68

Chapter 2

Accounting for Receivables

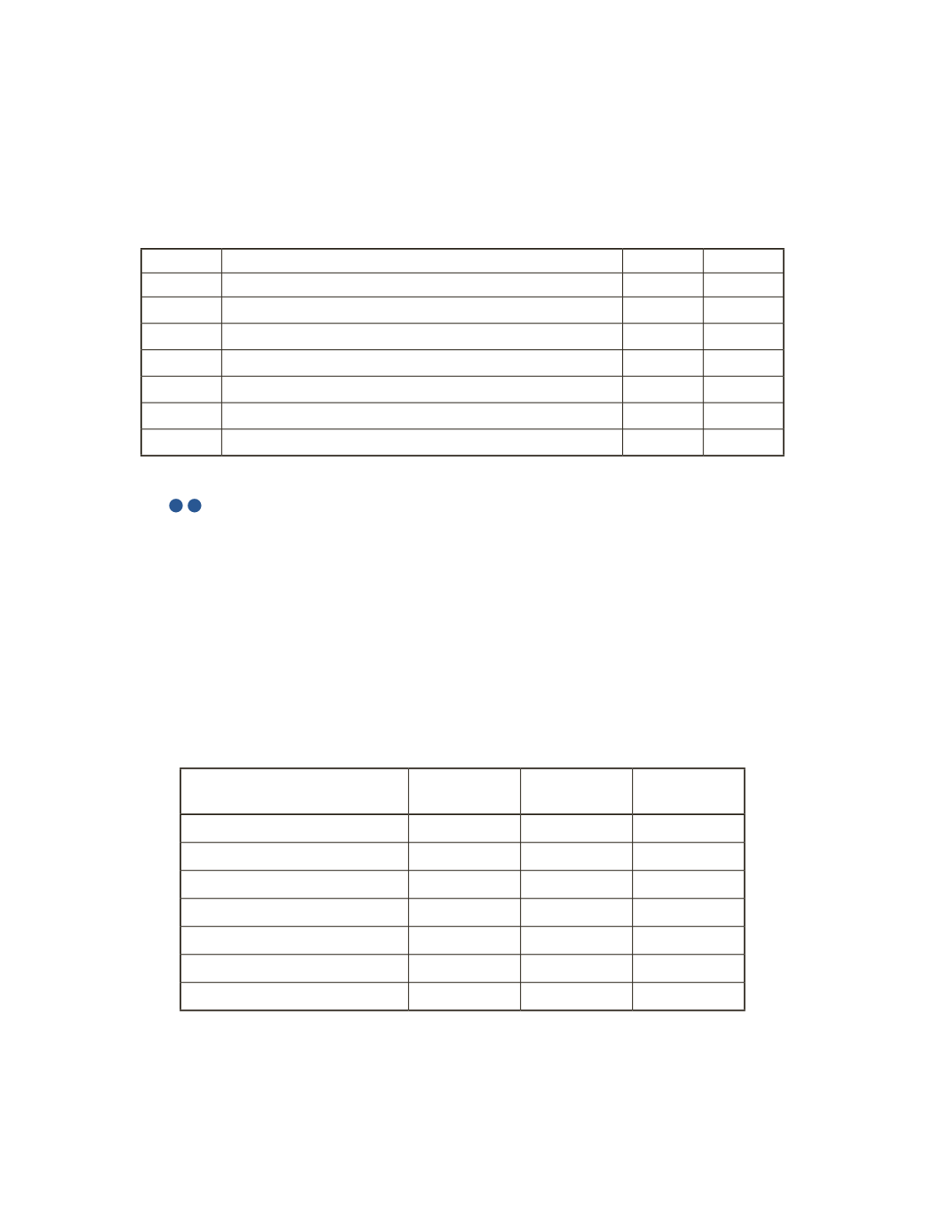

b) Prepare the journal entry to record bad debt expense for the year.

Date

Account Title and Explanation

Debit

Credit

AP-13B (

2

3

)

Williams Canada operates in an industry that has a high rate of bad debts. Before the year-

end adjustments on April 30, Williams Canada’s accounts receivable has a debit balance of

$485,000 and the allowance for doubtful accounts has a credit balance of $15,700. The year‐

end balance reported on the balance sheet for the allowance for doubtful accounts is based

on the aging schedule shown below.

