Chapter 3

Long-Term Assets

99

After the auction, the entrepreneur had the machine moved to the factory. Moving the

widget machine cost $2,000. After the machine was placed in the factory, an electrician was

contracted to install additional power lines and hook up the machine at a cost of $1,000. A

plumber was also needed to connect the machine to the water mains. This cost $500. A gas

fitter was required to connect the widget machine to the gas line at a cost of $200.

Before placing Auto 1 and 2 into use, the entrepreneur took both autos to the local repair

shop. The mechanic said that Auto 1 needed a new engine that would cost $2,000 and

Auto 2 needed a major tune-up at a cost of $500 (the tune-up is required to get the car

going). The entrepreneur paid cash for the repairs. Early in 2016, the entrepreneur advertised

and sold Auto 1 for $8,000 and replaced the front brakes on Auto 2 for $300.

The entrepreneur’s company uses a half-year method for depreciation (i.e. ½ year’s

depreciation in the year of purchase, and ½ year’s depreciation in the year of sale). The

company uses straight-line depreciation, with an estimated residual value of 10% of cost for

all assets.

Required

Write the journal entries to record the following.

a) Using straight-line depreciationmethod, record all journal entries related to the above

transactions. When allocating a bulk purchase, round up to the nearest dollar. If necessary,

adjust the largest number up or down to avoid journal entry imbalance due to rounding.

Note: The exact journal entry dates can be omitted for the purpose of this exercise. Simply

indicate if each transaction belongs to 2015 or 2016.

