Chapter 3

Long-Term Assets

106

AP-13A (

3

)

On July 1, 2015, Earth Corporation purchased factory equipment for $150,000. The equipment

is to be depreciated over eight years using the double-declining-balance method. Earth

Corporation’s year-end is on September 30. Calculate the depreciation expense to be

recorded for the year 2016. Earth Corporation depreciates its assets based on the number of

months it owned the asset during the year.

AP-14A (

6

)

On February 1, 2016, Eastern Company acquired the assets ($800,000) and liabilities ($500,000)

of Newton Corporation. The agreed purchase price is $500,000 in cash. Prepare a journal entry to

record the purchase.

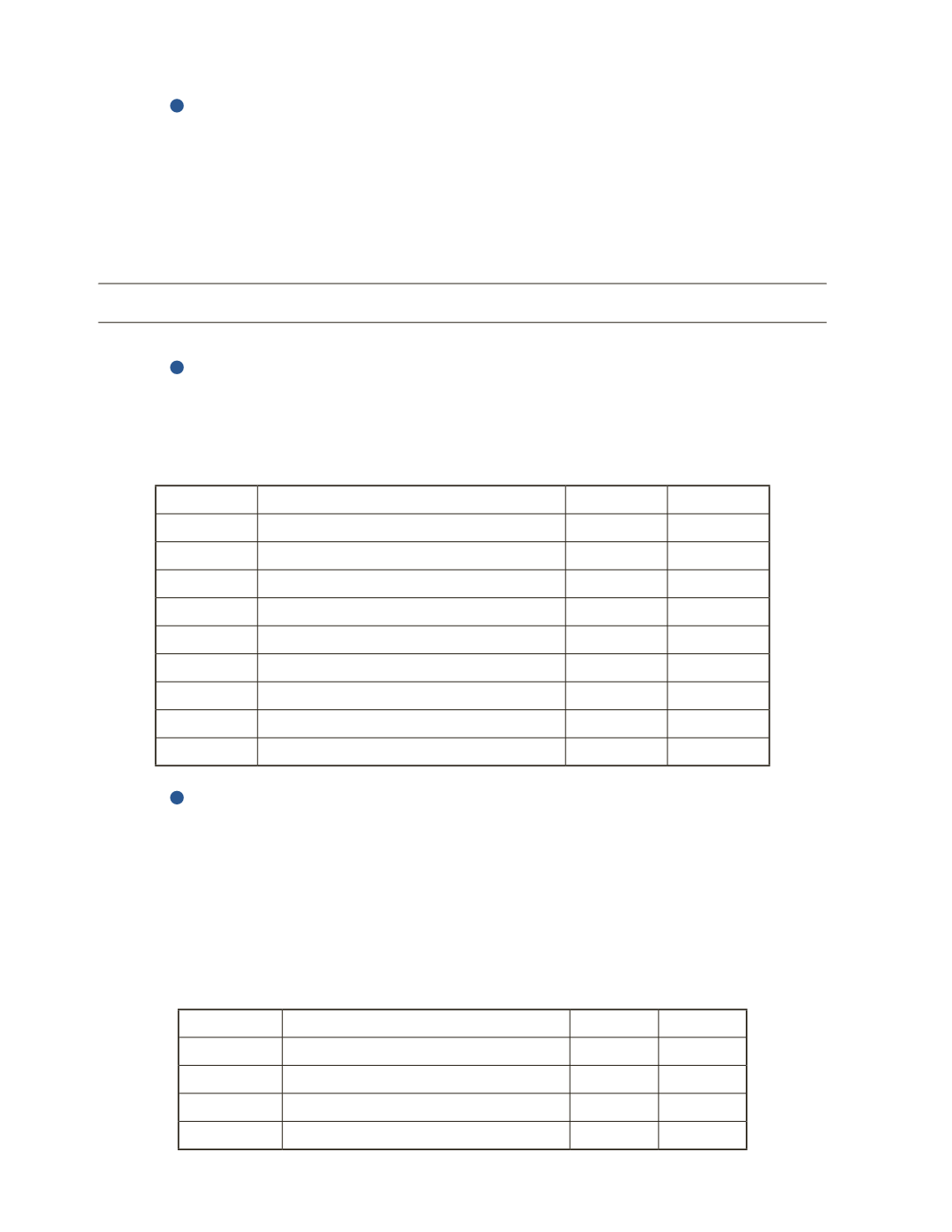

Date

Account Title and Explanation

Debit

Credit

AP-15A (

6

)

On January 1, 2016, Lava Company purchased a $90,000 patent for a new consumer product.

