Chapter 3

Long-Term Assets

92

Application Questions Group A

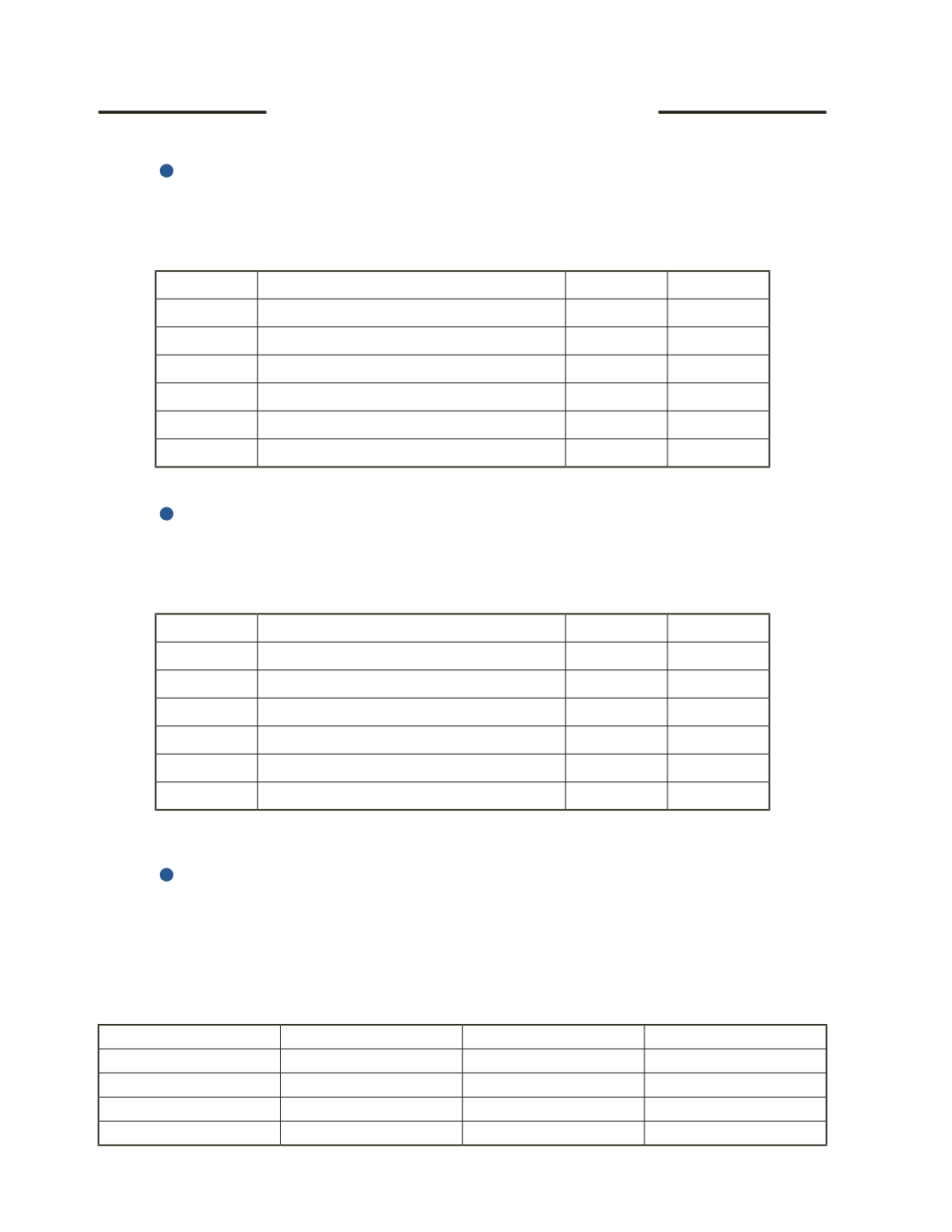

AP-1A (

2

)

Prepare the journal entry for the purchase of machinery worth $200,000 (on credit) on

March 6, 2016.

Date

Account Title and Explanation

Debit

Credit

AP-2A (

3

)

Prepare the journal entry to record depreciation of $2,000 for a long-term asset on

February 29, 2016.

