67

Chapter 2

Accounting for Receivables

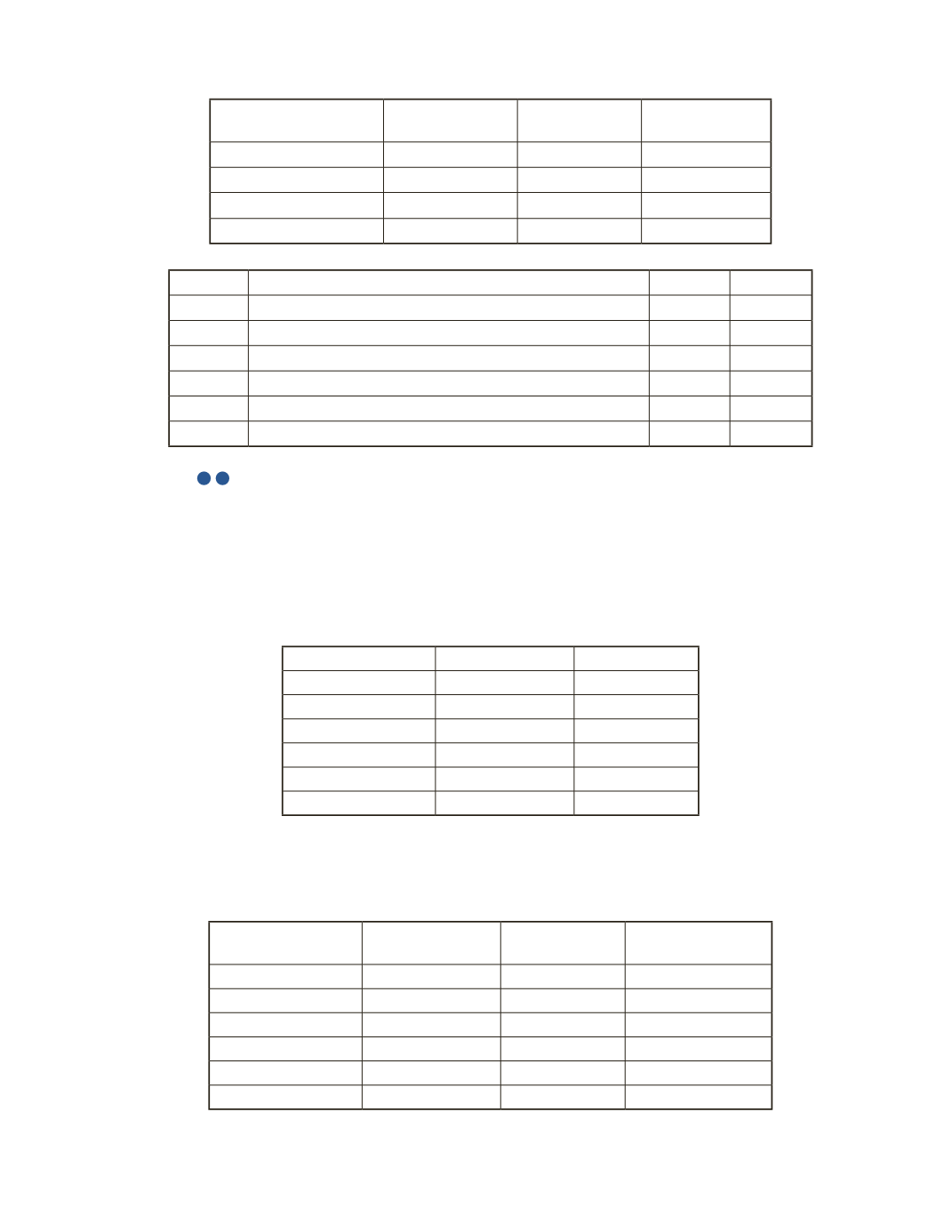

Aging Category

Bad Debt % Balance

Estimated Bad

Debt

30 days

2%

$25,000

31–60 days

3%

10,000

More than 60 days

4%

2,000

Total

$37,000

Date

Account Title and Explanation

Debit

Credit

AP-12B (

2

3

)

Nortelle Canada operates in an industry that has a high rate of bad debt. Before the year-end

adjustments, Nortelle Canada’s accounts receivable has a debit balance of $536,000 and the

allowance for doubtful accounts had a credit balance of $20,000. The December 31, 2016 year-

end balance reported on the balance sheet for the allowance for doubtful accounts is based

on the aging schedule shown below.