However, the patent’s useful life is estimated to be only 10 years due to the competitive

nature of the product.

Required

a) Prepare a journal entry to record the purchase.

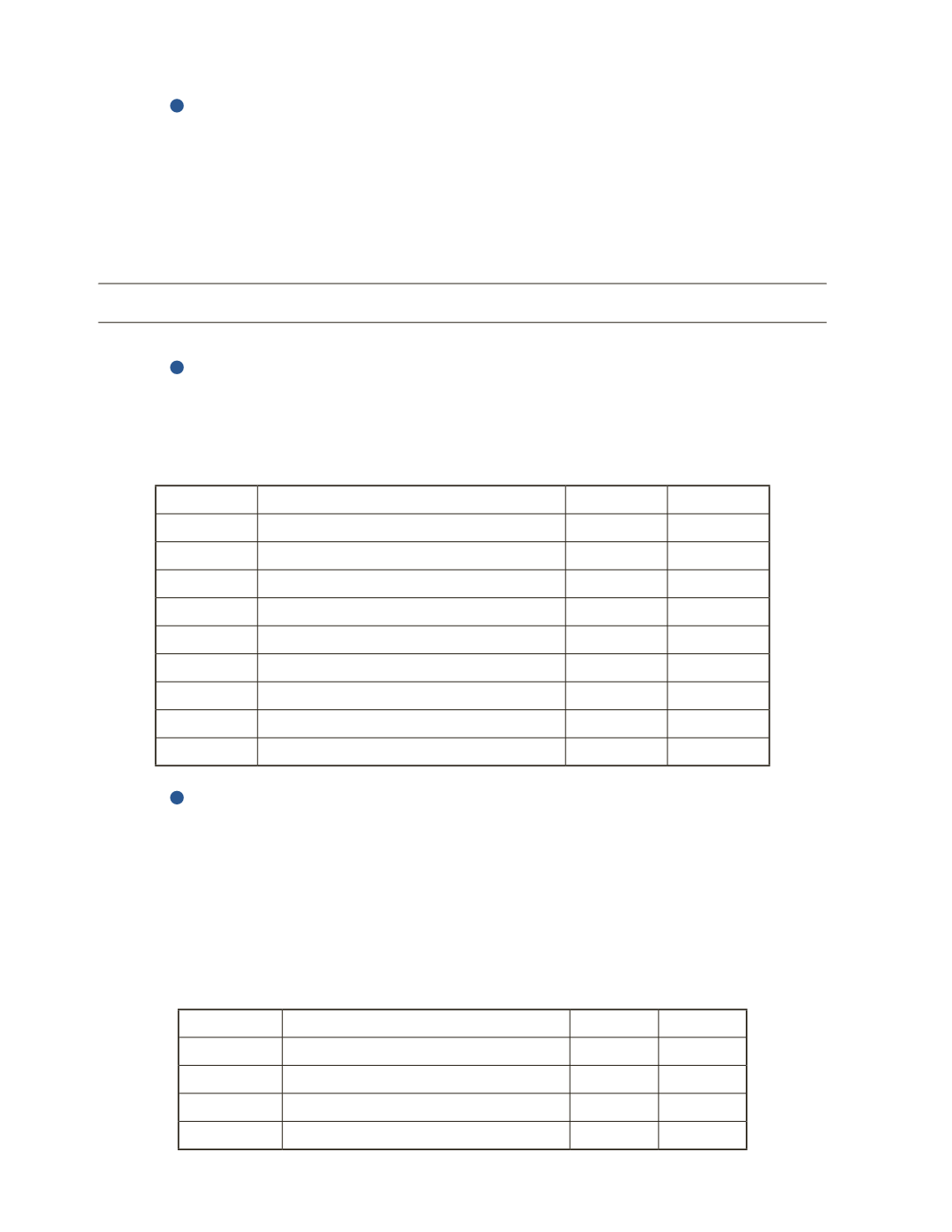

Date

Account Title and Explanation

Debit

Credit