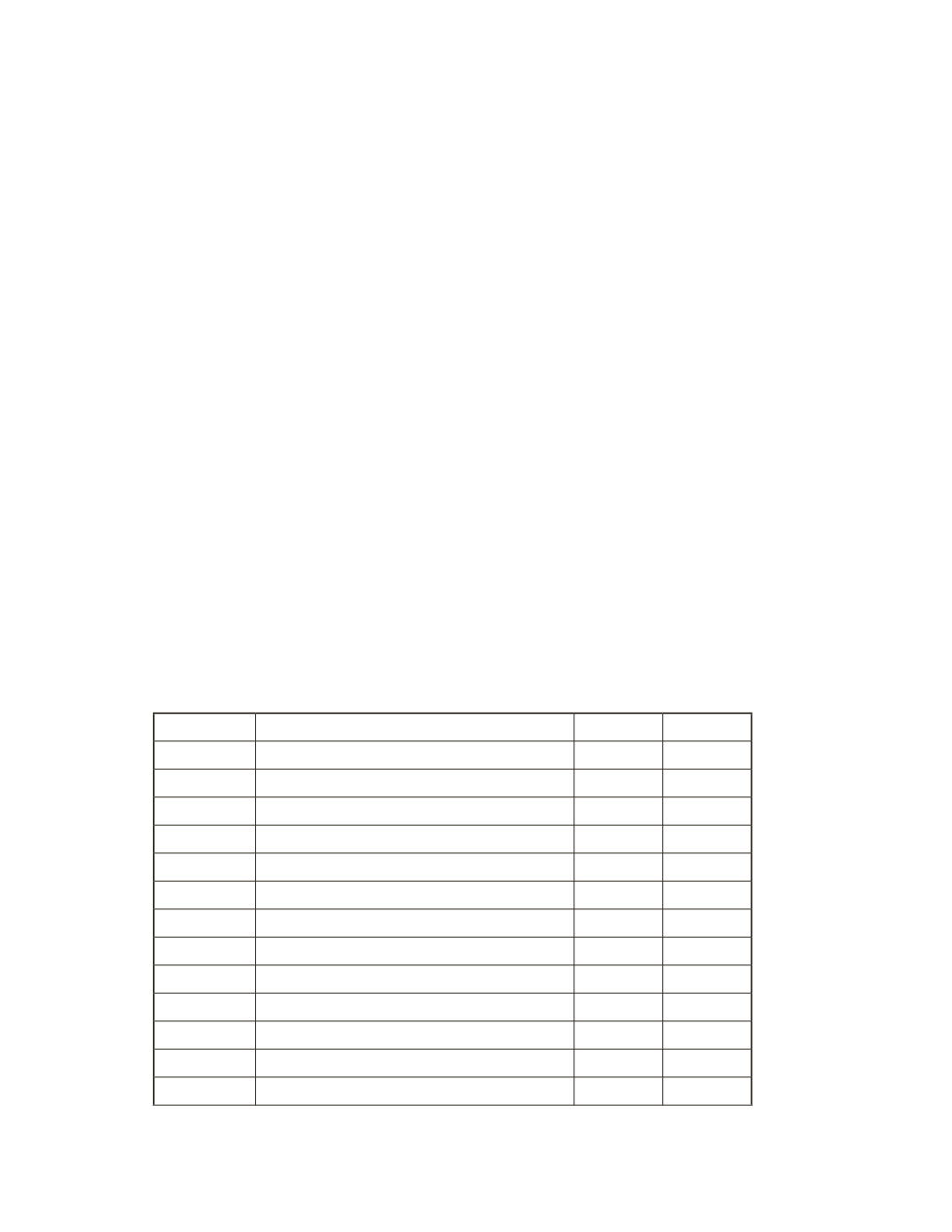

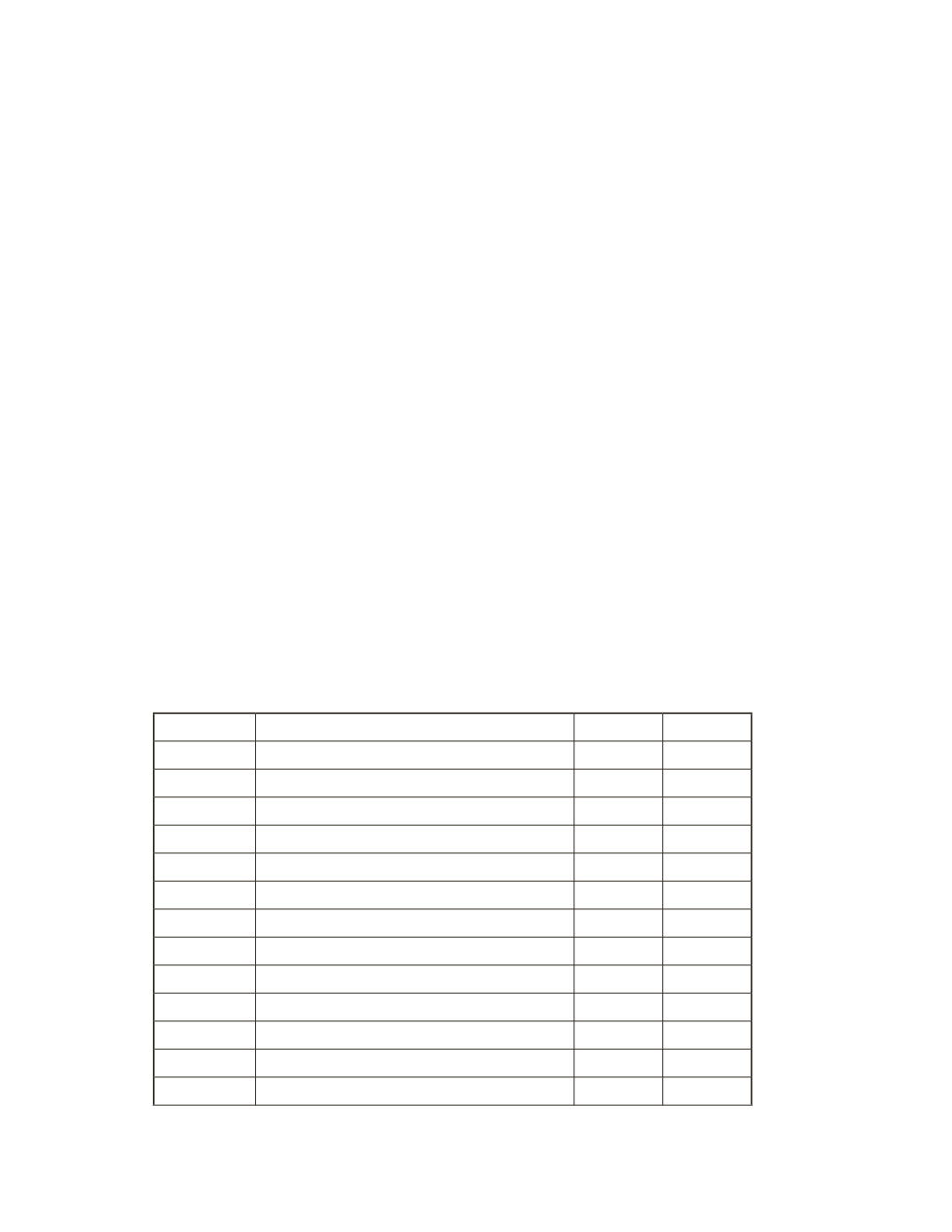

Date

Account Title and Explanation

Debit

Credit