69

Chapter 2

Accounting for Receivables

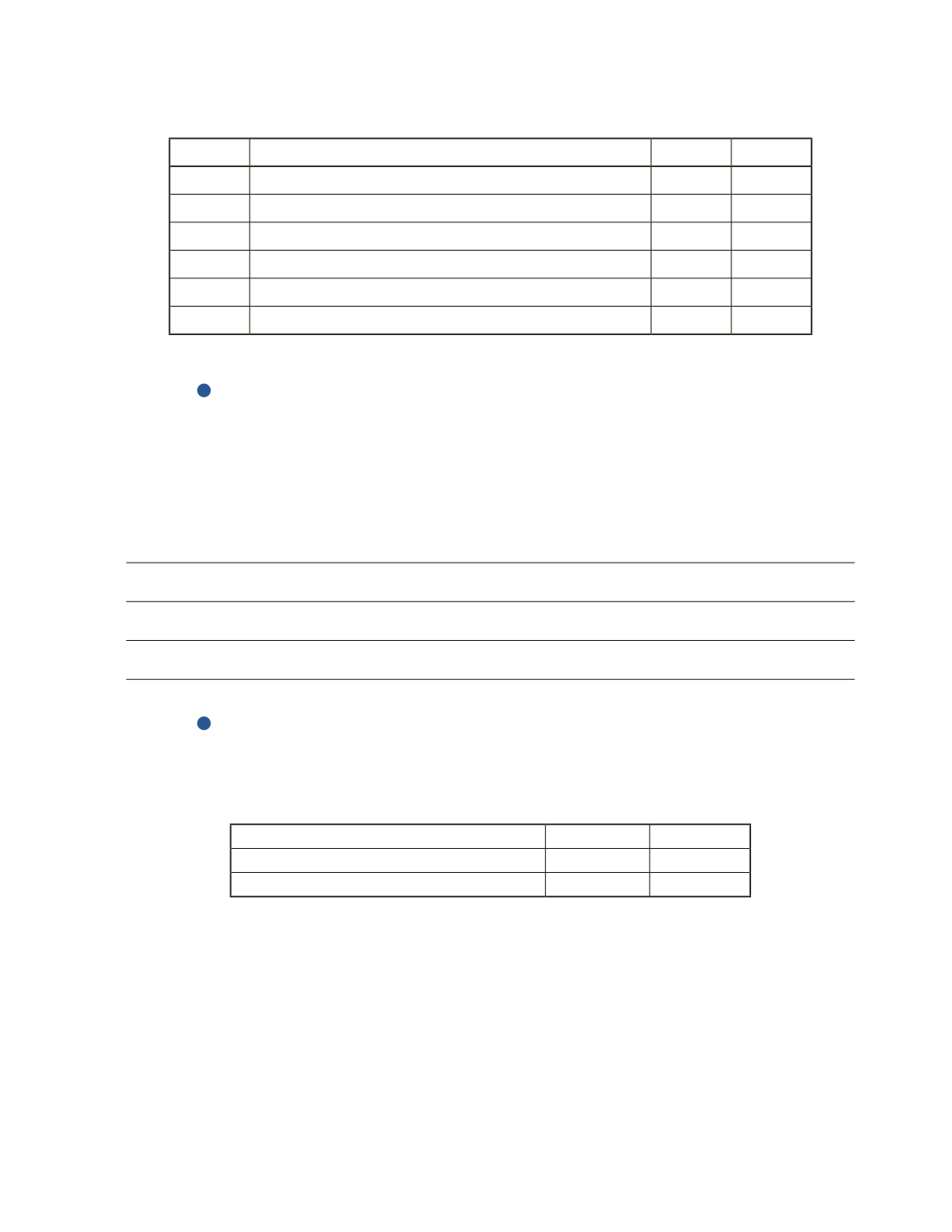

b) Prepare the journal entry to record bad debt expense for the year.

Date

Account Title and Explanation

Debit

Credit

AP-14B (

2

)

On January 1, 2016, Jay Company’s allowance for doubtful accounts had a credit balance of

$30,000. During 2016, Jay charged $64,000 to bad debt expense, and wrote off $46,000 of

uncollectible accounts receivable. What is the balance of allowance for doubtful accounts on

December 31, 2016?

