66

Chapter 2

Accounting for Receivables

AP-10B (

2

3

)

Dalton Company has the following unadjusted balances on December 31, 2016. All amounts

shown are in their normal balance.

Accounts receivable

$425,750

Allowance for doubtful accounts

25,000

Sales (10% of sales are cash sales)

950,000

Sales discounts

15,000

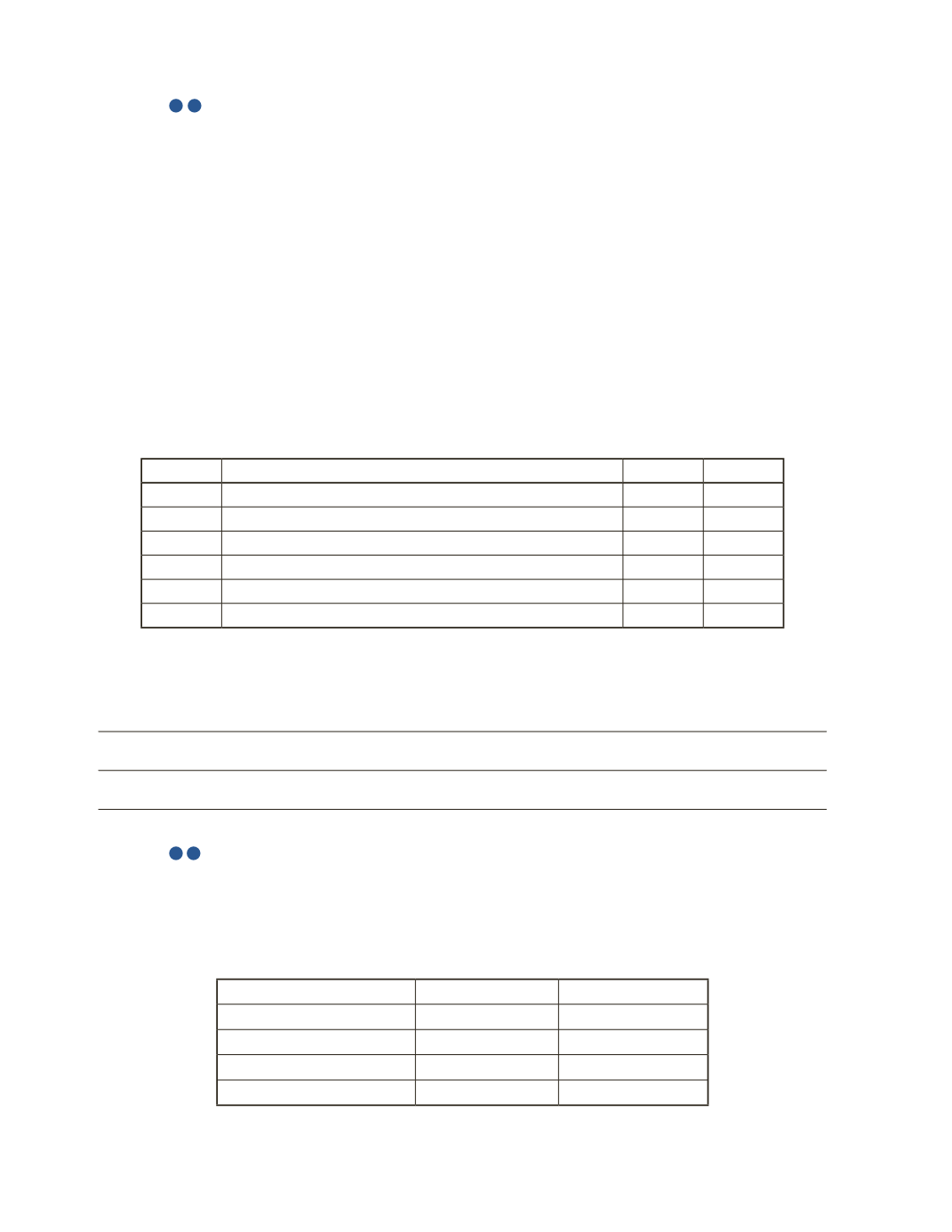

Required

a) Dalton estimates that 1.5% of net credit sales will be uncollectible. Prepare the journal

entry to record the uncollectible receivables on December 31, 2016.

