Chapter 3

Long-Term Assets

95

AP-5A (

3

4

)

Equipment was purchased on December 31, 2012 for $50,000. The asset is expected to last for

four years, at which time the estimated residual value will be $10,000.

Required

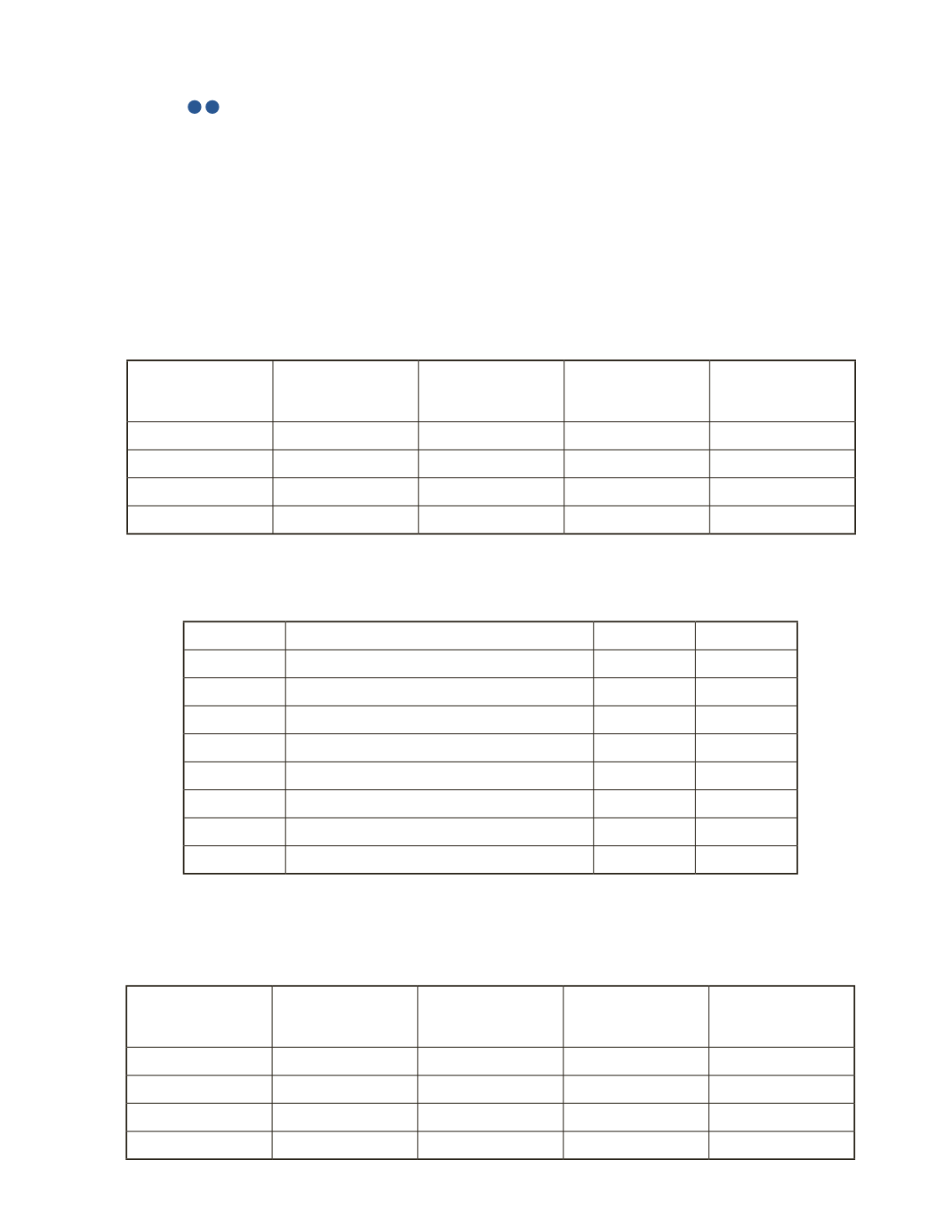

a) Prepare a table showing the year, the cost of the asset, the amount of depreciation

expense each year, accumulated depreciation to date and net book value. The company

uses straight-line depreciation.

