63

Chapter 2

Accounting for Receivables

b) Assume the company uses the balance sheet approach and estimates uncollectible

receivables to be 7.5% of accounts receivable. Prepare the journal entry to record bad debt

expense on December 31, 2016.

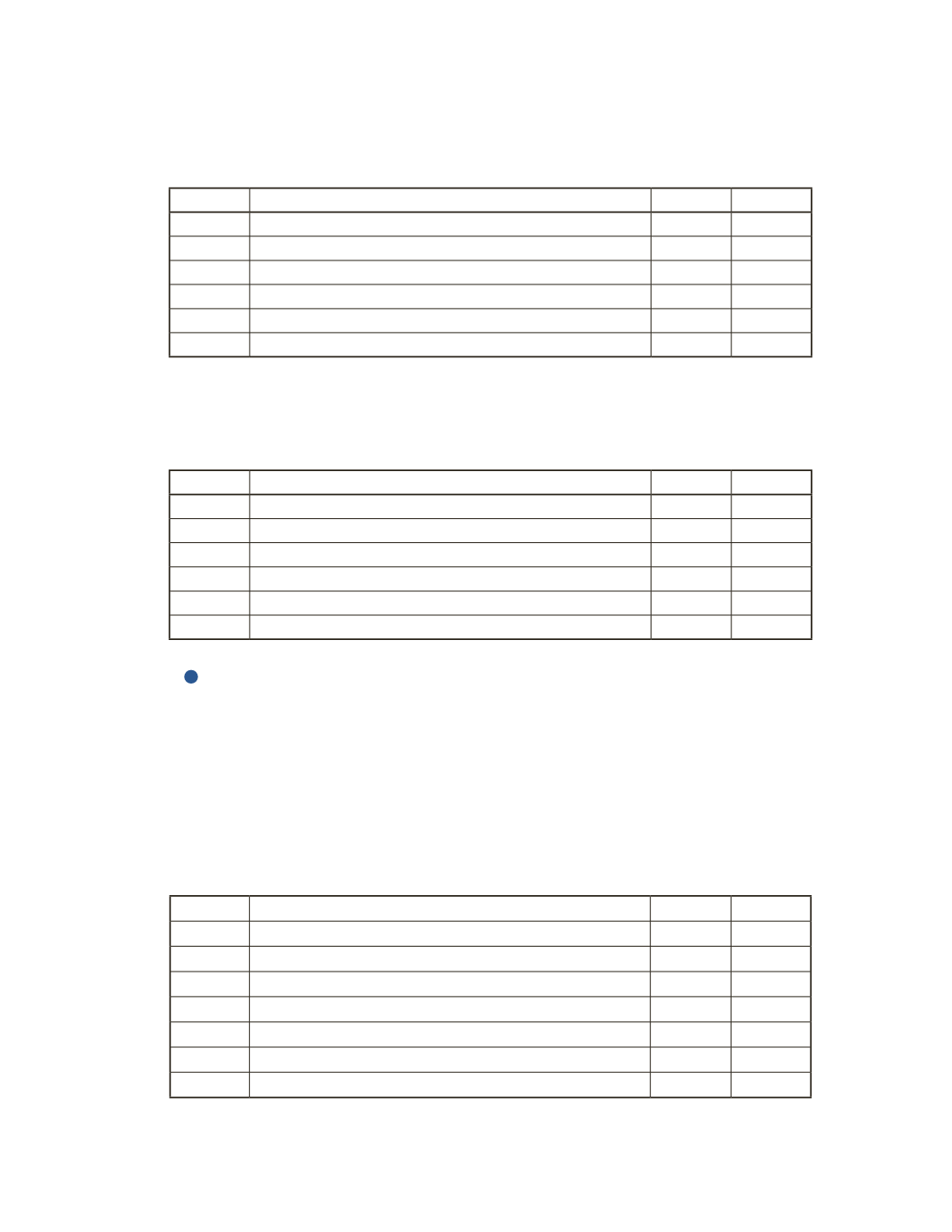

Date

Account Title and Explanation

Debit

Credit

c) Assume the AFDA has a debit balance of $2,000 on December 31, 2016. Using the balance

sheet approach and estimating that 7.5% of receivables will be uncollectable, prepare the

journal entry to record the bad debt expense on December 31, 2016.

