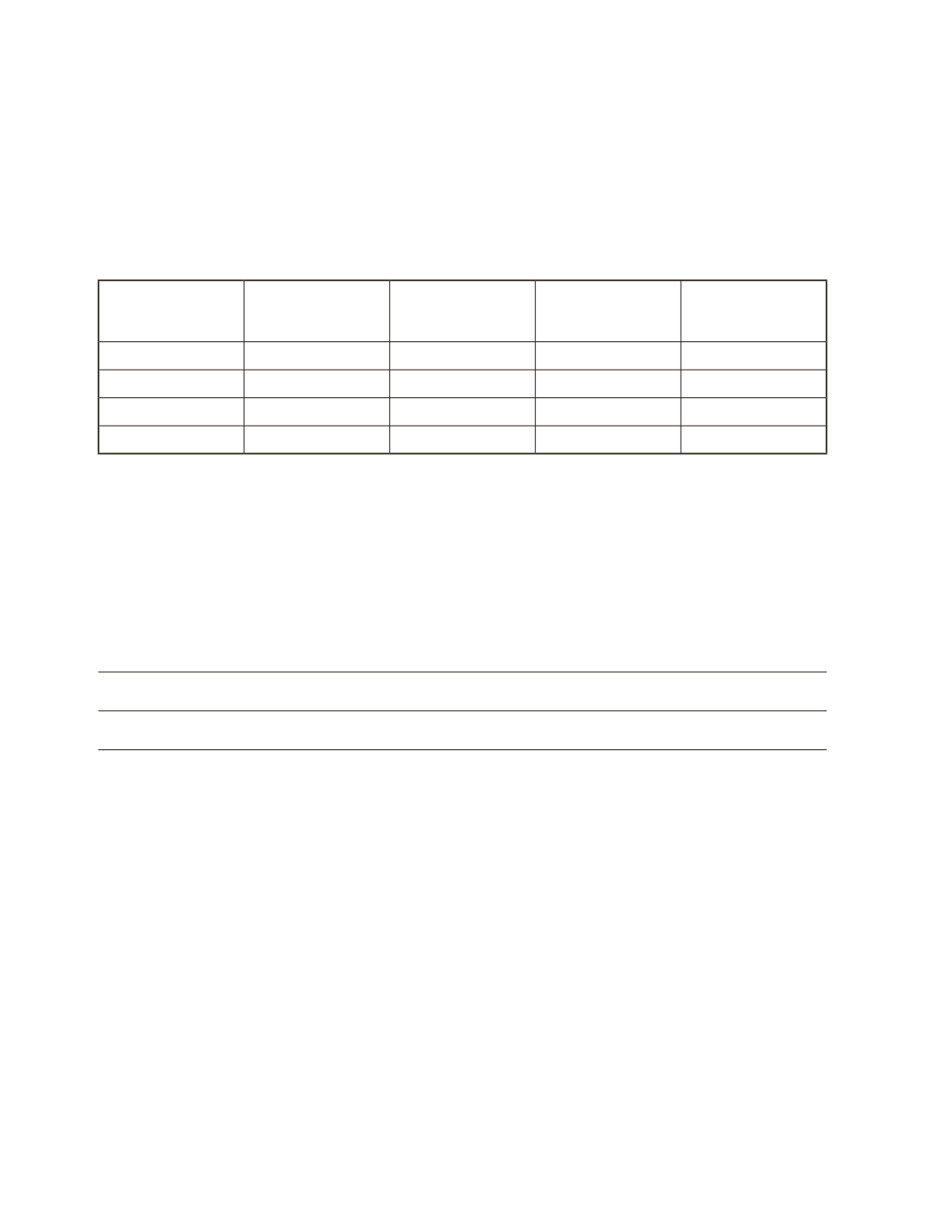

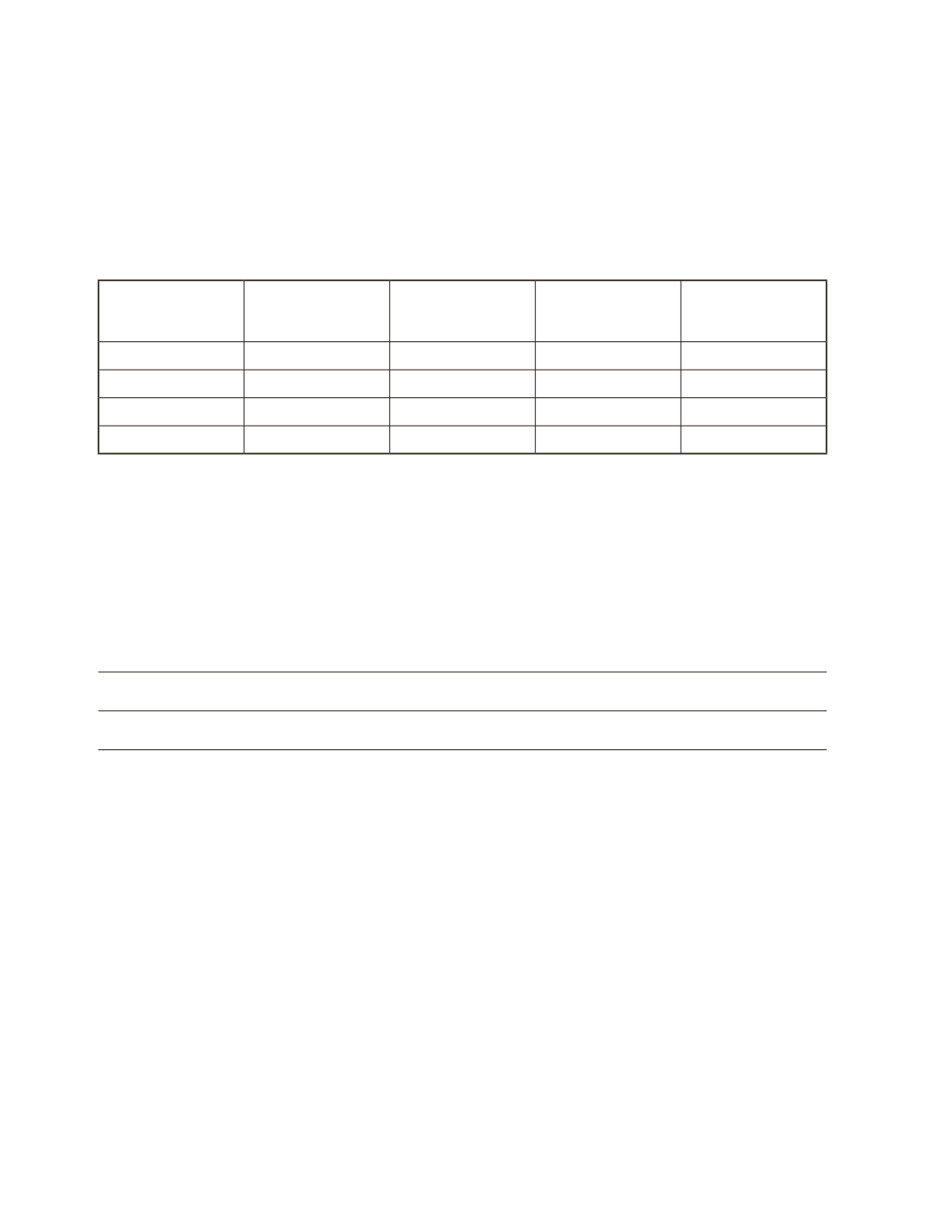

d) Using the same purchase information and residual value at the beginning of the question,

assume that the company uses the units-of-production method. The asset can produce

one million units. Record of production: year 2013—300,000 units; year 2014—250,000;

year 2015—300,000 units; year 2016—100,000 units. Prepare a table showing the year,

the cost of the asset, the amount of depreciation expense each year, accumulated

depreciation to date and net book value. (Hint: Depreciate the cost of the asset minus its

residual value.)

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation

To Date

Net Book Value

Analysis

Since the double-declining balance method for depreciation allows charging higher

depreciation in the first few years, some business owners may want to use this method for all

assets. Is it appropriate to use this method for all assets?

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________