Required

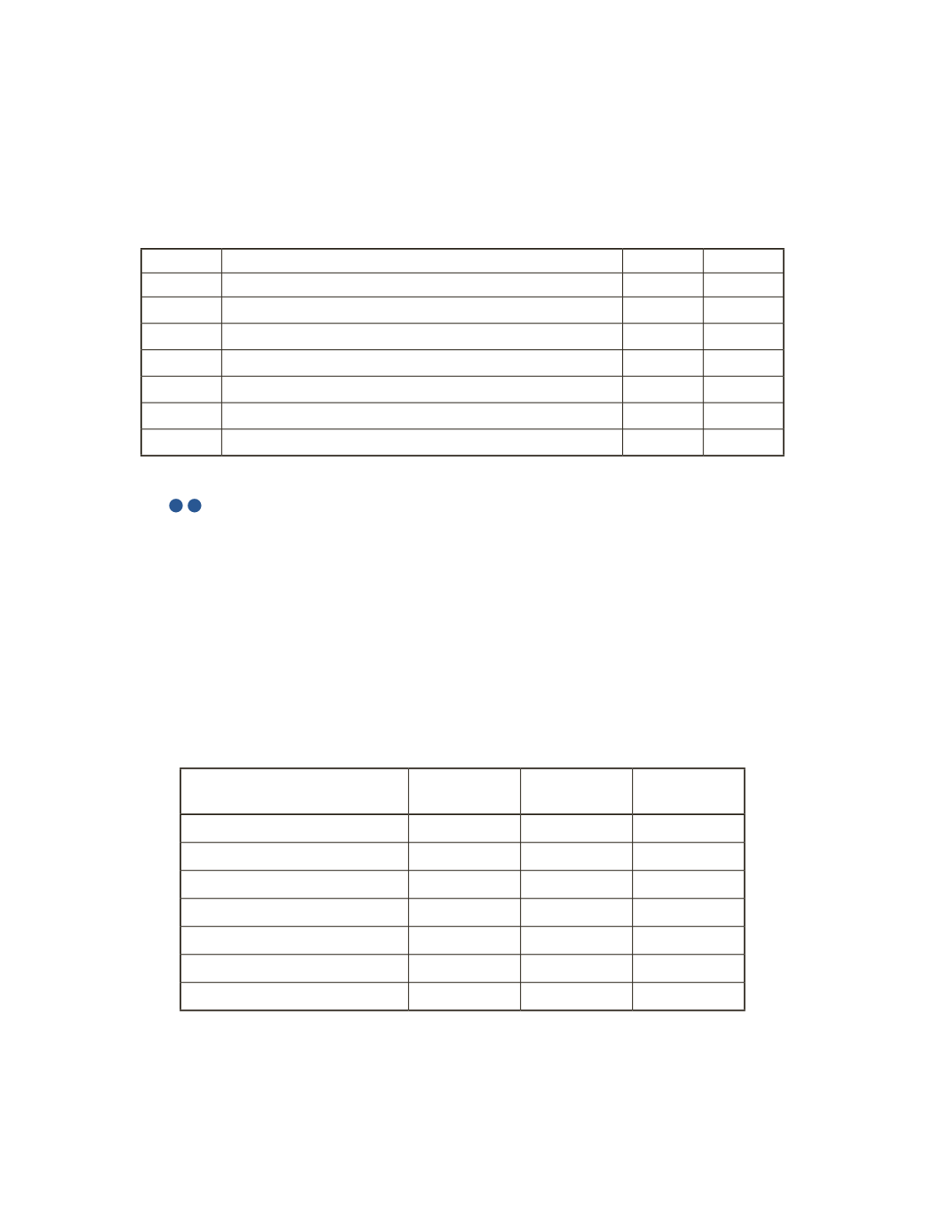

a) Fill in the table to calculate the balance for the allowance for doubtful accounts.

Aging Category

Bad Debt % Balance Estimated Bad

Debt

Less than 16 days

2%

$270,000

16–30 days

4%

$84,000

31–45 days

7%

$71,000

46–60 days

12%

$30,000

61–75 days

21%

$17,000

More than 75 days

44%

$13,000

Total

$485,000

______________________________________________________________________________

______________________________________________________________________________