Date

Account Title and Explanation

Debit

Credit

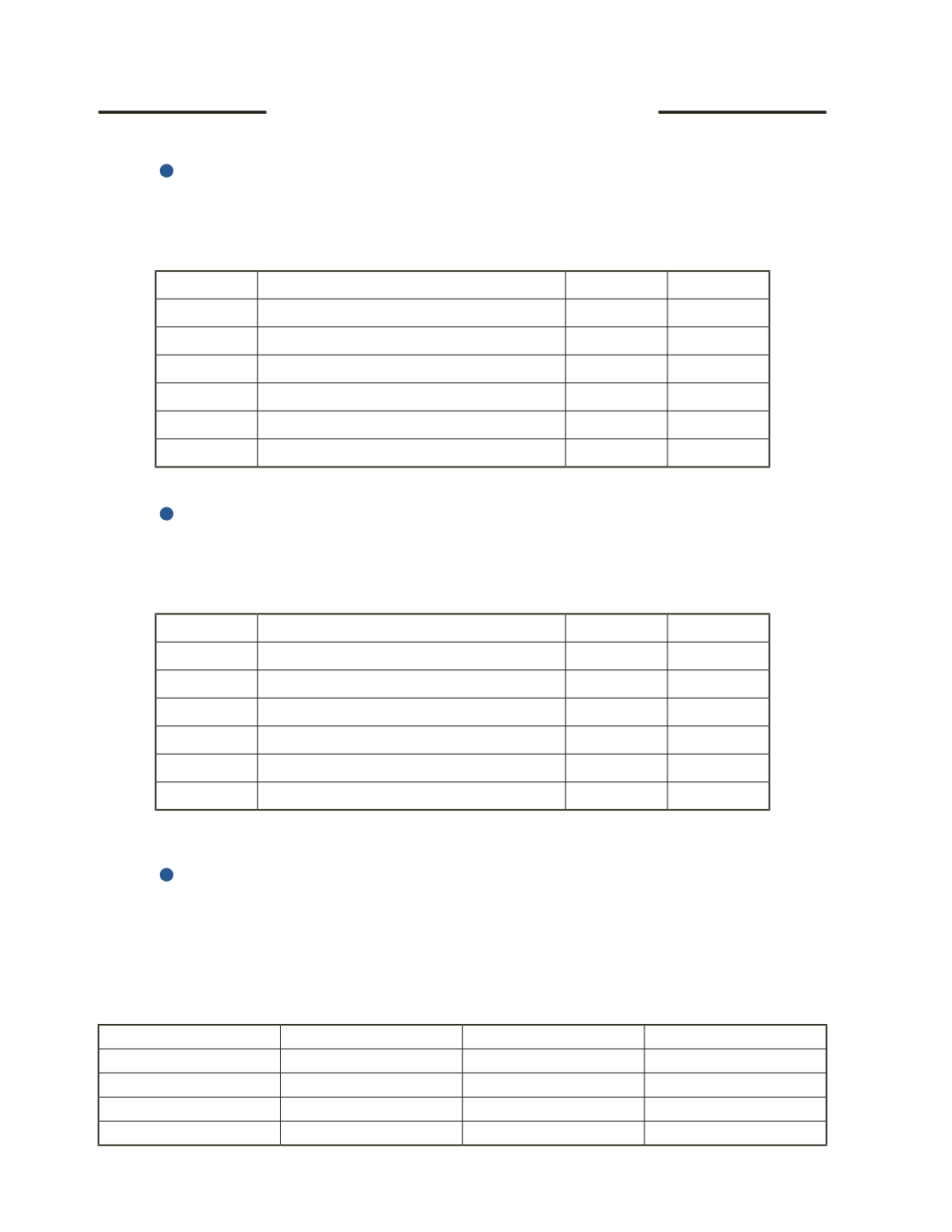

AP-3A (

2

)

Land, building and equipment were purchased for a total amount of $800,000 on May 25,

2016. The assessed values of these purchases were, Land—$600,000; Building—$300,000;

Equipment—$100,000. Calculate the cost of each asset by filling in the following table, and

write the journal entry that records the purchase.

Item

Assessment

Percent

Applied to Cost