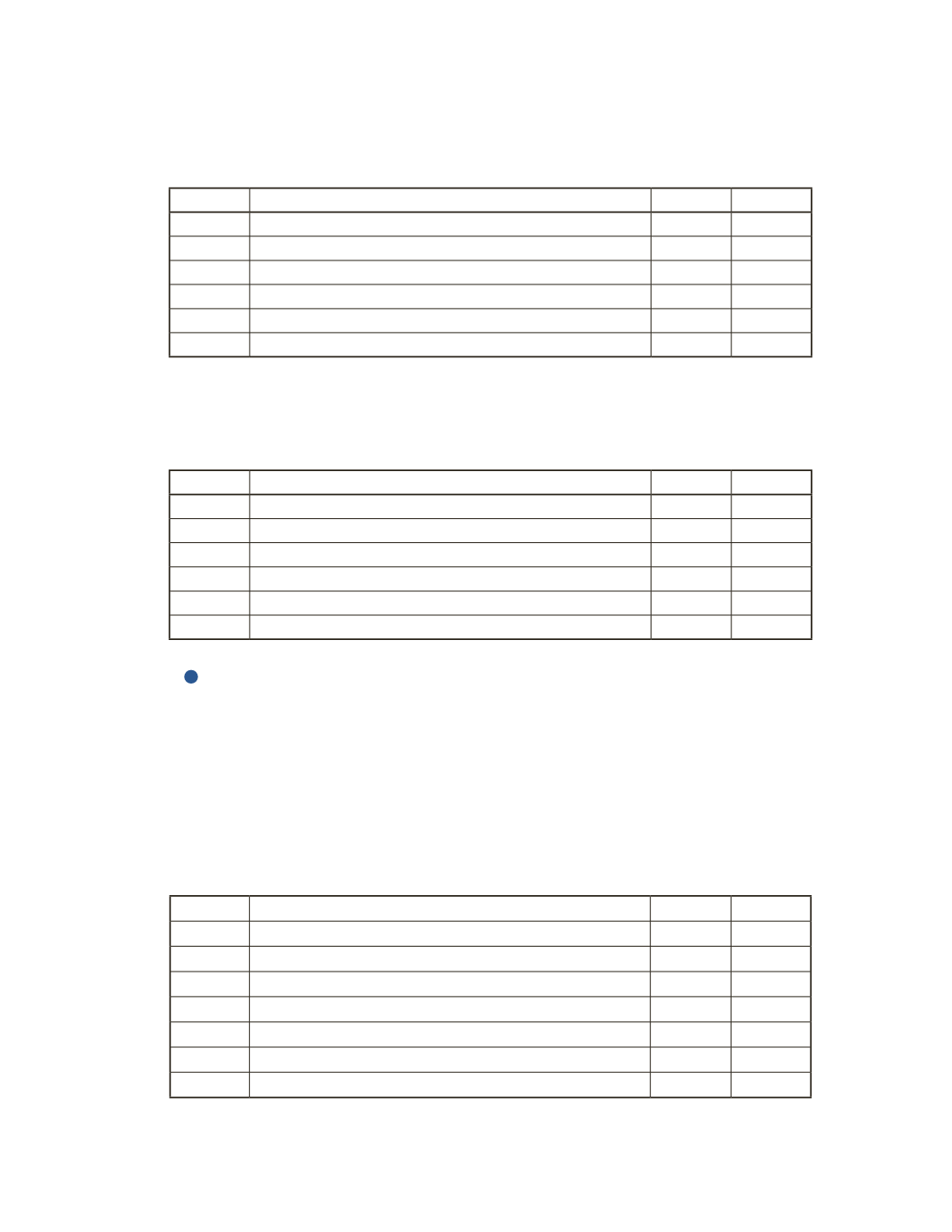

Date

Account Title and Explanation

Debit

Credit

AP-7B (

2

)

Jane Lee is the owner of a small consulting firm called Lee Solutions. On April 14, 2016, Lee

Solutions’ accounts receivable account balance was $10,000. A week later, it was discovered

that Mr. Joe Black, who owed the firm $1,500, would not be able to make the payment.

Required

a) Prepare a journal entry to write off the amount deemed uncollectible.

Date

Account Title and Explanation

Debit

Credit