AP-15B (

5

)

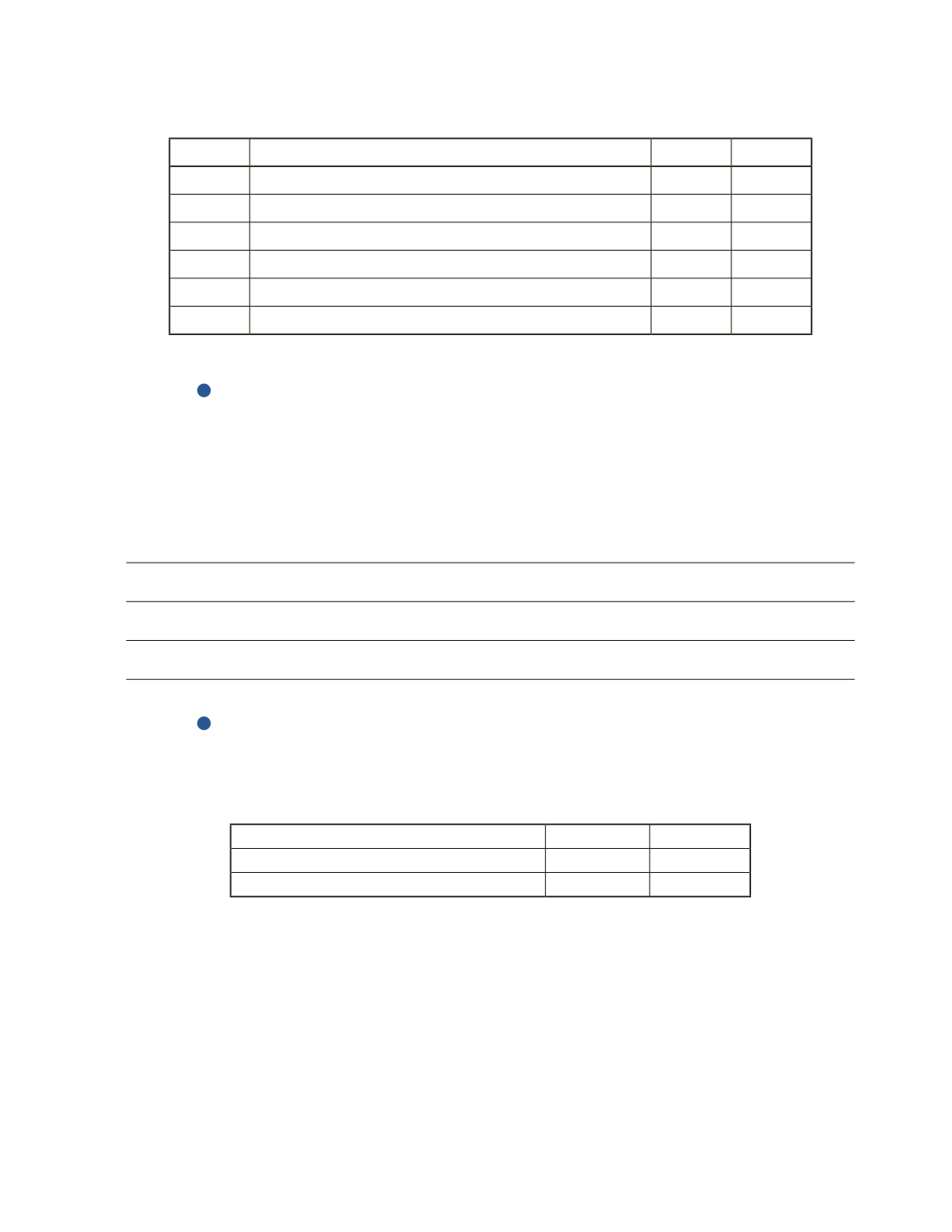

A company’s relevant accounts receivable information for years 2015 and 2016 is provided

below.

2016

2015

Average Net Accounts Receivable

$1,486,739

$1,769,032

Net Credit Sales

23,075,635

22,107,539

Required

a) Calculate the accounts receivable turnover ratio for 2015 and 2016.

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________