Date

Account Title and Explanation

Debit

Credit

b) Prepare the balance sheet presentation of accounts receivable on December 31, 2016.

AP-11B (

2

3

)

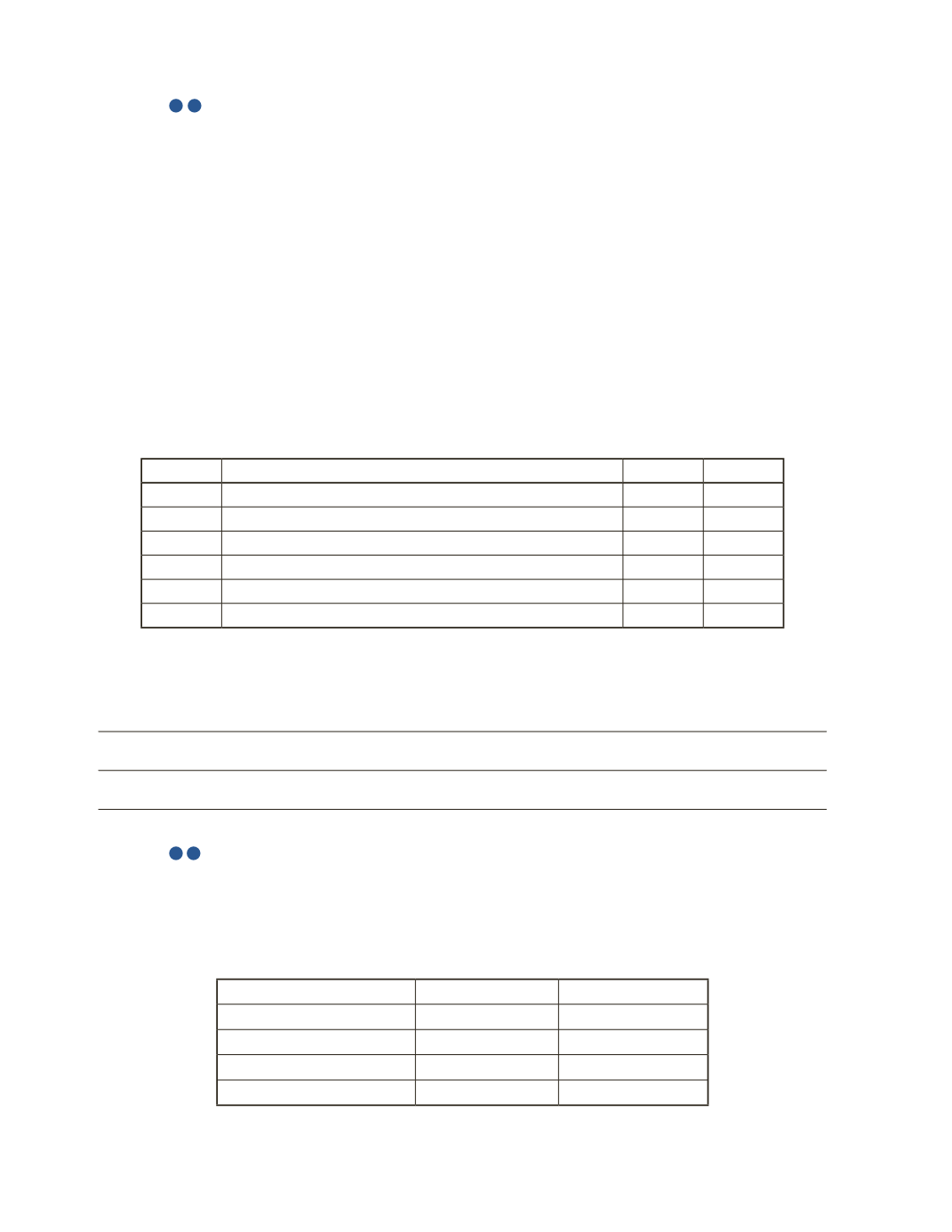

Fishy uses the balance sheet approach to estimate uncollectible receivables. Use the following

table to determine the amount of bad debt expense, and prepare the journal entry on

June 30, 2016 to record the bad debt expense. The allowance account has a zero balance.

Aging Category

Bad Debt %

Balance

30 days

2%

$25,000

31–60 days

3%

10,000

More than 60 days

4%

2,000

Total

$37,000