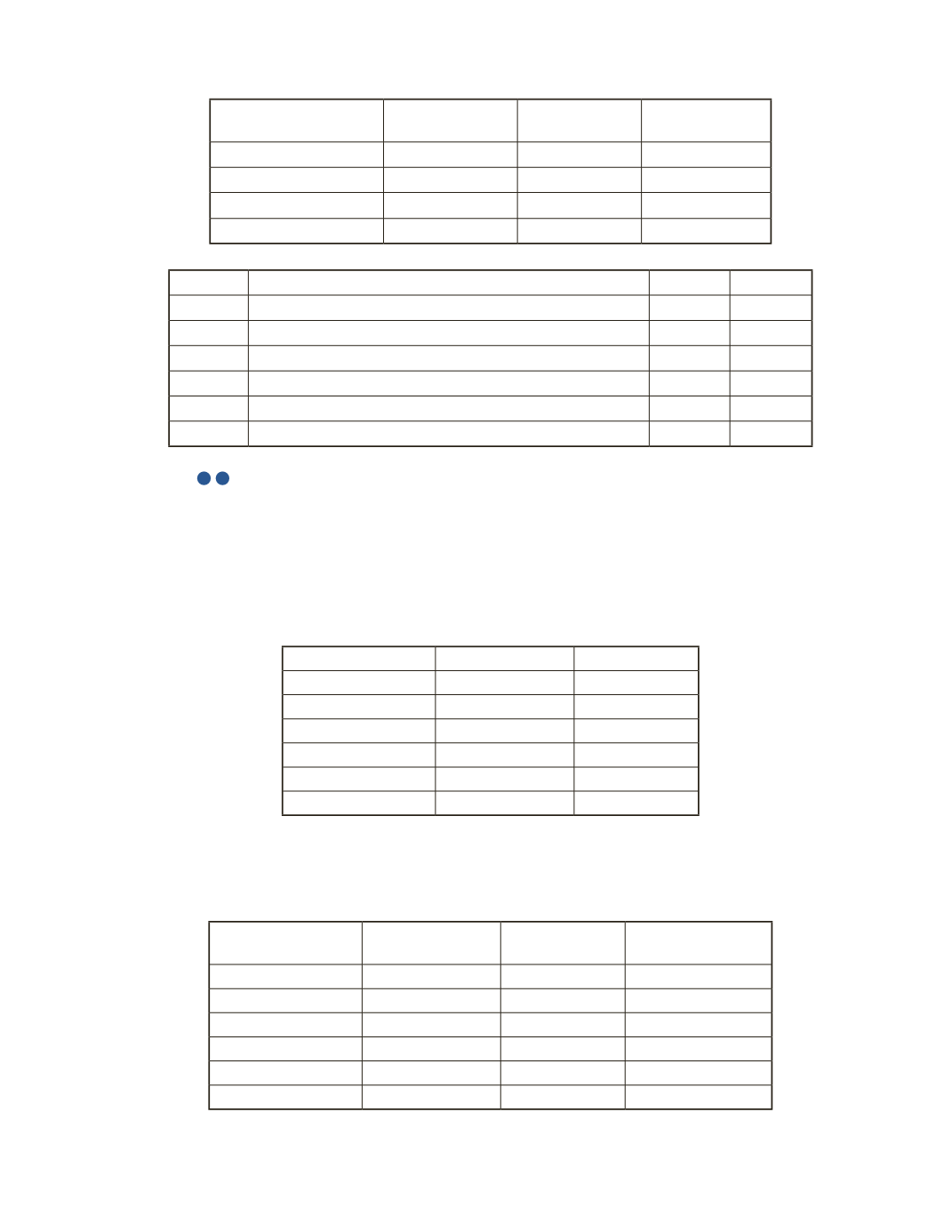

Aging Category

Bad Debt %

Balance

Less than 16 days

2%

$300,000

16–30 days

3%

100,000

31–45 days

5%

75,000

46–60 days

10%

32,000

61–75 days

20%

18,000

More than 75 days

40%

11,000

Required

a) What is the balance for the allowance for doubtful accounts at year-end?

Aging Category

Bad Debt %

Balance

Estimated Amount

of Bad Debt

Less than 16 days

2%

$300,000

16–30 days

3%

100,000

31–45 days

5%

75,000

46–60 days

10%

32,000

61–75 days

20%

18,000

More than 75 days

40%

11,000