78

Chapter 2

Accounting for Receivables

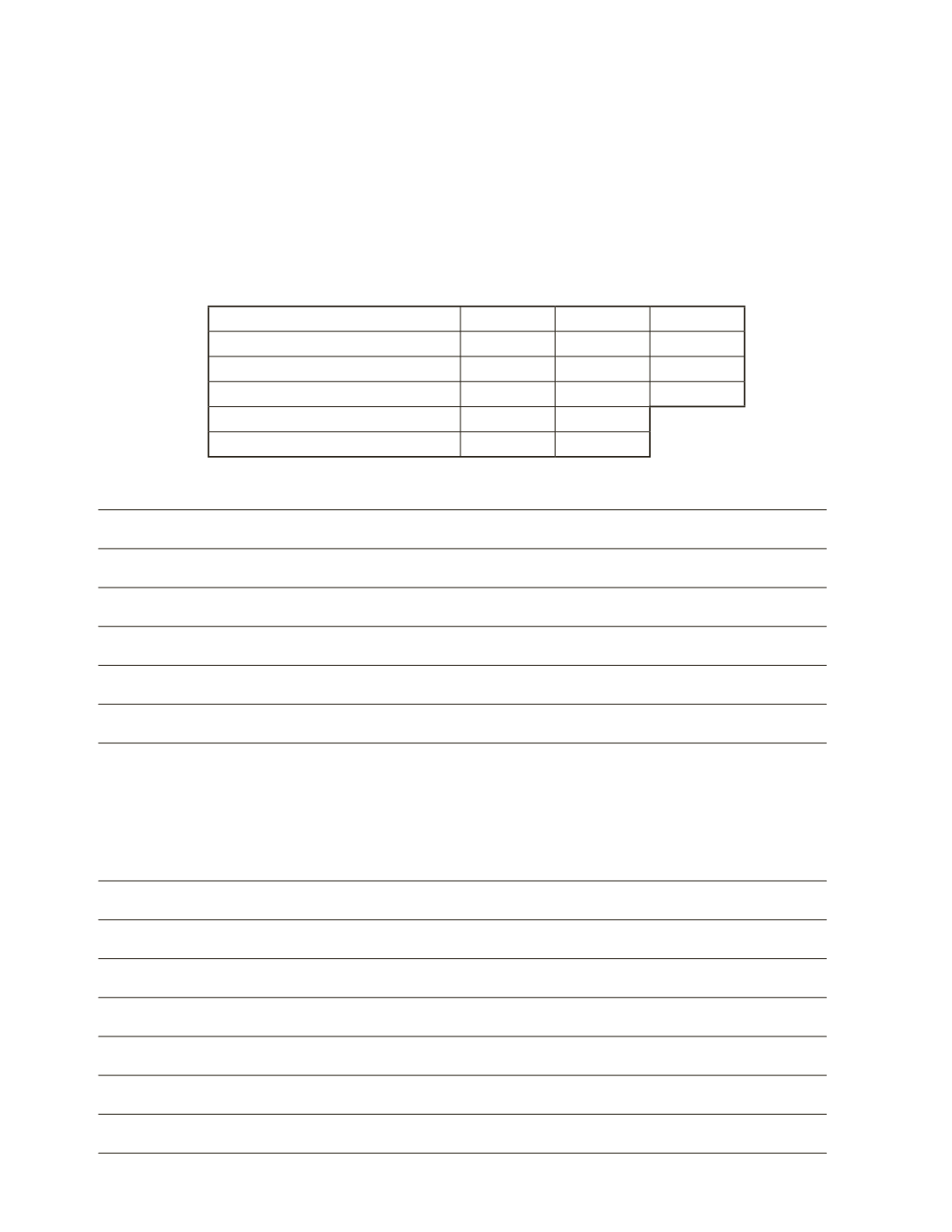

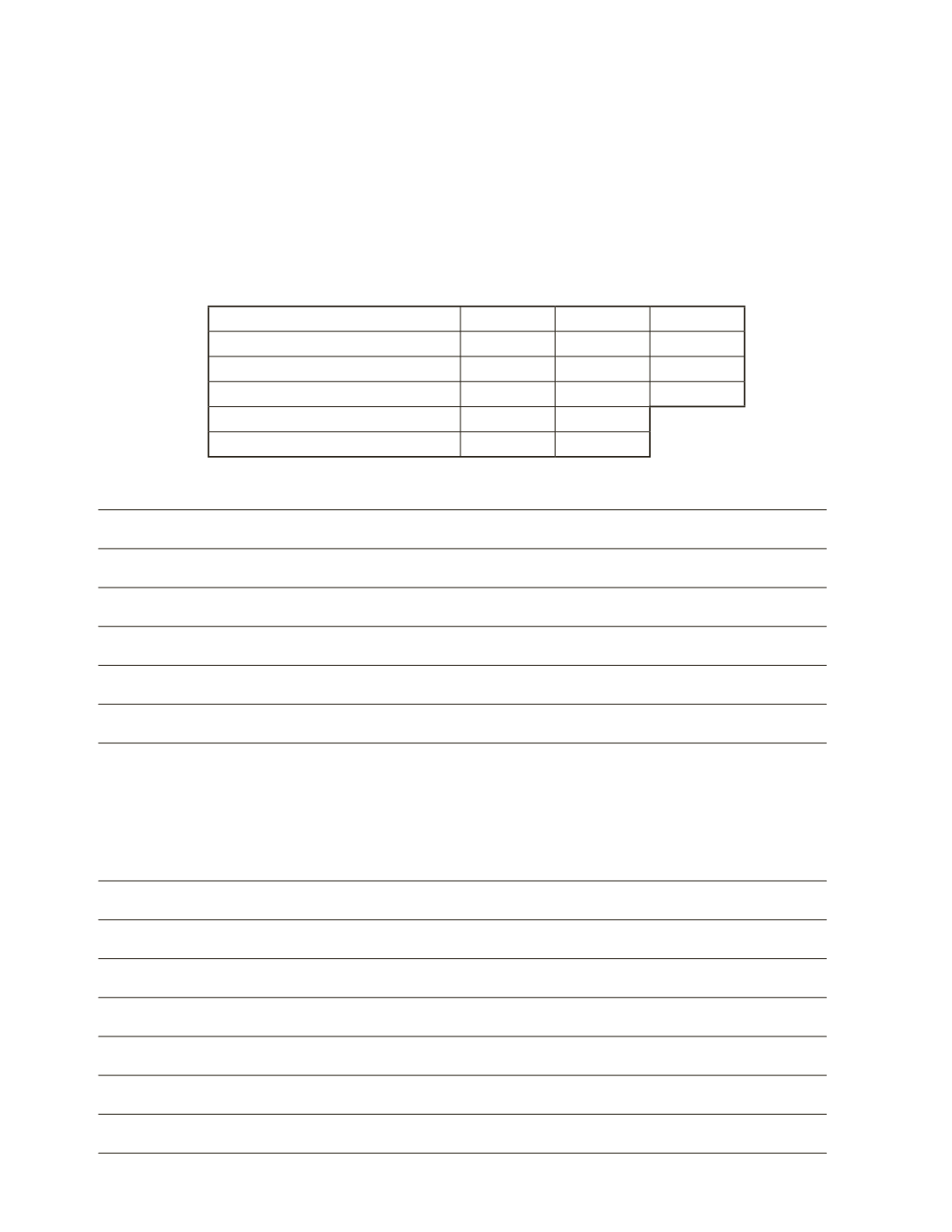

Required

a) To account for bad debt, Softbed estimates that 2% of its gross accounts receivable

balance will become uncollectible. Use the information provided in the table below to

calculate allowance for doubtful accounts balances for 2014 to 2016, and the days sales

outstanding and accounts receivable turnover for the years 2015 and 2016. Compare the

results of ratio calculations and comment on whether the company’s performance has

improved or weakened.

2016

2015

2014

Net Credit Sales

$4,500,000 $4,200,000 $4,000,000

Gross Accounts Receivable

490,000

400,000

770,000

Allowance for Doubtful Accounts

Days Sales Outstanding

Accounts Receivable Turnover

b) What are other methods that Softbed can use to estimate its bad debt? Which method do

you think would be most suitable for Softbed?