Year

Cost of Long-Term

Asset

Depreciation

Expense

Accumulated

Depreciation

To Date

Net Book Value

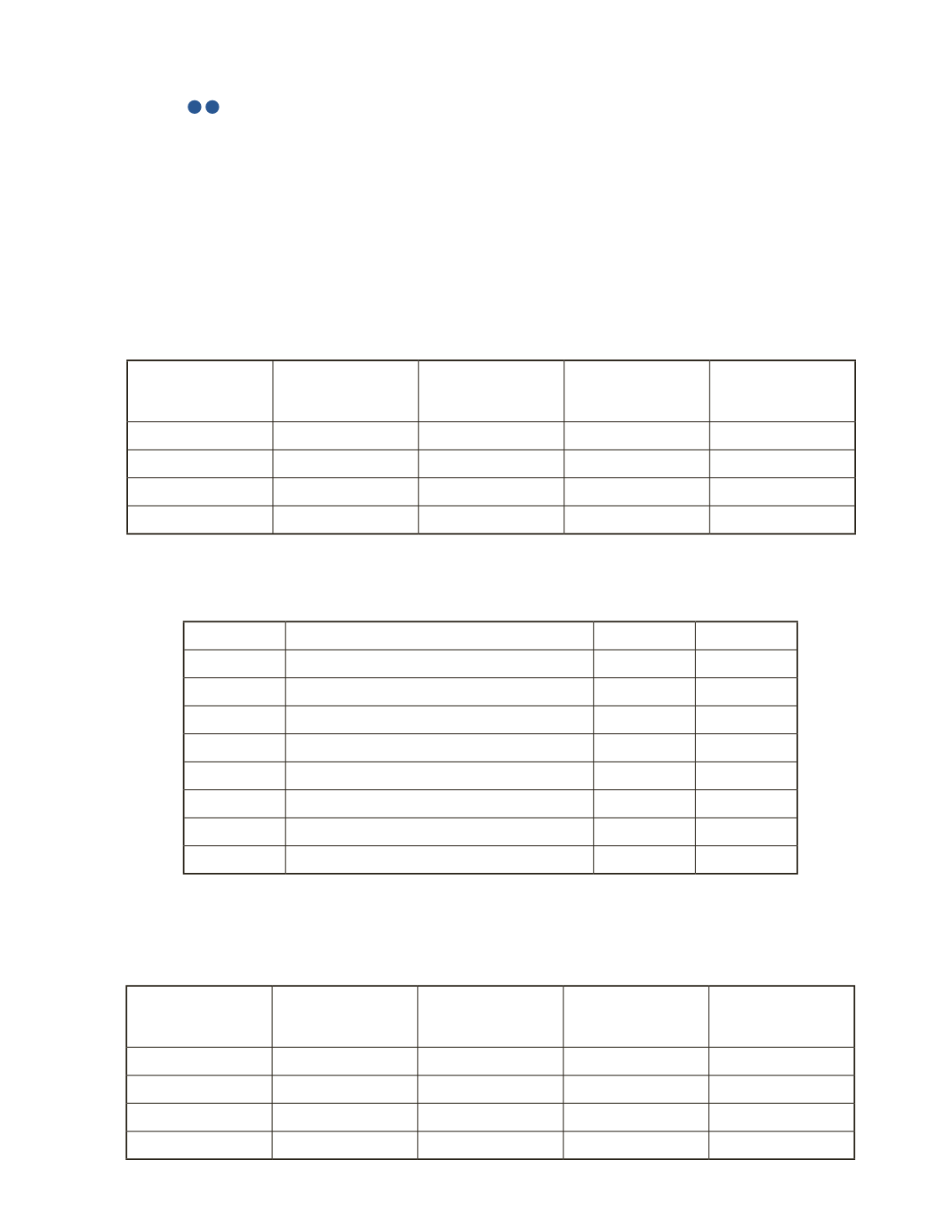

b) The asset was sold for $12,000 cash on the first day of 2017. Prepare the journal entry to

record the sale.

Date

Account Title and Explanation

Debit

Credit

c) Using the same purchase information at the beginning of the question, prepare the table

assuming that the company used double-declining-balance depreciation and the asset

had no residual value.

Year

Net Book Value at

the Beginning of

the Year

Depreciation

Expense

Accumulated

Depreciation

To Date

Net Book Value at

the End of the Year